Thanks. You mean the x-ray function? And then using the valuation / size matrix? I can find VT, but not CSIF funds. Can somebody explain more? Seems obvious for some participants of the forum, I don’t get how to get figures to compare the different CSIF and VT based on size (small mid large), however I did a bit of efforts / research

…which should basically be (not “fees” paid to anyone but rather) the short term interest rate differential between CHF and USD. Even without looking up and comparing the actual numbers, I remember that the USD had considerably higher interest rates than the CHF, from 2015 onwards.

So yes, with the exchange rate largely flat but higher interest rates in USD, the hedged fund underperformed. The opposite happened in 2020: the differential in interest rates has narrowed and the US has lost value against the CHF - and the hedged fund has overperformed.

Thanks ! I assumed .com and .ch would be same data, my bad. Will do my home work. Ok, so you use the matrix size and type. Cheers.

Just registered to Finpension and went through the first steps (so please bear with the silly questions ![]() )

)

I’m trying to see which fonds I’ll end up using and I’ve looked at the data here:

https://finpension.ch/en/fees-returns-3a-funds-compared/

If you filter the following things:

- remove anything that’s not a year old at least

- remove anything that has a zero to 3% return on the 1-yr, 3-yr or 5-yr horizon (bad performers)

- remove anything that is too expensive (TER >1%)

Then it’s really not a lot of funds that are “good”, namely these stayed:

- LUKB Expert-Vorsorge 75

- Postfinance Pension 75

- LUKB Expert-Vorsorge 45

- Swisscanto (CH) Vorsorge Fonds 75 Passiv VT CHF

I have one 3a account with the PF75, that’s still expensive at 0.97% TER but it seems to be a good performer. The other candidate available in Zürich is Swisscanto Vorsorge 75 Passiv VT CHF. Can we buy this within finpension 3a? is there anything that says I shouldn’t?

What about all the other funds that can be bought inside finpension? Couldn’t find such a table yet as linked above.

I don’t see it that way.

The dollar did better in the first 3-4 years than expected by keeping its value relative to the chf, so the unhedged fund did better.

In the last 1-2 years the dollar did worse than expected and the hedged fund did better.

Hey, I am also new on this, so no questions are silly ![]() However, at finpension you cannot buy any fund you want (like PF75), but only a limited list that they provide here:

However, at finpension you cannot buy any fund you want (like PF75), but only a limited list that they provide here:

https://finpension.ch/en/3a/strategies/index-tools/

The list you sent is just for a comparison of how these funds (almost all) have a more expensive TER than the ones finpension offers (on my link above).

Hope it helps.

@Lonair I would be interested in your results. Let us know how it goes, please!

In this file I did the replication looking at country and size:

https://drive.google.com/file/d/1DVMP-AMoAQExM4OXFAgwMiuEb7qSjndU/view?usp=sharing

See tab 2)

Basically somewhere 10-15% looks ok and takes into account the missing small-mid caps from the initial exercise.

As we are now trying to match objects on various dimensions, there is no perfect match. In the tab 3) you can see the impact on the initial country replication. Also we are limited by integers for the inputs in Finpension.

Let me know if any comment, in particular if you see something wrong !

Cheers

My understanding is that hedging is always a cost but I never investigated further. I saw it like friction that always slows you down, regardless of the direction you take.

Let me try to understand the logic here. So if the outlook changes and there is an expectation that the USD will outperform the CHF, the hedged version would provide better returns assuming USD/CHF stays constant?

Currency heding with shares is only interesting for short run (maybe up to 5 years) investments, where currency fluctuations can generate quite a bit of variability.

For 3a and other long term investments hedging is irrelevant because currencies will move pretty much in line with the inflation differences between the currency areas in the long term.

Think about what happens in the next economic crisis (the one that is not coming since 2015  ).

).

The CHF will be a safe haven even if the base rate is negative. Switzerland can’t keep up with the USA and ECB printing money (can it?), so I believe that the CHF will eventually be significantly stronger than the Dollar or the Euro. In this sense, hedging could help you - or not?

Just look about what happened in the last economic crisis (the one that began with COVID in March this 2020). The CHF was a safe haven even though the base rate is negative. Switzerland couldn’t keep up with the USA and ECB printing money (can it?), so the CHF indeed become significantly stronger than the Dollar. In this sense, hedging did help you, didn’t it?

not sure how ironically you meant this, but a 6-months performance (difference) is not saying much for a larger trend.

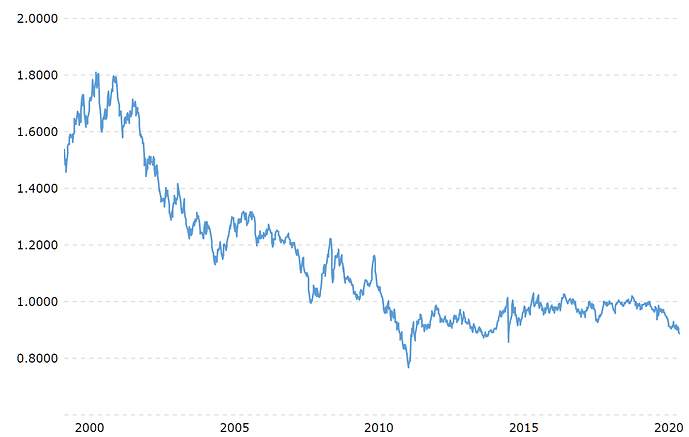

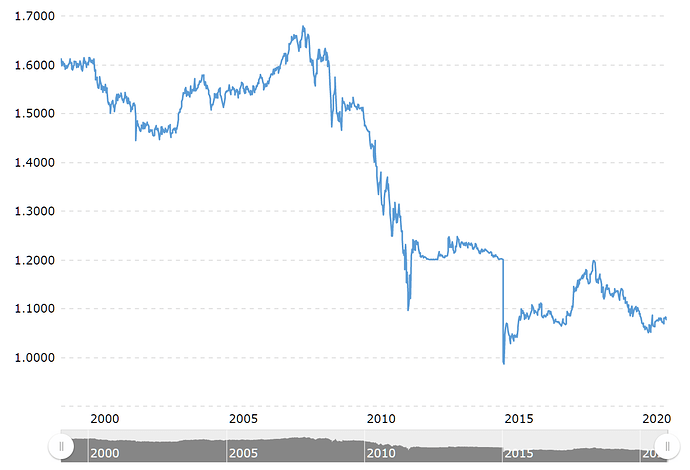

I’m rather looking at this as a trend

(USD/CHF 20 yrs)

and this (EUR/CHF 20 yrs)

Thanks, I’ve plugged all other funds into my excel as well.

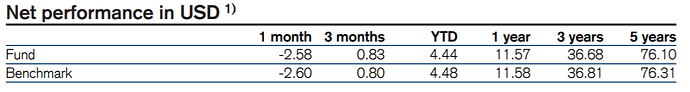

However the data is a bit misleading/inconsistent.

For instance

- CSIF (CH) III Equity US Blue - Pension Fund ZB CH0030849712

If I check the same on Finanzen.net

Who to believe now? Or what’s the basis of this difference?

Another question: why chose anything else from here than MSCI Quality tracking fonds? The other stuff seems to be way inferior (with the exception of the above “US Blue”)

Yes, as long as inflation is higher in other economic areas than in Switzerland the CHF is likely to appreciate. In the short term the fluctuations may be massive. In the long run the Swiss Franc is likely to appreciate by the inflation differential. You can’t hedge against that.

But unless you are investing for the short run, you should not consider hedging.

Hedging is useful if you need an amount in foreign currency in 1 year for instance and you need to be sure that what the amount will be then (e.g. to fulfil an order for a big machine).

If you invest for 10-20 years, hedging is irrelevant. You can’t hedge for that amount of time anyway. Your returns in CHF are unlikely to be affected by currency fluctuations in the long run.

Look, you’re investing for 20-30 years. Forget about currencies hedging, which is a sort of market timing for currencies. Just buy ETFs, stay the course, and reap the benefits.

thanks, I accept your professional clarification and I believe you - it was just weird to see that the dollar has lost half its value in the last 20 years against the CHF and it’s still considered to be a better option for the next 20 years (where we might end up at a 0.5 exchange rate if the trend continues).

The difference is because finanzen.net shows the current status (17.12.2020), while the one in your picture, given in the factsheet from finpension website, is the snapshot on 31.10.2020:

Regarding your 2nd question, then I have to say I am very new at this, so I cannot really tell what kind of strategy each of those funds serves.

Hey, great job, quite helpful! I have a few questions though:

- In 1) Country replication, why do SMI and SPI Extra indexes are not 100% Switzerland Shares (you use 94 + 6, but both should be 100% Swiss)? Did you try to add already some cap size on the country match criteria?

- Same question for 3) Final replication (there you have 75+25)

What I did extra is to reiterate the numbers chosen to be entered in finpension and retrofit them into sheets 1 and 2, until I got a closer match on both Country and Size. I then end up with:

73% CSIF (CH) III Equity World ex CH Blue - Pension Fund ZB

09% CSIF (CH) III Equity World ex CH Small Cap Blue - Pension Fund DB

14% CSIF (CH) Equity Emerging Markets Blue DB

02% CSIF (CH) Equity Switzerland Large Cap Blue ZB

01% CSIF (CH) Equity Switzerland Small & Mid Cap ZB

Another thing: I wonder now if we should use the “Quality” version of the World ex CH fund, as it seems to pay-off despite the higher TER.

SMI + SPI Extra represents the Swiss stock market without overlap. So I tried to use the cap size based on morningstar.ch. I was expecting more something like 80% / 20%, but if I use the correct cap size value it’s 94/6.

Corrected now. It did not affect the formulas as they were linked directly to sheet 1).

Exactly it’s iterative. In the exemple I have currently on the sheet you see that by matching mid-cap, there is overall less US exposure, and over-representation of small caps. So by doing the iteration you arrive again at better US exposure (e.g. country match) and probably small-cap under-representation. I guess you have now under-exposure of mid-cap, as it is not possible to have a perfect match. That’s why sheet 2) is really useful to understand the match, e.g. the choices you have to make.

Fully agree, and VT should be the way to go for passive investing. For the moment I just replicate VT because I’m starting to invest only now in VT on IB. Maybe when I have a lot of VT in IB I might diversify a small part of the portfolio which could be the part in finpension, as this Quality fund is accessible only there and not on IB if I got it well (only for institutional investors).

Note also it’s not perfect because the size / type matrices do not sum to 100% in the databases, so I renormalized to 100…