The SLI is the Swiss Leader Index which is a caped index and not an index proportional to market capitalisation (like SPI or S&P500 for example). It has been made to have an index that is in compliance with the european directive on undertakings for collective investment in transferable securities where a stock shall not be more than 10 % of the value of the found A found based on the SPI does not comply with the EU regulation as NOVN, NESN and ROG are far above the 10% limit.

My personal interpretation is also that it has been made to sell more crap (Swiss Banks) than good stuff. It also has the problem there is a permanent rebalancing in order to respect the maximal ratio of a stock and this increases the TER.

it is a side remark on UBS being reather heavily weighted in that fund. among the mustachian investors it is common sense that you want to be well diversified in you asstes (socks), and a 9% share of a single stock in a fund is considered very poor diversification. That also means that the fund is very sensitive to that single stock. as the ultimate reference, take Vanguard’s VT (global stock market fund), where the biggest single stock is apple with 1.7%. the fund contains ~7700 stocks

@fedra forgive @hedgehog, he’s probably the most knowledgable here, but can get irritated by reading the same questions over and over.

SLI was introduced as an answer to people not being happy with SMI. SMI has 20 biggest Swiss companies, proportionally to their size. As an effect, 60% of the index consists of just three companies: Nestle, Novartis and Roche. SLI limits the proportion of the largest companies in the portfolio. In my personal opinion, a better choice is SPI, which has over 200 companies (market cap based).

However, you need to understand what is the size of the Swiss stock market relative to Europe and the World. Do you want to put your money in such a narrow niche? The stocks in this index are very much correlated and depend on the condition of the Swiss economy. If you want to stick to boglehead/mustachian rules, you will not buy such a small ETF.

some swiss etf which distributes capital gain instead of dividends may be really good tax-wise, so swiss etf particularly during retirement are not to dismiss lightly, particularly if more and more distributions will be capital gain redistribution and thus not taxed.

@Grog, which ETF’s distribute Capital Gains? I have never heard about such a thing before, but of course could be… just don’t see the point so much. Capital Gain goes into the value of the ETF, and dividends get paid out (if it’s a distributing ETF), that is my understanding. The way you would get your capital gains out is by selling some of the ETF, which is indeed tax-free. Or do you mean dividends out of Kapitaleinlagenreserven? But that would be some select companies and not ETF’s.

To me it is also unclear, why would a company distribute capital gains. Getting 1 CHF of capital on your 100 shares should be the same as you selling 1 share worth 100 CHF. I can imagine that it is only tax free on the same rules as selling shares is. So in the end I don’t see the advantage that @Grog sees, but on the other hand, if it exists, it has to exist for a reason.

There was already an example on this forum:

One part is coming from Kapitaleinlagenreserven

That’s a good example from the other thread. Since we are talking swiss brokers , which requires 0.075% for every Swiss share you sell, if you get that kind of distribution you avoid Swiss stamp duty ( and of course the transaction fees) So that’s that minimal advantage, but mostly for retirement in Switzerland ( no currency exchange, no income tax, no stamp duty etc) .

I do not know how it works for ETFs, but usually when a company distributes capital gains, it is the distribution of profits that do not come from general operations, but from the sale of an asset.

Example : You are a lemonade company. Usually you pay dividend to your shareholders as a part of the profits from selling lemonade. But this year, you sold a subdivision of the company (or a factory, or any other asset). This money coming from the sale is capital gain that can be distributed to shareholders as it is not used in the business anymore.

Good example. Correct me if I’m wrong, but a capital gain would be the difference between sale price and buy price (or build price). So if you bought the factory for 3 million and sold for 5, you got 2 million capital gains.

Well if you sell shares, you also pay no income tax, so no difference. The stamp duty and broker fees make sense, in theory. 0.075% stamp duty plus, let’s say 0.12% fee, that’s total cost of 0.2%. Now let’s say you got, let’s be generous, a million franks worth of ETF. The ETF will pay 1% this year as capital gains distribution. So you get 10’000 straight to your pocket. Congrats, you just saved 20 franks! ![]()

Well, I searched the blog before posting so not to annoy anyone but I didn’t find any previous post about my question…

Getting to the important topic:

I hate to: the products I prefer are US ETFs but what about the currency risk? If everywhere is said that the dollar is overvalued and will loose its power before or later, are the much better gains in investing in USD stocks and bonds going to compensate an eventual loss in the USD to CHF conversion? I am living in CH and maybe will end my life here so I have to reason in CHF.

Burton Malkiel in “Random Walk Down Wall Street” makes a very good case for international diversification and capitalization weighted portfolio. If you don’t want to go fully international (like VT), go for US with for example VTI fund and/or with other developed nations with some other fund, but please, don’t go with ONLY 30 companies in ONLY one country and MOSTLY banks. That’s nuts.

Properly diversified portfolio should have at least 60 companies (check the book why 60) from different sectors and preferably from different countries, so that they are less correlated and don’t move together up and down. To put it differently, imagine something bad happens to Switzerland - like the thing that happened to Japan since 1990 and after two or three decades your investments brought you to the same point where you started. It’s also much more probable that you’ll get better returns with international (or at least US and/or other developed markets) exposure, even if Switzerland will do fine.

You have to understand that in the long-term investment in such a narrow market is a bigger risk than currency risk from investment in the properly diverisifed portfolio. If you invest in VT ETF for example, it’s price is in USD but underlying assets are in many different currencies:

https://personal.vanguard.com/us/funds/snapshot?FundId=3141&FundIntExt=INT&from=mfsResults&funds_disable_redirect=true#tab=2

So, even if USD is overvalued and will lose its value in comparison to CHF, half of the assets in VT ETF are denominated in different currencies. You also have to take into account that even when USD will lose value, it’s quite probable that USD stocks in VT ETF will increase in value much more than any Swiss-based fund in CHF, so the return will offset the much of the loses from currency exchange. It’s highly unlikely that USD will ever lose much more than potential gains from returns in US equities.

In short: don’t fall into home bias and diversify your portfolio.

PS. Or, if you really have to, put some small part of your portfolio in a Swiss fund (SPI index) and rest into global fund.

Absolutely not. Actually my asset allocation is as follow:

1/3 USD:

-

50% Stocks ETFs (SDY, VIG, HDV, VDC)

-

50% Bond ETFs (USA bond ladder 2018-2027: IBDK, IBDC, IBDL etc.)

1/3 EUR (I have expenses both in CHF and EUR)

-

50% Stocks ETFs (SPDR; I know very high TER, 0.30%, only 10 years of growing dividends, but at least ‘only’ 10% financials)

-

50% Bonds ??? (waiting that ishares is going to offer the european counterpart of the above USA ladder ETFs)

1/3 CHF

-

30% Stocks ??? (I don’t have the skills and the time for stock picking, so as usual looking for ETFs but very pure choice in CHF. I recently found this https://www.bamertpartner.ch/equity-savings/sda-monthly-report/ which is better listed here https://www.wikifolio.com/en/int/w/wf0bpswiss (press the link ‘Portfolio’). Or I have found a swiss investor in Seeking Alpha happy with HBMN and BION. Comments, especially here, would be VERY welcome, still in deep sea…

-

20% Gold (I consider it as Stock)

-

50% Bonds ???

i think your idea of diversifying is good. diversify assets (stocks, bonds, a bit gold,…) and currency is a very good approach. the ratio of these assets is depending on your taste and risk tolerance, noone here can tell better than yourself.

still i join in in the thought of switzerland is a tiny market (3% of VT, for example) such that bloating it to 1/3rd of a portfolio is questionable. it is also agreed consens within this forum that swiss goverment bonds are currently inferior to just cash, because the yield is around zero and with expected rises of interest rates the next years current bonds will lose more value.

As swiss investor, dividend strategies are disadvantageous because dividends are taxed, where course gains are not. so focusing on dividend stocks will just increase you tax bill, not your long time growth. the same argument holds for coupons paid by the bond issurer, whichis another argumen for smaller bond fractions in a swiss portfolio.

I for one don’t understand why you put 1/3 of your portfolio in foreign bonds. These are USD and EUR fixed income assets, heavily dependent on exchange rates and eaten away by inflation. What’s the point of holding foreign bonds for a person who intends to retire in Switzerland? Anyone?

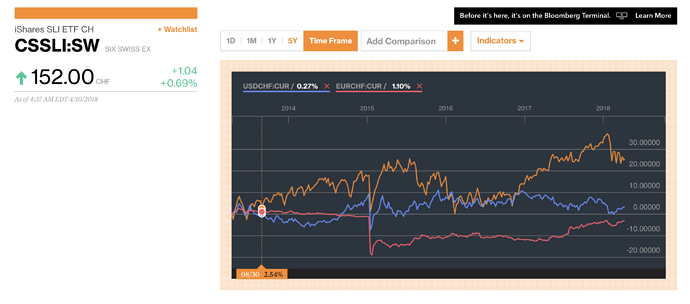

Then CSSLI is definitely a wrong product for you. Although it’s technically denominated in CHF, most of their profits are in USD and EUR, so have a guess where things go when CHF rises, look at some plots of them together

What you attached (blue) is the price of USD in CHF

Thanks, screenshot fixed.