Probably split into Fixed and Saron (e.g. 33%/67%), but depends on your risk tolerance. I haven’t thought it trough completely, but I find SARON quit interesting and dont think it raises over 0% anytime soon.

Make sure that you also know the margin of the bank/pension fond. In my case the SARON was at 0% but with a margin for Swisscanto of 0.65% where a 7y fix term was 0.55%, therefore I skipped the SARON option

That’s what I’m doing at end of January: 5 years for 0.69% for 680k CHF (negotiated almost a year ago).

Why not 10 years? Aren’t you worried that after 5 years interest rate will be higher and you will have to re-negotiate a mortage with bad rates meaning that you will actually lose on what you gained during those 5 years. Of course it is possible that rates stay the same but somehow it is like playing the casino…

For some reason 10 years feels like a much longer time to me. If I would have kept the first mortgage 10 years at 0.94% I also would have made a loss…

I see, then good the interest rates did not climb  I always have the feeling this is so impossible to predict and no matter what you chose it’s pure luck…

I always have the feeling this is so impossible to predict and no matter what you chose it’s pure luck…

Going middle ground usually makes me hate myself less whatever happens.

I’d also pick 5y vs. full SARON or 10y fixed.

Indeed it’s a tricky casino style game. But if we are honest if it’s 0.55% or even 1.5% it’s still ok from an overall perspective compared to >5% in the past. Therefore, my way initially in 2017 was LIBOR (0% but 0.65% margin) and 10y at 1.23%. Afterwards after 3y which was the minimum LIBOR duration they wanted to change me to SARON with the same condition and therefore I changed in 2020 to the 7y for 0.55% knowing that I will never be better with the SARON. The risk of course is that in 2027 both mortgages are due for renovation. If the rates are to high I will need to sell part of the VT’s to reduce the mortgage to a reasonable monthly amount and go for a SARON or a short duration mortgage hoping for a better future

In 3 to 5 years the interests could be unreasonably high (if you’re unlucky), but you’d not be able to fight the banks as they will know you MUST refinance and you probably can’t cash out the mortgage entirely by then.

Therefore I’d pick 10 yrs fix on all, with an option to cash out the mortgage within/after those 10 years (50-60k a year savings should be doable) if needed - then you have a negotiation base with the banks.

My strategy has the same goal that all my individual mortgages are due at the same time and hence I can renew them all together with hopefully more margin for negotiation with the banks. However sometimes I’m not sure if it was worth the extra effort after the first 3 years to get a new mortgage to save some 100 chf over the entire period. But I guess that’s all about mustachian

Not correct. Only the one that runs out.

True but usually no other bank gives you mortgage if there are not the priority security holder and hence you are kind of bound to your bank

thx. edited my previous post to avoid confusion

In his inspiring recount, Pasquale the Swiss Multi-millionaire warns us against “the risks of a mortgage on his private home, and (…) to use a mortgage to (…) take advantage of the current low rates to make his savings grow elsewhere”… which is what I am currently doing.

Can anybody help me understand what these risks are, if the residual debt is below 50% of the commercial value of the estate and as long as the mortgage payments are met ?

Read this thread for a start.

Or this thread:

Interesting NYTimes article I recently read related to this topic, below.

It seems like in the US, many mortgages are fixed, and for long durations… a bit like in Switzerland. So the argument in this article is that you can lock in the amount now, so that even if rates go up (and potentially rents, although more controlled in Switzerland), you have certainty of costs of your mortgage.

It is an interesting hypotheses - I think everyone would agree rates are going up. So wouldn’t it be advantageous to lock in a low rate now while you can?

They are going up now, but you don’t know what happens in the next 10 years. Maybe interest rates increase massively and it was a good choice, maybe they decrease again in 5 years and it was a bad choice.

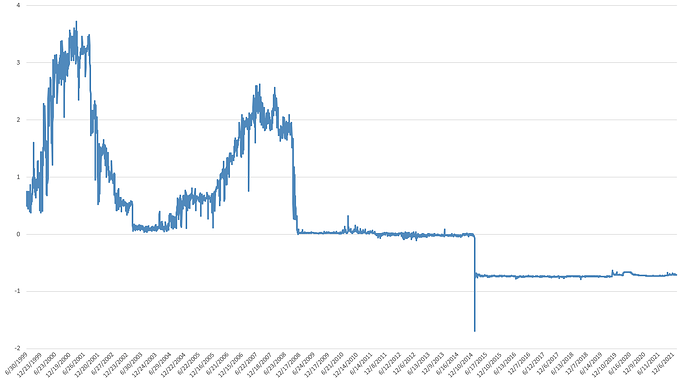

Just an example, my parents once locked in a rate of 2.5% for 10 years, saying “it can’t get any lower” and you see how low the rates now are…

Everyone needs to decide for themselves whether they want to take the risk of variable rates.

By “now” you probably mean “since then and until recently” ![]()

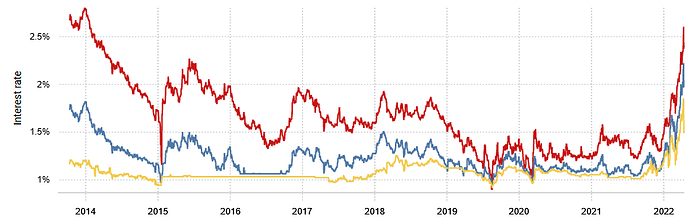

Some banks are even back to the 2.5% level for 10Y (red line in the chart below)!

Source: Comparis

Exactly. They refinanced somewhere at the beginning of the 2000’s and were coming from the 90s with rates of 7-8% incredible ![]()