I did a detailed comparison here of the different platforms: https://pensionsystem.ch/finpension-viac-frankly-comparison/

75% MSCI World ex CH

10% MSCI World Small Cap ex CH

11% MSCI Emerging Markets

2% SMI

1% SPI Extra

1% cash

And then disable rebalancing (if it’s possible in 3a).

Thanks for your work @Cortana and @TeaCup as well as the others above. One naive question, why would you disable rebalancing? The funds on finpension are in CHF. Doesn’t that mean, that there are no rebalancing costs occurring?

I guess the idea is that since it’s already cap weighted no rebalancing should be necessary. (Not sure if it’s true due to accumulated dividends that might make things diverge).

What I’m wondering is whether it makes sense to include anything with less than 5%, isn’t it overkill to replicate in that much detail? If it becomes a large fraction of the equity universe, you’d only miss a tiny bit anyway, right? (basically you’d miss that part growing from 2% to 5% so this is somewhat bounded).

Am I overlooking something? This would make it much simpler to just ignore SMI/SPI.

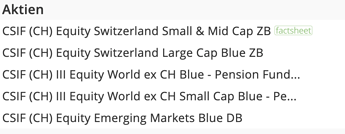

Noob question : I have CSIF but no MSCI in finpension…?

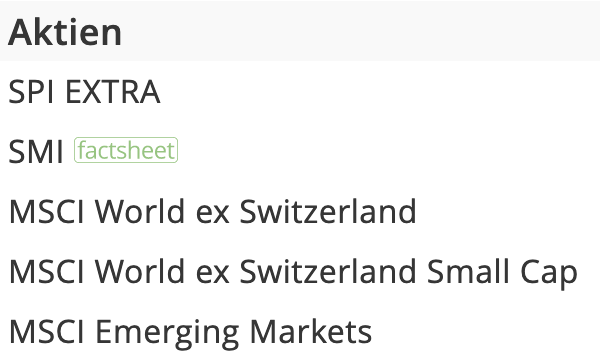

CSIF are product names, MSCI the corresponding index names…

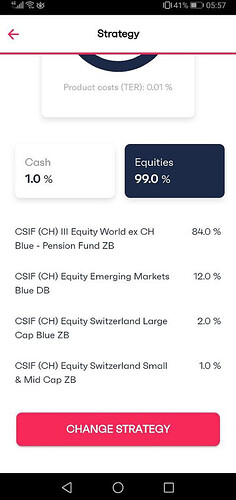

Screenshot of the product names:

Screenshot of the above products with their corresponding index names:

Not possible that why I recommended to remove the CH part

Thank you very much, more clear that way.

Because these fixed proportions are only true now. In 3 years MSCI Emerging Markets could be at 13% instead of 10% for example, so you don’t want Finpension to rebalance back to 10%. You let it be so it stays at market cap weights. You could also adjust these %-settings on a regular basis, but that’s too much work IMO.

As @wapiti pointed out, disabling rebalancing doesn’t work. What are the rebalancing bands of Finpension? Viac uses 2% absolute. If it’s the same at Finpension, I wouldn’t remove Switzerland. There won’t be a rebalancing with Swiss assets as there is no way that SMI could grow from 2% to 4% or SPI Extra from 1% to 3% to cause rebalancing problems.

“If the weighting of a fund deviates from the target weighting by more than one percentage point, your entire portfolio will be realigned.” https://finpension.ch/en/3a/faq/

The easiest would be to chose 99% MSCI World ex CH, but you miss small-cap and EM, otherwise you need to adjust on a regular basis. Each buy and sell has a cost of around 0.03% to 0.10% (displayed on the factsheet). Finpension like Viac use netting to reduce this cost.

“But before we do so, we check whether other customers within the finpension 3a Retirement Savings Foundation client base have orders to the contrary. In the end, we only trade what is necessary below the line. The rest is charged internally at the currently valid price. Fund units are moved from client X, who wishes to sell, to client Y, who wishes to buy the same fund units. Of course, this internal settlement, which is called netting, is fully automated.”

I would also recommend to take into account your whole assets. Because if 3a is 5% of your total asset, the impact of your 3a strategy will be small.

This makes perfect sense, thanks a lot for the detailed explanation

The quality fund contains only companies that have " historically high return on

equity, stable year-on-year growth, and a low leverage ratio"; the world ex ch fund is just a basket of companies with no consideration at all for growth, ROE, or debt of the individual companies in the fund. Performance chasing is a common mistake - if you are chosing the quality fund only based only on the fact that it outperformed the world fund since 2015, then thats the wrong reason; on the other hand if you are chosing the quality fund becuase you believe that companies with high ROI, conistent growth, and low debt will outperform the general world market over the long run, then that is a good reason to chose the quality fund. In my opinion it is unlikely that the world fund will ever outperform the quality fund over the long term; but that’s just my opinion and of course i could be wrong.

You need to be aware that it is always relative to the price.

So why would the market value two companies with the same profitability different?

Sorry but im not sure exactly what you mean about always relative to the price - from my perspective I don’t invest in “stocks” I invest in “companies” - I dont care what the stock price is I only care about the company and where that company is going in the future - I am happy to pay up for high quality companies which I feel have a great future (unless of course the valuation is nonsense (i.e. i feel that the company will never grown into that valuation or at least it will take an unreasonable amount of time to grow into that valuation)

But with regards to your question there are many reasons why a company with the same profitability would be valued differently by the market (e.g. TAM). Many hyper growth companies are not profitable yet; but they have a huge valuation; because of their growth they are expected to growth into their valuation over time - and the market prices in this poteintilal (hence the high valuation).

But, forgive me becuase I am not fully clear on what all of this has to do with my previous post which related to the quality world fund v’s the ordinary world fund.

How do you know if the valuation is nonsense?

You more or less said that you are willing to pay anything with the exception that you won’t pay if it is too high.

There is another post in the forum “If I was an index investor” that discusses Quality factor. Here is a link to an article I shared there which shares a theory why Quality stocks might outperform.

I have updated the table with more data https://pensionsystem.ch/finpension-viac-frankly-comparison/ and include some feedbacks. I hope it will help people to choose the right provider

Hello there!

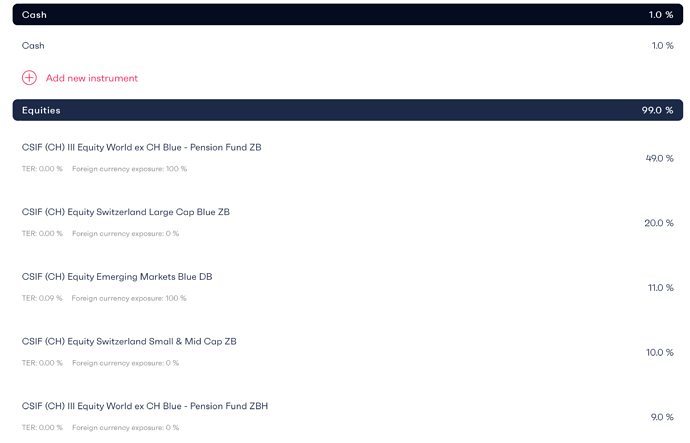

I just opened a Finpension account and I tried to do my best to modify the equity 100 portfolio.

This should be a mix between VT and what they proposed:

Do you think it’s something that can work?

Thanks

I was tempted to emulate VT, but then I tried to stay more in CHF.

Btw I have already modified in this way:

Hey @yakari thanks for the quick answer.

Probably my knowledge is still limited, but I had the basic idea to overweight CH, since I have 100% of my stocks in US.

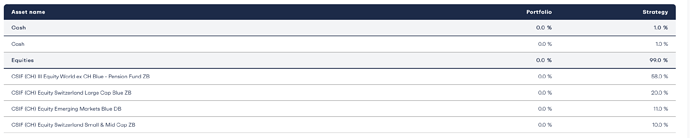

The alternative would be, as someone mentioned, this one (maybe removing the 1% and 2%![]() ) :

) :

I have just sent the money today…so most probably I can still potentially change it