Nothing yet in AG/SO. Prices still on the same trend (upwards).

In my experienxe, the number of ads in the berne area increased by about 20-30%, but still not back to pre-covid levels.

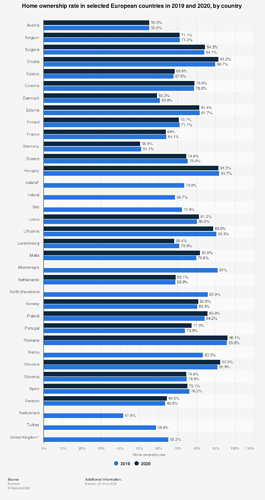

Just wanted to show this. The original statement about this image:

Germans are not really hedged against inflation because of much lower home ownership rate (around 50%) compared to the rest of Europe which is much higher.

Interesting correlation between the countries’ development and home ownership. ![]()

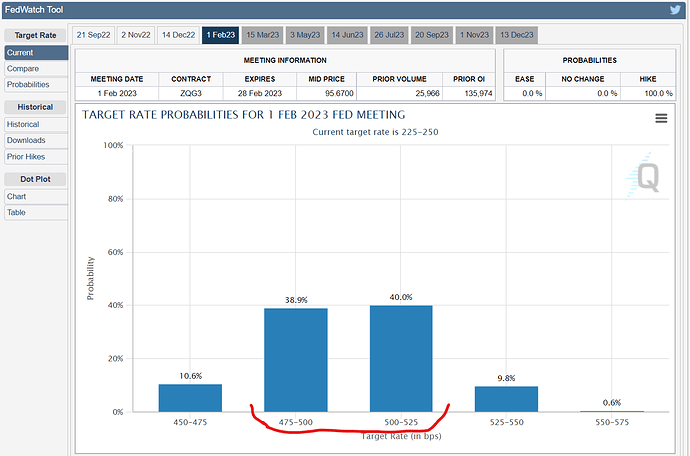

and it gets even scarier as you zoom out.

If the dollar arrives at 4.5-5%, where does that put the CHF? 2-3% Saron at 3.5%?

That’s a LOT of pain ahead, and a lot of people having trouble paying for their mortgage refinancing.

Inflation is much lower in Switzerland. They don’t have to rise interest rates that much to get inflation in the desired area.

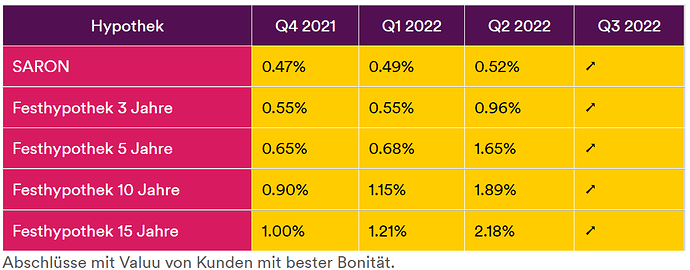

3.5 seems like a stretch, but SNB is about to raise the raise into the positive territory. This willl mean for some people a substantial ( percentage-wise) increase in that they pay.

Imagine all those people with Saron at 0.9%, add to that 0.5. I guess they will notice. Articles will start about how difficult life is for them.

More pain to come ?

And yet a friend of mine with a Saron mortgage keeps telling me his mortgage payments won’t go up.

There are people out there who are at risk and don’t even know it. Which I find a bit scary.

Same here, I also have a friend who tells me exactly the same, plus he tells me that with his bank he can change anytime to a fixed mortgage… I don’t even want to know how much the fixed mortgage would be, somehow some people simply don’t get the risk aspect.

There is a reason why the 10yr rates are at almost 2.0% and it’s not the SNB. The banks are pricing in a significant rate hike in Switzerland as well. Chances are, over the long term, the SARON construct will not be significantly cheaper (also read: timing the market).

Yes, he also keeps telling me that!

Maybe it’s the same guy! ![]()

We saw what a 5% Fed Fund rate did to the US economy back in 2007. The amount of debt nowadays is way higher and I believe it should not take too long before we see the effect and a new heavy recession kicks in. Then they will have to stop the rate increases, just my opinion.

When it comes to the sustainability of high Interest rates in CH, also keep in mind that interest payments are tax deductible (maybe not for long based on the discussion in the parliament) and that if your friends are in the top earners a 1% increase in payments translates into less, e.g. for a high income in ZH in the 45% tax bracket you almost get a 50% discount so there’s still room before it really hurts. I’m more concerned by the price correction that may follow and that could trigger margin calls from the banks upon mortgage renewals and those who did not save thinking they were done with housing expenses and had max LTV will be in a lot of trouble as all of a sudden they might be required to add 100k equity.

Isn’t also more difficult to get a mortgage? After all here they count that 1/3 of your salary should be able to cover 5% interest rate.

I don t hink the requirements to get a mortgage will change, of course if interest rates end up above 5% in CH (unlikely in my opinion), they will compute based on market rates and take the highest of the 5% / whatever the market rate is. For new buyers if prices go down it should actually become easier to buy a property since you will need less equity than before but the issue will be for the ones that need to renew an overvalued property as the bank recalculates equity requirements. It should not be a problem of affordability but a collateral one in that case as LTV (i.e. how much you are able to borrow based on the current value of your property) requirements come also into play.

The SNB just rose the deposit rate 75bp, from -0.25% to 0.5% today. It’s an end of an era! Negative rates are over.

That means that all SARON short term loans are now costing at least 50bp more than yesterday. That could be a shock to people used to paying only 0.5%, with costs now doubling to 1%.

But I don’t think we’ll see the real-estate bubble burst soon; the process will take a long time (read: years, not months). I don’t think a majority of owners have variable rate loans, so the pain is only felt when refinancing.

Real estate valuations are based on properties that are being sold. So everybody that buys something now will have to get a mortgage at a higher interest rate. Still, I don’t think that prices in Switzerland will drop. Interest rates are only one factor and there are many more (immigration, limited land etc).

I expect that they will just stay stable and stop increasing by 5-10%/year.

The requirements to get a mortgage are calculated based on a hypothetical 5% rate. The costs for a 5% rate should not exceed 33% of your income. Hence 0.5% should not represent more than 3.3% of your income. Such an increase does not sound that dramatic to me. It’s still super cheap, I’d think rates need to increase a lot more before it really hurts the SARON mortgage holders…

Let’s also not forget that their debt is worth a lot less thanks to inflation!

I wonder how this post will age. ![]() so far it’s not great.

so far it’s not great.

SARON at 1.3% already, halfway to 2.5% (10y).

Where is that “Limited Land” thing come from? Switzerland is so lighly populated as no other country in Europe. You could add another floor onto Zürich and BOOM there’s 200k people more with no additional land used.

The whole of the Swiss population could easily fit into Kt Aargau for what it’s worth.

There’s plenty of (agricultural) land to build on, they just need to recategorize them.

Not too concerned myself. Appreciation has raised the ownership rate of objects massively these past years so most mortgages will not be at risk I think, except maybe the people who bought at stretched valuations for a stretched financing during the last 2 years.

according to this article, if 10 percent of the morgages will default / not pay, that’s more then the capitalization of CS and UBS together (which also says CS is instantly bankrupt ![]() ).

).

So we might face some huge walls of worries rather sooner (2023) than later (2024+).