Apparently, the banks here charge very high fees for investing in index funds and ETFs. Instead, I was considering using Swissquote upon advice from a bank consultant. The most recent discussion about this that I found was a few years old, so I just wanted to know what the community thinks about it now.

Degiro has the absolute lowest fees on the market. They also have a list of comission-free ETFs.

Hi @slive,

I am on the process of changing from Swissquote to DeGiro and I will share some of the info I got this month (August 2019, I’m a buy and hold investor):

1 - I’m with Swissquote since 2008. I have 1 IBAN for 3 Currencies (CHF, EUR, USD). If I only have deposits and no ETF or Stocks the maintenance costs is 0 CHF

1.1 - Last year I bought Stocks and since then I pay 16.16 CHF/Quarter (total 64.64 CHF /Year) maintenance for the Depot

1.2 - and paid in fact 34.80 CHF commission to buy my stocks in the SIX… this makes Swissquote as bad as UBS (charging 40CHF commission, 1.50 CHF SIX fee and 0.90CHF Stampelsteuer)

2 - then to escape 1.1 I first considered moving to CornerTrade. Their commission for my Stocks would be 18 CHF and maintenance was for free

2.2 - they changed the maintenance charges in July 2019 and now charge 35CHF/quarter (140CHF/year) if you don’t trade for 2 consecutive quarters…

So, I decided this is not worth the risk as I don’t know how regularly I will be able to invest. The initial idea with CornerTrade was to have a Swiss based broker. But their fee structure is no longer appealing to me.

3 - DeGiro seams to be the cheapest kid in town. It also has a list of free ETFs (no commission for buying) including the ones I am planning to invest in and charge no maintenance fee

3.1- however, you can only chose 1 base currency. My stocks are in CHF, the ETF is in USD but traded for free only in Amsterdam and in EUR.

3.1.1 - They convert everything from your base currency to the target currency of the product automatically and charge 0.1%. There is an option of turning off auto-currency-conversion, then they will keep your deposits and dividends received in EUR or other currencies in that currency. You can then reinvest without FX costs. You can also convert currencies manually, this costs 10 EUR +0.02%

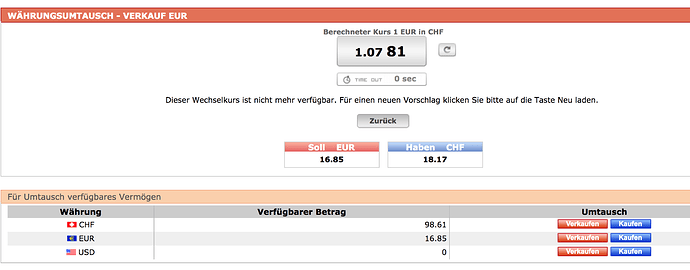

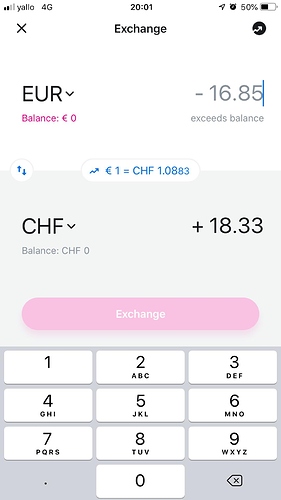

My issue now is: the deposit has to arrive at DeGiro in the target currency so I don’t pay the conversion fee. With Swissquote I had the 3 currencies in my account and could exchange it “free of charge” (the rate was suboptimum as I have made a comparison this week).

I also considered Revolut, as they announced this month that would be possible to trade for free just like Robinhood. However, it turned to be only for EU customers (or UK even) and only for US Stocks.

Anyhow, I registered with Revolut for cirrency conversion and did a comparisson:

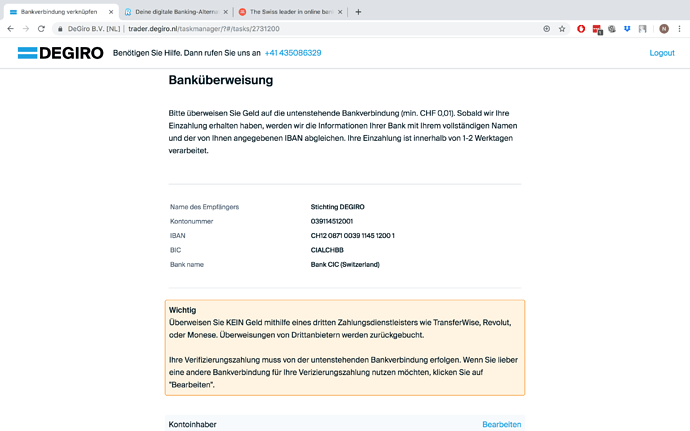

Then my plan was simple: use Revolut to convert from CHF to EUR, transfer it to DeGiro and invest in the ETF. But this seams not to be possible:

You need to have an IBAN. My wife used to convert currencies with IB! But this would also not solve the problem because with IB you also don’t have an IBAN.

Then you ask, but why dont you use IB? The answer is simple: there are cost comparisons showing IB is only better than DeGiro for portfolios larger than 100k

My solution now (still to be tested next week) is rather complex but if works I will have a good solution to avoid FX fees:

I have opened an EUR Privatkonto with Migrobank (free if you have more than 7500 CHF). I will now send CHF from my main account to Revolut, convert it, send it back to MigrosBank EUR account and from there transfer to DeGiro.

There is 2 ways of sending from MigrosBank to DeGiro 1- Sofort 2 - Bank transfer

Sofort costs 1.25 CHF

Bank Transfer: DeGiro’s account is an CH IBAN so this Inland transfer should be 0 CHF. However, I do not know what happens if I transfer EUR there… maybe their receiving bank will automatically convert it to EUR…

As mentioned in 1, Swissquote could be used to convert CHF to EUR but it would be difficult to bring it to DeGiro, 1 - Swissquote is not on “Sofort” 2- they charge 2 CHF/2 EUR to send inland and SEPA transfers

If sending EUR to DeGiro’s CH account does not work, then I will activate the auto conversion and pay the 0.1% as it will be much simpler…

hope those lines help

regards

Without being familiar with DeGiro: It might be a multicurrency account but as it’s held with a Swiss bank most likely isn’t. So the funds would likely be returned or converted by Bank CIC.

The likely solution is to make a transfers to DeGiro’s SEPA EUR account in the EU - the same as EU customers do. Should be 0.30 CHF per transfer from Migros Bank. Though the question is whether DeGiro’s will levy additional chares, since your SEPA transfer will originate from outside the EEA.

Even then, Degiro is cheaper if you go for the Basic account.

Foreign brokers are generally cheaper as mentioned (and preferred?) by others, especially as you can avoid the Swiss stamp duty. I prefer a broker with a Swiss banking license that is Swiss regulated.

And in that case, Swissquote is afaik the cheapest, certainly much cheaper than traditional banks. Nonetheless, a certain minimum per trade and minimum total assets is required to make it worthwhile.

Swissquote fees to be precise:

-

Account fee of 0.1077%/year on securities (min. 64.64 CHF/year, max. 215.40 CHF/year)

-

Trading cost for ETFs are…

- 9.85 CHF/trade fixed

- 0.075% (CH) / 0.150% (foreign) Swiss stamp duty

- 1.50 CHF/trade + 0.015% SIX exchange fees (min. 2 CHF, max. 150 CHF)

- = for example 27.85 CHF for a 10’000 CHF trade of a foreign ETF

-

FX spread is 1.7 PIPS (0.017%) for a forex account. Might be higher for a trading account, e.g. for selling received USD dividends, but I myself have never seen anything remotely as high as @miriade is showing.

Before opening a basic account, try to read and understand about the risks of the broker lending your securities. And maybe you are the interested to know the fees of the degiro custody account. (IB also offers to pay the customer for lending the customer’s securities to a third party.) Even thogh Degiro was cheaper for me I went to IB didn’t like these rumours:

https://www.google.com/amp/www.amsterdamtrader.com/2015/09/degiro-clients-as-counterparty-for-hedgefund.html/amp

If something’s free,

you are the product

Is that still true when you take into account expense ratios and withholding-tax complications due to lack of non-EU funds?

There are other brokers out there with commission-free ETFs. Schwab does, even IB does (but IB’s selection is terrible).

100k is not much money in Switzerland

And there’s IB-affiliated CapTrader who does away with the fees from a lot lower limit than 100k.

I don’t know why people are always referring to the >100k rule for IB. Yes, you pay 10$ per month if your account has less than 100k on it. BUT: the commission for trades is deducted from those 10$. Hence, you are paying 10$ if you do nothing, but also only pay 10$ if you are doing some trades.

To give you a real world example:

For three buys at DEGIRO (AllWorld, EM, SmallCap), I had to pay ~10.50CHF. Then, for selling the same, another 8CHF. Plus 3CHF for transferring money back to my normal bank account.

In total: 21.50CHF for buying and selling three ETFs

IB instead: buying three ETFS (US, DevelopedWorld, EM) was 3$, changing currency from CHF to USD was 2$. Didn’t sell any of those yet, but it will also only be 1$ most probably.

Those 5$ were deducted (included) from the 10$ monthly account fee, so for 10$ per month I could buy 8 ETFs and change currency.

From my point of view, IB is better even for accounts lower than 100k. You can change 10k CHF to USD for 2$. Good look trying that one with DEGIRO (they don’t have a fixed rate).

There’s nothing „complicated“ about withholding tax with Irish ETFs. To the contrary, as we’ve seen some reports (and also depending on canton), it’s the reclaim of US ETFs bought at IBKR that can occasionally get a bit „complicated“ with withholding tax - though this might result in slightly lower overall tax burden on distributions of US companies.

Fair enough, but imagine the scenario where I am only buying my VWRL once or max twice per year… no other activities…

Most Kanton’s handle it without issue.

And that still leaves the expense ratio aspect unanswered.

Also, VWRL on the Dutch exchange is a free trade with Degiro. You just pay 2.5€/yr for holding positions on that exchange. For simple buy and hold with a single or few etf’s, degiro is clearly cheaper than IB for <100k USD.

14 posts were merged into an existing topic: What should you focus on to accelerate FIRE?

If you take into account the higher TER of VWRL compared to VT (that you can’t buy at Degiro), and extra tax on dividends, Degiro is only cheaper under around 25-30k.

Thank you all for your insight. Having looked at the options, I chose to go with Swissquote for now; I figured that I will pay a small premium for the security of an established Swiss company managing my money.

Just to chime in on the unrelated discussion in the last few comments: I really agree that growing income is more important than cutting expenses. But I also think it may be harder than it sounds for many earners and that we should show empathy, not condescension, to those who are less privileged when it comes to talents and opportunities.

Of course you are right. I was, wrongly, assuming that everyone is trading on a monthly basis.

If you only buy VWRL once or twice a year, it’s cheaper to go with IB.

0.25% VWRL vs 0.09% for VT = 75’000.- at IB to break even (no taxes, fees)

15% withholding tax on dividends for VWRL = 40’000.- if you calculate with 2% dividends (800.- * 15% = 120.-)

So depending on the number of buys per year, IB is indeed cheaper from 40k

5 posts were split to a new topic: Where should you focus on to accelerate FIRE?

And this can actually go down to 1$ for all 3 purchases together.

Use tiered pricing.

Depends on personal level I would still say.

Being FI (and maybe RE) with 50 is still way better than with 65+. ![]()