I hope you don’t take it personal if I visit this thread regulary in the coming years xD

Cortana what you think ?

You think than all people without job and all closed companies continue to bull run the market by increasing his global value ? Or printed money can add any value to something ?

Or a war CN-US can’t happen if US lost the war of USD domination ? (look a little CN production… own CPU, motherboard, dram/nand memory, a lot of nuclear reactor for power, car, … CN is almost not dependent to any other countries but EU/US are 100% dependent of CN. actually EU prefer some internal wars with UK trading deal or who pay the debts of other EU countries… US are busy to their presidential election but during all this time CN have dedicated planes for deliver/export their goods everywhere…)

US have always made war when all goes wrong and this can happen but market will probably lost a major part of his value in the next quarters (take months/years and march is the first) and can keep this value some years after that. When people lost trust to printed money all people remove their money and interest rate can only increase with all consequences for countries with a lot of debt or more debt than cash.

What OogieBoogie write on this forum it’s just gold and very nice of him. Everyone take care of this market can avoid big losses. Blackrock, Vanguard and other big market companies have billions on market if they decide to short there’s absolutely nothing you can do.

You can play if you are a pro else try to keep some value outside of this market for not lost a lot of money.

No one know the price of a share in 6 months but history and actual events give us some advices.

EDIT :

It’s may be not the right because need more check but look that : https://www.zerohedge.com/personal-finance/number-permanent-business-shutdowns-rising

It’s not now the real problem but in 5 months if some companies can’t have the same activity than 5 months ago.

I did almost exactly the same a couple of weeks back. Kept a little Gold. I am turning 50 but age is not the main reason I sold. I just believe that what is going on is in no way normal anymore. Of course some smart experts will come with numbers and ratios showing that the sky is still blue, but turning on the TV one should slowly realize that this “hype” is not sustainable.

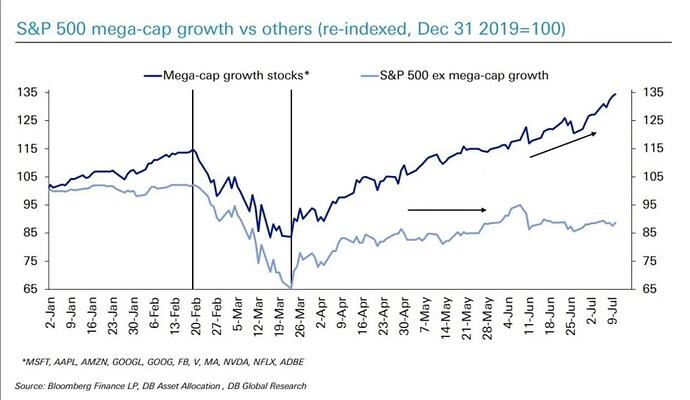

The stock market isn’t the economy. It doesn’t make sense to base your investment decisions on what you see on your TV. It’s counter-intuitive, but when it seems that stocks are riskier, then future returns have to be higher to compensate for that risk. Plus then there is that:

It doesn’t matter if millions are unemployed and everything is going to shit when the main companies of the index are doing great.

Just listened to a related snippet of a Bloomberg’s podcast yesterday - with Bill Miller.

Correlation between the stock market and the economy = 0.09 (insignificant, i.e. random)

Correlation of the 10-year rolling period between the stock market and the economy = -0.4 (i.e. even inversely correlated!)

The markets “predict” the economy, not the other way around.

Yes, but we do have a very special market situation with now with Central Banks buying what ever they can put the hands on. So I would say that this current situation here is more the outlier situation than the normal.

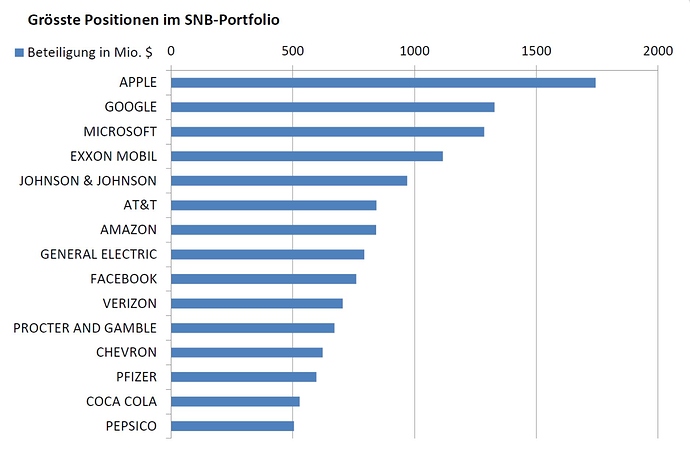

SNB US positions in 2017 (sorry, bit old)

Early 2020 figures show around $6.4 Billion for Apple alone (up from $1.75 Billion from your chart) and around $97 Billion in total (only for US stocks, not US bonds or other currencies holdings).

Impressive rise!

Would be curious to see reports of the timing of those buys ![]() (i.e. late 2018? is March 2020 part of pre-“early 2020”?)

(i.e. late 2018? is March 2020 part of pre-“early 2020”?)

Considering Apple price almost tripled from early 2017 to early 2020, it’s an impressive rise but didn’t involve as much new buying to get from 1.75 to 6.4 as it may at first appear.

SNB communicates that they don’t stock-pick but do more market weight investing.

Ah very true, didn’t take that into account.

This is the GMI monthly report which is available mostly for institutional investors, family offices or the private investors with really deep pockets. It was free of charge as a demo report from April 2020 (begin peak time of Covid) available on the GMI homepage. The report is thought-provoking and trying to look into macro investment industry from different angles.

Like with all things, take this with a grain of salt. It has really a lot of information and I had to read several topics more than once to understand the thought process behind.

Link:

http://www.globalmacroinvestor.com/wp-content/uploads/2020/05/GMI-APRIL-2020-The-Unfolding.pdf

Edit: If anybody want to buy this report (plus services) - it starts with $15k p.a.

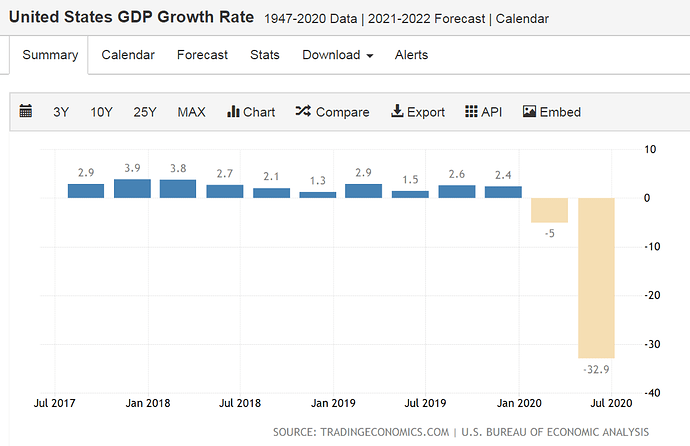

Seen positively: it means there is now finally a huuuge growth potential!

Any FOMO feelings yet?

Just wondering what your current plans are.

I‘ve sold everything a couple of days ago.

No, actually I haven’t. But I‘ve entered sell orders for all of my stock positions on IBKR.

Mostly stop orders (which haven’t triggered yet).

I want to just mention that whatever seems reasonable, may be wrong, because you don’t know what governments and central banks will do. You think stocks are trash at this price, but maybe cash will become even bigger trash?

There is this Polish home-grown investment advisor, who runs a blog with his team. He makes bold predictions but often times they prove to be correct. Yesterday he wrote about the plans of the “ruling class” for the next couple of years. He claims that since 2008 they were trying to cause huge inflation to devalue debt, but it has not worked. Now they changed their strategy. They print even more, and this time money also goes directly to the people, “to the street”. They also want to increase circulation by putting an expiration date on this money (you have a month to spend it).

Still very bullish on BTC & Gold and smaller position on GAFAM (or FAANG). Performance YTD is over 10% - I feel save and very confident with my decisions so far. Thanks for asking ![]()

For both it is valuable to be attentive to the buzz-o-meter (colleagues, friends, …).

If it well captured by Google Trends.

Here a comparison for BTC, here for Gold.

Ultimately, will Cortana sell to OogieBoogie or vice-versa?

We will reach both FIRE and and toast to each other. Having a nice drink in the hand on the little island we bought with the money we made being FIRE-smart here…

Thanks, did knot now that chart for BTC & Gold. In my understanding only private investors have some kind of Gold or especially BTC in their portfolios. But not many professional asset managers who are managing clients money have them in their portfolios. Reason is that they don’t want to underperform compare to their peers - who are also not invested in those assets. Now with Warren Buffet buying Barrick shares this fixed predictment will break and more professional will buy some kind of gold. Similar but even more extrem is the situation with BTC. So I do see the price of both really in the beginning of a longer bull run.