As the guys explained above one time conversion fees are negligible compared to the yearly service fees Swiss robo brokers charge.

How will you automate the FX and international transfer to avoid having to log in every month? Banks can easily charge couple of % Fx spread. Perhaps you can automate in Transferwise (?)

I asked Transferwise for suggestion earlier today and will report what they have to say.

p.s. I can’t believe I’m the first Swiss resident to open a free ETF Sparplan in Germany… Would be great to learn the tips & tricks from existing users so we don’t make the same mistakes…

Here’s their answer. It seems we can’t automatize everything with Transferwise so we have to find another way to automatically transfer money to Germany every month…

Scheduled transfers only works in you have opened a CHF account with us. It is a multicurrency account which we provide for most of the currencies.

Since you will be sending from CHF to EUR, you can open CHF balances with us and add money directly to your CHF balances.

In your case, you need to open CHF balances and add money from your Swiss account manually.

After adding the money, you can set up a scheduled transfer to your German account and as long as you have money in your CHF balances, we can send money to your German account.

We’ll remind you to add enough money to your CHF balance for your transfer before your scheduled date.

Please note that we cannot add directly money to your CHF balances.

Also, we cannot take money from your Swiss account and use them for scheduled transfer.

You have to add money manually to your CHF balances.

That sounds like it could easily work? You set up a “Dauerauftrag” in your Swiss bank to transfer the money to your Transferwise account, and then you do a Scheduled transfer from Transferwise to your German broker.

You can’t, since Wise doesn’t provide personal CHF account details (see last sentence in rexleonis post).

It’s not that hard though. Similar to the deposit notification at IBKR - yet a bit more streamlined. Though on the other hand I think you can’t make it recurring at Wise, like you do with IBKR.

In the end, I could easily create a transfer notification in the Wise app and do the CHF bank transfer to them in two or three minutes sitting on a train or something.

Wise supports Direct Debits. And so do most German brokers for their ETF savings plans.

It’s very straightforward with the German brokers I know, though the handling of fractional shares can seem slightly cumbersome upon sale / when doing the tax return.

The question is how you’re going to transfer CHF cash to EUR:

a) SEPA Direct Debit from your CHF bank account (if the Swiss bank allows Direct Debits)

b) Straight SEPA Transfer in EUR from your CHF bank account to the German broker

c) Using an intermediary such as Wise or Revolut*

No rocket science (well, except the SEPA Direct Debit from the Swiss bank maybe).

So? You still get an IBAN with a reference number to top up your CHF. If that reference is always the same, it should be no problem to just set up an automatic transaction every month or so.

No, you’re getting a Swiss IBAN to top up your account in any currency / or pay anyone in any other target currency - by way of transferring CHF to that account.

Unlike Revolut, where CHF transfers via Credit Suisse will always end up in your Revolut CHF balance, they don’t necessarily at Wise.

In other words: You have to choose a target currency in when setting the top-up notification in Wise’s app (or on their web site). And probably the account, too - whether you want to have it credited to your own borderless account or directly make a payment to someone else.

If you’re just blindly transferring to Wise’s account, they’d have no instruction what you want to do with the funds - crediting them to your CHF borderless account balance would merely be an assumption that that’s what you want. So I’m not sure they’d do that.

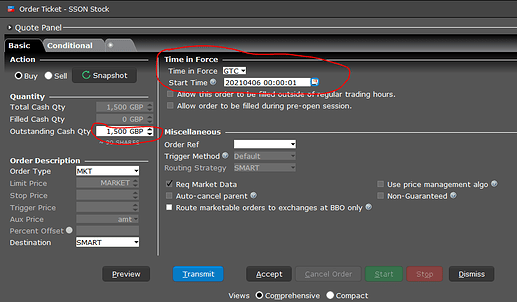

When you create an order on IB, you can set a “time in force” date. The order will only be activated after that date has passed. This way, you can open TWS just once and add orders for the next year so you don’t have to log in again as long as you have sufficient funds. The orders will show as pending on the TWS.

I actually create these recurring orders with a Python script, but it should be quick enough to create them manually too.

So you have to manually create each and everyone of the 12 orders for the whole year?

In principle yes, but I personally have a script to do it.

Even if you submit the orders manually, I guess it’s still better to do it once a year rather than 12 times.

Thanks for sharing this tip. Would you be able to advise where you find this option? I was unable to find it in TWS, IOS or Web interface

[Edit: I think I figured it out. In TWS click on “Order” button then see screenshot below

I am not sure whether this option was already visible to me or only after I configured my layout as outlined in this link]

I suppose you use these scripts for monthly ETF purchases? May I ask why don’t you employ a free German broker to do it all for you automatically in an ETF Sparplan?

One reason may be no US-domiciled funds for EU residents/brokers.

In TWS click on “Order” button then see screenshot below

Yes, that’s one way to do it. I came back to grab a screenshot but you were faster than me.

The classic TWS also shows pending orders as a table, and it’s easy to see upcoming orders once you enable the “time in force” column there.

May I ask why don’t you employ a free German broker to do it all for you automatically in an ETF Sparplan?

Mostly laziness and avoiding yet another account to manage, secure, report taxes on, etc…

I’ve been doing that for almost two years now, Transferwise just adds the CHF to your CHF account.

I then transfer to my Revolut account, where I exchange to EUR (1000 free each month, above that with a small fee), and then it automatically is sent to my DKB account.

This still has a manual step in there (Transfer to Revolut + currency exchange), but if you stay with Wise, it could work completely automated.

You mean that they‘d convert the funds to EUR, just based on the assumption that you want to fund the EUR SEPA standing order?

Would be even more surprised if they did …but then, maybe based on your experience I shouldn’t ![]()

Good point, I never tried myself with Wise, and Revolut does not automatically convert to EUR to make an automated transfer possible (accidentially happened once and failed  )

)