And today it had hit at 18 months low ![]()

It had helped indices in USD to reach the highest values since October’s bottom, which indices in CHF haven’t done yet.

3 posts were merged into an existing topic: Benchmarking The Market

Usually if the DXY rises, it’s not good for equities (US) as well as for CHFUSD

I’ll be the first to admit that I’ve been blind to the fact that bonds loosing value would endanger the banking sector and that my narrative for the current downturn had many blind spots.

I’m bracing myself for another leg down, though have tinkered enough for my likings last year and will simply hold my allocation through the potential fall and rise this year.

Even more reasons not to trust bonds ![]() .

.

The fun thing with bonds is that they are one of if not the most reliable asset available, in that the rules that govern it are set at its emission, but they are also used for a lot of things they don’t do, and when it occasionally fails, we rediscover that bonds in and of themselves are not a be all end all safe haven.

Reliable =/= safe. SVB seems to have failed because of risk management, not because of bonds in and of themselves. Choosing the right assets in accordance to our goals and the risks we want to reduce or are willing to accept is the hardest part of investing, to me. I find that my biggest hurdle when investing is to fight back pride when it settles in.

Even mountain guides stay humble in regards to the mountain environment. Being humble, keeping our eyes open and staying honest with ourselves are in my opinion very difficult traits to keep, yet very essential ones when investing.

3 posts were merged into an existing topic: Benchmarking The Market

9 posts were merged into an existing topic: What’s your (investment) strategy for 2023?

USDCHF have reached a 26-months low. Interesting. I wonder if it will drop to levels not seen since Frankenshock.

@FunnyDjo I came across some interesting graphs regarding Japan:

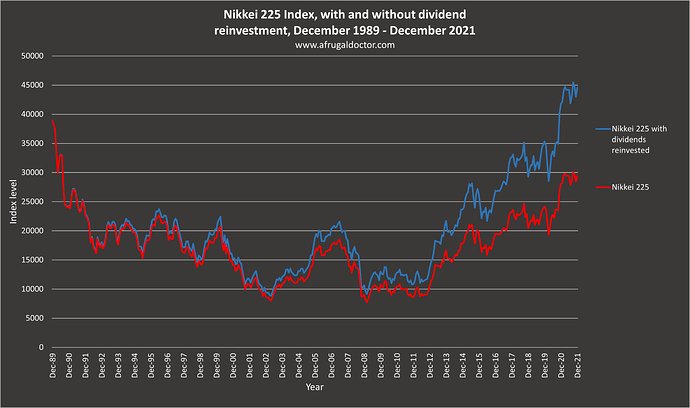

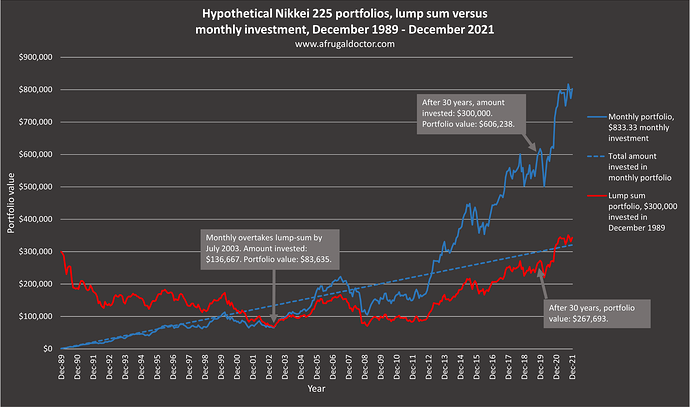

Japans stock market actually recovered after 30 years with dividends reinvested. For someone accumulating and starting investing back in 1989, it wasn’t that bad after 30 years.

what a relief! ![]()

also, the most positive reading of this story is 100% profit in 30 years. That’s not even a 2.5% annual compound interest…

Is this inflation adjusted?

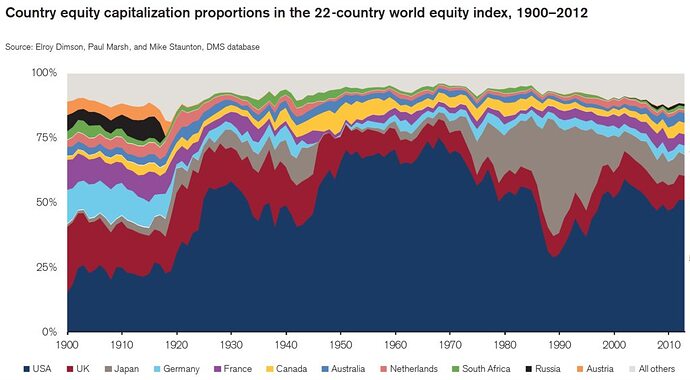

My point is why do you want to take the bet of giving 100% to 1 country (even USA) when you could diversify and avoid waiting a 30 years recovery.

It is already more than 65% of global market so at least it will rebalance his weighting automatically on VT.

Japan had amazing stock returns for 40 years prior to that.

Their global market cap weight went up from ~0% to ~43% in that time. They just seemed unstoppable.

It sounds like the USA today to me with usd supremacy on commodity exchange and international treaties to be able to sue any foreign corporations treating American competitors (e.g. Alstom penalty allow GE to acquire discounted).

But who knows what will happens next with LNG contracts now made in yuan.

Someone investing 2.1k/month and aiming for 2 million to retire managed to do it within 33 years ![]()

So if you start investing in your 20s, you‘re highly likely to retire before 60 even if we experience a Japan-scenario globally.

Given the interest rate differential there’s no reason to believe it won’t continue to drop (or you could make a lot of money ![]() )

)

Is the drop really because of interest rate differential? If there would be no other factors at play this would be perfect carry trade and USD would rise against CHF.