NYSE S&P500 10 mins in:

The weird psychology in the accumulation phase:

Going down: Yeah, I’m going to be buying low! ![]()

Going up: Yeah I’m getting richer! ![]()

(Also going up but buying soon on autoinvest: why does it ALWAYS get expensive now?)

It’s not entirely rational…

Totally, need tricks to stay motivated while earning good money and being frugal. Very long-term benefit is not that easy to keep committed to when it can feel that one is losing comfort today, tomorrow, for a month, for six months, for a year etc.

Anything to remain motivated is golden and whoever thinks otherwise needs to better understand human psychology. Humans are anything but rational.

At least you have positive emotions ![]()

For me it’s:

Going down? Oh no, I’m losing money ![]()

Going up? Oh no, I’ll have to buy high ![]()

More like:

Going higher: OMG. I under-estimated how much these morons are willing to overpay!

When SMCI reached $1000. I really wanted to short, but I really couldn’t be sure how much more stupid people buying could be.

And even if I did, I might have looked right for 2 days, but it’s almost back at $1000 again!

That’s really the problem I’ve had when trying to time the market. One can successfully identify an overvalued market due for correction but people can be irrational longer than I can stay confident I can live with the consequences of my positioning. Overbought markets can skyrocket way higher even when they’re already very high, and investors can come down to reality at any point.

I find funnier not to have to deal with any specific positioning as I watch them suddenly realize that “hey, maybe the Fed isn’t cutting rates right at the first opportunity!” for the third time in a row, then rebounce higher on the earnings results of a seller of shovels in the middle of a gold rush toward a mountain of fumes.

So I decided to wait and of course the market is exploding now ![]()

Charlie Munger “The money is in the waiting”.

I am waiting too, haven’t spent anything other than filling my 3A in 2024, you’re not losing anything. Hell, even VXUS is moving.

Can you maybe wait for another 15 years or so? ![]()

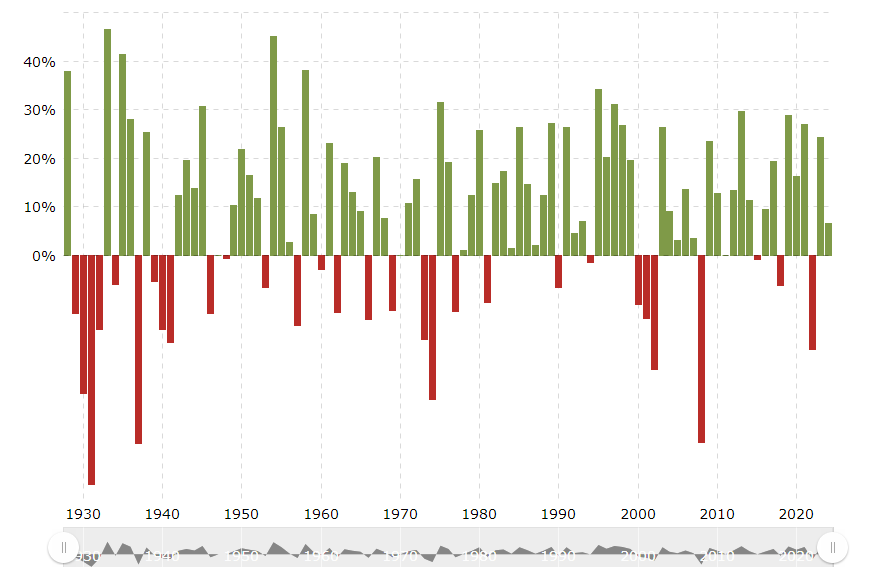

Yeah, me too… Normally I buy at the beginning of the month, which would be much cheaper… But in Feb I have not enough money for a bit (waiting for big reimbursement from health insurance) and when I got it the markets were already much higher. But in the meantime I saw the chart I pasted here, which kind of suggested me that maybe I should wait still a bit more ![]() . I guess I’ll then buy normally at the beginning of March again.

. I guess I’ll then buy normally at the beginning of March again.

Statistically, excepting 2008, the US electoral years were bringing positive returns. I think this year will bring more growth with some moderate corrections along the way. Another reason for being bullish for me is that we already had two years of negative returns, and again, statistically, a third one in a row is very unlikely. That being said, no one can predict the future, but I do tend to be optimist. ‘‘Time in the market beats timming the market’’. In the end, it’s just numbers on a screen ![]()

Which were those?

In my books only 2022 was negative.

From Nov. - Dec. 2021 all time high, we were in negative territory for 2 years, until Nov. - Dec. 2023. Not sure what you see in your books ![]()

If that’s the way you measure years of negative returns, then we’re by definition out of it since we have reached a new peak (in nominal USD) and what we are faced with are the odds of a new crash/correction/run of the mill negative year.

The reason to be bullish, then, is “just” the usual “stocks usually go up over longer term periods” which is a nice way to encourage us to stay the course, provided we’ve picked an allocation allowing us to withstand a crash as one could happen whenever.

I don’t think market timing data can be derived from “we’ve just reached a new peak”, infering that we shouldn’t face negative returns in the short term since that’s exactly what happened in 2006, when the nominal with dividends reinvested recovery from the dot com crash was reached, just before the new crash of the great financial crisis.

…correct

…it will happen, but we don’t know when, might be 1 month or 10 years, no one can predict de future…

Well, if statistical data doesn’t help you in your decision, it does help me. I might be wrong, but I am posting this every year somewhere on this blog ![]() The only data we have is historical and based on that it’s enough reason for me to be bullish long term and also around key events that might happen again. As I don’t have a crystal globe to predict the future, it just a way to look at it. What’s the alternative?

The only data we have is historical and based on that it’s enough reason for me to be bullish long term and also around key events that might happen again. As I don’t have a crystal globe to predict the future, it just a way to look at it. What’s the alternative?

This chart is probably calendar years 1.1.-31.12., so your “custom” 2 year period (starting in Nov/Dec) would not be reflected there.

What I meant by “in my books” = calendar year 1.1.-31.12.

Only 2022 had -18% if looking at VT in USD.

Fair enough, but that’s even more of a reason to be bullish now, as there are much more years with positive returns vs. my ‘‘conservative’’ period selection ![]()

The 2022-2024 dip is kind of over.

Should we start a new thread about our feelings about the current market conditions?

- Yes, start a new thread.

- No, we are not finished here yet.

As you have noted, in inflation adjusted CHF terms, we are not yet at a new all time high (unless that has changed in the last 2 weeks).

To be fair, I’m mostly indiferent to the question. I say do with it whatever is the cheapest to maintain for the forum.