wow, so why are the RE prices not falling already? ![]()

Still almost no supply and that might not change anytime soon as Switzerland is very small and imigration high.

I know. Just expected a hug, really ![]()

It’s only a few weeks like that. Be patient…

I can wait another 1.5 years (naturalization).

We’ll see. I just saw some really good places these weeks in Kt AG.

One of them went in a week, being extremely pretty but also super overpriced.

The other one is also quite nice but is unsold since 2020 and they’re not moving an inch with the price.

Strange market, this.

Vor ein paar Wochen haben Sie sich für das Neubauprojekt mit 6 Doppel- und Reiheneinfamilienhäusern in Elgg interessiert. Wir haben gute Neuigkeiten für Sie! Wir konnten aufgrund der aktuellen Situation die Verkaufspreise reduzieren und freuen uns, Ihnen die angepasste Preisliste zusammen mit den weiteren Detailunterlagen über diesen zukommen lassen zu dürfen.

Things seem to have started moving…

It’s pretty incredible that the interest rates went up so fast. People buying houses right now are in so much worse situation than those that bought them a few months ago. Surprising.

Next thing to happen is changes in SARON, it will go up up up, and complaining will start

they will buy the running mortgages on the current properties, which will also mean… drumroll… that the prices will NEVER fall ![]()

The Cortana effect isn’t only valid in the stock market. Right after we sign the contract on Tuesday, RE will crash again -40% in the next years.

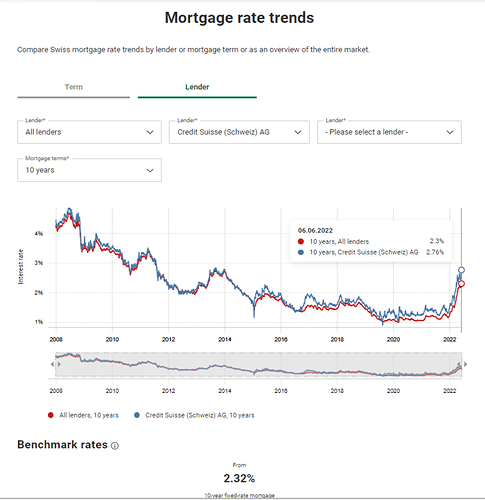

Per Comparis there has been a ~1.3% increase on 10 year rate. Not yet +3% per the thread title but it feels significant

Example for a 2m CHF property:

Cost to rent 4,500 CHF /m

Monthly cash out to own 6,200/m:

80% loan, 10 yr fixed @ 2.32% : 3,090/m

Maintenance / repair fund / co ownership costs 1% : 1,667/m

Amortisation to 2/3 value over 15 years: 1,500/m

Excludes opportunity cost and purchase taxes

isn’t unfair to use amortisation as a cost?

Indeed it is not a cost. It is a monthly transfer of cash to equity invested in the property. I included it because at the current prices (2m for a flat or small house where I live) I am not certain I would get it back in 10 years. But if you ignore that the cost would be 4,700/m

I forgot tax on deemed rental value which depends on your canton and income. I am only familiar with Geneva where it would be ~500 CHF/m (market rent 4,500 - 3090 interest x 40% marginal tax rate)

So 2.32% still seems to justify the current price of the example you used.

I guess we need to go over 3% to see some changes in prices.

In my example it would be 4,500 CHF to rent vs. 5,200 to own which is excluding amortisation and excluding opportunity cost on the deposit.

I agree it will not cause a sudden crash but it might take some of the post Covid craziness out of the market by end of the year

Yeah but there is also value in owning something that can’t be measured in CHF. I think it’s fine to pay a premium for that.

We frequently ask ourselves the same - whether to just screw it and buy for “enjoyment” reasons

The problem is that the properties around here just cost obscene amounts of money, eggs in one basket stuff. At the end of the day they are not a big improvement on our current rental. Let’s see what happens

Just one datapoint, but the deemed rental value of my house in Zurich is much smaller than the market rent, i.e., 14K for a house which would rent for 40-45K/year.

Same for us, also Zurich, 11.5K for a house that would rent out 35-40K/year.