Can you or somebody else please explain in layman terms what does that mean and how could it solve my issue?

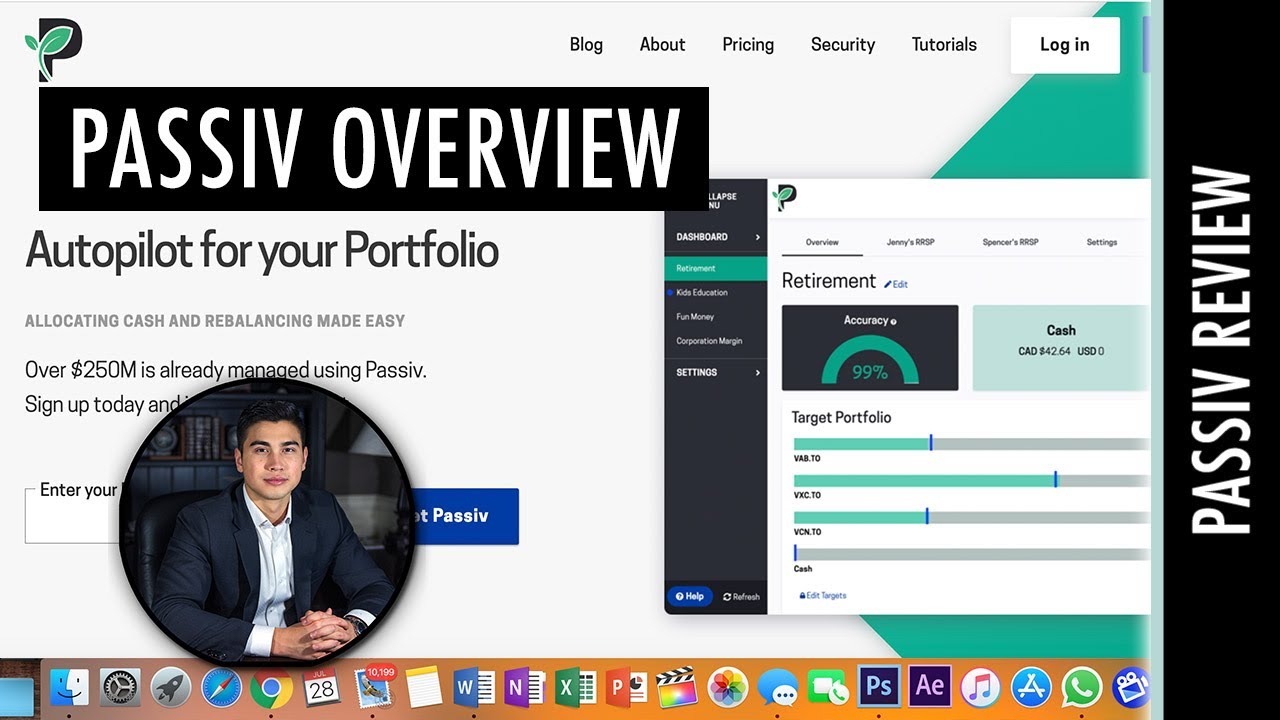

Here is a online review of Passiv. It looks a lot more user friendly than Interactive Brokers TWS solution

It will take 24 hours for my connection to Interactive brokers to be approved so not yet able to say if it works reliably

I confirm this worked for me. It sent me an email when cash landed in my Interactive Brokers account and told me which trades to place, for free (no additional cost vs usual IB trade fees). So not fully automated but good enough to force me to act.

Once you set up an account (video above) here are the steps that need to be followed:

- Set up a recurring deposit in IB and in your online bank to fund your IB account regularly

- Go to Passiv’s Settings and ensure cash alerts are enabled so they notify you when you have cash available to invest

- Get an email, login and follow the calculated trades. (I did not test the following but if you want to pay a premium plan USD 99 /yr Passiv will place the calculated trades directly with One-Click Trades)

Step 1 is probably the most complex for anyone not familiar with IB. Perhaps someone more knowledgeable in IT can comment on the security aspects

It does not work for Mutual Funds and it did not let me enter a negative cash position (margin loan)

When I was young and poor, I used VZ.

It was very good, but my wealth grew, and the 55bps eventually became too much.

You can build your own strategy from this selection of trackers, that includes Vanguard, iShares, Xtrackers, etc. Then you just wire money in, and they do automatic investing and rebalancing.

Sorry, is this automatic investing or manual?

I would say semi automated, they don’t fully automate the trades for security reasons. I tried to describe above. Let me know if I can clarify something

The problem is they charge 0,55 % “service fee” which is catastrophic to the future gains.

So I have to login every month to make the trade?

What happens if I don’t login for months? Will investments in my chosen ETF still be executed every month?

You will receive an email from Passiv every time money arrives in your IB account via the standing order you can set up

If you pay the Passiv premium plan usd 99 per year you click the link in your email to log into Passiv, click “place trade” and you are done.

Perhaps it is not as good as the options available if you were in Germany but for me this is less hassle than transferring to a German bank as it avoids international transfers and it is the best solution I am aware of

If you don’t want to pay USD 99/yr Passiv still calculates the trades to rebalance your account for free, just you don’t have the “place trade” button. So you have to log into IB and place the trades. By default the Passiv account is set to “buy only” so it rebalances without incurring trading fees to sell ETFs

It is 99 CAD per year. If you are part of the https://community.rationalreminder.ca community, you can get the premium plan for 50% off for life until the 16. of April.

Does anyone know what the advanced currency handling mean for Passiv?

(does it not work for multi currency without it?)

Even better. So less than 40chf per year with the discount ( 3.30 chf per month)

Thank you very much for your time but this is exactly what I don’t want and the whole reason I opened this topic; I want it to be fully automatic and I also need/want no rebalancing.

Would be interesting to hear what solution you find

No, it will not be executed automatically. It’s a 1-Click solution. You have to confirm the execution every time you wanted. Another point is that the connector to IBKR is not stable. That’s why i canceled and re-balancing for 1 etf (VT) is not worth the money…

Because I signed up for an account I am getting educational emails from Passiv. Summary:

"By default, Passiv tries to get you as close to your target by displaying trades based on your available cash regardless of currency… With [Passiv’s advanced currency handling settings] you can alter Passiv’s calculations to keep your currencies separate (eg CAD dollars will be used to only purchase CAD stocks) "

I will open an ETF Sparplan in Germany and save 50k chf in the long run on “management” fees.

I used to do the same with an account in the UK. I changed to IB mainly to avoid the hassle of having to stage transfer of chf salary through IB or a discount Fx broker to convert to GBP. In addition I prefer to have all assets in one place for efficient treasury management and to take advantage of IB low loan rates. Lastly there are Inheritance tax considerations for me if I hold assets in a uk account

Problem is that you will have conversion fees to send EUR to Germany, which is a bit annoying.

You will (often) have such fees and “hassle” of currency conversion at IBKR just as well.

I’m using IBKR myself to do my currency conversion but I don’t really feel it’s any less hassle than, for example, TransferWise. This is even more true when using Wise’s borderless account and/or taking into account the red tape of the account opening procedure with IBKR.

IBKR of course does have its own advantages as a broker and is inexpensive.