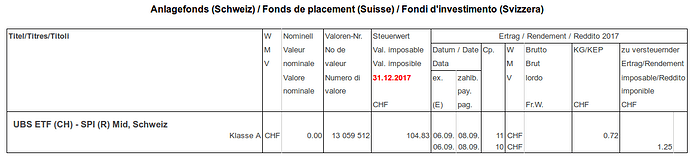

This is because on 08.09.2017 you got two types of payment.

A payment of CHF 0.72 per share which is the payment of a capital gain, which is not taxable in Switzerland and on which there is no withholding tax of 35%.

A payment of CHF 1.25 per share which is an income, has the 35% withholding tax refundable if you fill your tax declaration.

The website ICTax - Income & Capital Taxes

tells you all the details about it.

The dividend paid with the profit obtained from capital gain are not taxable since the last modification of the tax system for companies in Switzerland, 2 or 3 years ago. This modification had been widely criticized because it gave advantages to some billionaires of this country. Once the law is there it is not forbidden to the small investors to take advantage of it.