Which would emphase that the people doing the forecasts aren’t necessarily representative of the market, which begs the question of what actually is priced in the market right now. The funny thing is that the short did work, only for a short period of time and a definite amount of volume. If it is a short play, it is sobbering to see tactical plays having that kind of effects on the scale of indexes.

yahoo:

and what happens?

![]()

yahoo’s edit:

They didn’t even change the title that much. They might have some sort of algorithm… they just have to find the correct sentences that can be swapped easily.

I mean, if I didn’t screenshot the first one, I might have thought that I misread it the first time.

“amid” is also a nice word for those generic sentences.

It is an algorithm, happens all the time. They choose a reason then change the line using “stocks/bonds” “rise/fall” “after/amid/…”. Easy, cheap, non-actionable.

I have read “genetic sequences”, sorry for offtopic ![]()

Just sharing a good laugh I had today: San Francisco’s Fed President Mary Daly says “the data is not cooperating”. xD

Still better than “alternative facts” ![]()

Well, I do hope “alternative facts” are cooperating, otherwise, we’re not out of this downturn/seemingly coming recession, let me tell you that.

Also, for those who want to follow the UK blunder and the unbelievable stance and discourse of Liz Truss after having created a blunder in the bond market and her now former Chancellor of the Exchequer (Minister of Finances), Kwasi Kwarteng, openly stating that his policy was fine and that any trouble in the financial markets was for the UK central bank to deal with, and certainly not for the fiscal branch of the government, I do like Bloomberg’s Jonathan Ferro’s take on it in the Open Full Shows and the Surveillance. Latest edition: The Open Full Show - YouTube

(26:24 for parts of Liz Truss’ speech)

Isn’t it how things normally work? The central bank usually solves crises by lowering short-term rates directly, and by buying all the bonds until long-term yields are as low as desired. Then deficits don’t matter.

That’s how it’s been since 2008 but inflation changes things, central banks are busy fighting it and their tools are very blunt: they hit everybody equally. Only fiscal policy can allocate support and pain to engineer a soft landing.

The UK mini-budget was an inflationary bomb meant to stimulate the economy, at a time when the central bank is trying to cool it down. Central banks are the last ward regarding financial stability and have an essential role to play as providers of liquidity but when you propose a budget without runing it through the forecasting offices established especially for that very purpose and that investors loose faith in the ability of the government to make good on their bonds as a direct result of it, I’d say you could consider there are some levers you can pull to try and cool off the crisis you’ve sparked instead of throwing gasoline on the flames.

The situation is complex and central banks are reaping what they have sowed but fighting inflation is as much a matter for governments to tackle as it is for central banks. Countries where both institutions are working against each other are setting themselves for bad economic prospects and not very attractive from a long investor point of view.

Edit: just to be clear, I don’t say the Bank of England did everything right, their 3 days ultimatum was pretty poorly designed too and I can’t vouch for their policy, both parties seem to have been performing pretty poorly. I’m just saying that if you are a government and your line of defense is “I don’t have to do anything and if things go bad, I have someone to blame”, then your policy is pretty not government worthy, which seems to have been the result in the UK.

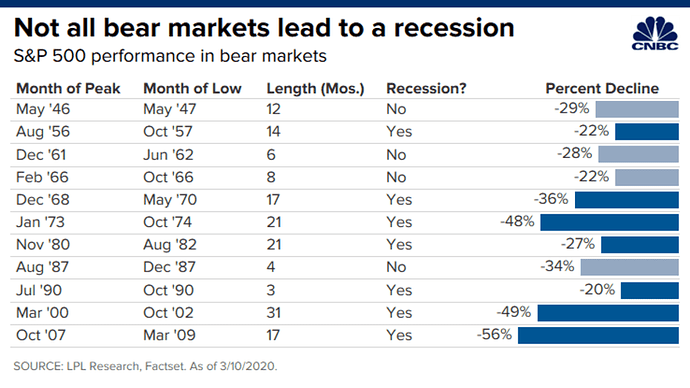

I think this is exactly the issue now. Looking at the past:

- In the 70’s US used expansionary policy to increase supply and balance demand in order to pull down inflation

Similar to the past, oil prices are high but we are unlikely to generate significant demand growth as we are past baby boomers period in EU.

Central banks and rate increases are only going to lead to recession. Instead govt should push oil producers to increase production and reduce oil price as this will benefit everyone. Biden tried to do with Saudi. Europe as always we don’t do anything. We should have coordinated an effort and really push oil producers…

What does mean for investing:

- oil prices will remain high even if GDP slows down as oil producers will slash supply

- inflation on goods will stabilize at some point as demand slows but take home earnings will reduce for low-middle income households, especially in EU as we get limited salary adjustments

- house sell will slow down as mortgage interest are getting so high to put off people.

- house prices will decrease as less but at lower price point transactions will determine market prices

- corporate are facing increasing prices and some lower demand. They will slash some costs but energy intensive industries can’t pass all costs to consumers (in some cases due to regulation, in other due to competition)

- corporate forward earnings will come down so stock prices. higher interest cause professional investors to reduce / limit stock allocation due to higher WACC (cost of capital) and retail investors as bond yields are getting attractive at relatively low risk

In all of this, there is the usual question. How much all of this is already embedded into stock prices already? Technically it should be, but I still see some pain ahead. Catalysts:

- 2023 corporate projections coming out next weeks will result in concerns about earning growth

- inflation won’t decrease much, rather stabilize until year end

- next year - q4 earnings won’t be too bad but people will look forward to 2023 earnings concerned

- I don’t know how people will interpret house price slowdown

Unless there will be something else popping out, by q1 2023 the market should have incorporated all the negative and ready to growth again.

Our governements have been punishing oil producers over the last decade pushing the ESG agenda. Strategic decisions are beeing made based on moral supremacy and emotions since that is what the voter demands. I doubt oil- and gascompanies will trust them now and invest longterm. They know as soon as the war in Ukraine is over they will be dropped like a hot potatoe. For me Europe stays ininvestable.

Just a curiosity: are there technicals to look at for establishing what has been priced in? Or just the assumption that institutions and big money are surely one step ahead?

I read that a good indicator - for the start of a more solid growth phase - could be when the bond market starts reversing

In your opinion they have been punished, in another they have been helped.

I worked nearly 30 years in the construction business and made the experience that in recent years the installation of new gas and oil heating systems have basically been outlawed in most Swiss cities. Recent demands for huge investments in the fossil energy infrastructure seem a bit inconsequent to me.

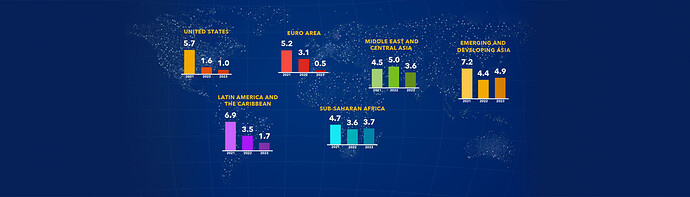

IMF latest GDP growth projections for 2021, 2022 and 2023:

The problem is that there is no real long-term strategy.

Plans and strategies age too quickly, especially in Europe.

There was an interesting article in NZZ recently (paywalled) about how Switzerland got where it is with its energy policy. In essence, the entire decision was done on the spur of the moment. Yet that’s not how countries should be run!

the CPI report came in hotter than expected. That also resulted in an expected drop in the S&P 500. However, the decline was so rapid and severe that it immediately took the S&P 500 to the level with the greatest concentration of open puts, at 3,500.

On top of this, the implied volatility levels were very high going into the CPI report, rising to around 70% minutes before the print came out at 8:30 AM. By day’s end, implied volatility for an at-the-money option dropped to approximately 40%.

The sharp opening drop in the market and the high implied volatility led to options traders quickly starting to sell their puts, with the average weighted price jumping from around $7 per contract to more than $20 by the time the market opened for an October 13, 3,500 put.

As options traders sold these puts, market makers were forced to unwind hedges and buy the S&P 500 futures, helping fuel the rally in the equity market. As the market stabilized and bounced off the 3,500, options for the October 13 trade date at the 3,600 strike price began to trade more heavily, which in effect, helped to fuel the rally further. As options traders began to buy these calls betting on the index bouncing, market makers had to hedge their positions again, buying S&P 500 futures.

As the day progressed, the call activity shifted higher as the S&P 500 pushed higher. The 3,680 and 3,700 call options were among the most active trade contracts on the day.

https://seekingalpha.com/article/4546756-stocks-may-head-lower-after-repricing-rates

the S&P 500’s miraculous rally of more than 2% by day’s end from a decline of more than 2% at the open has occurred just four other times over the past 30 years.

Three of the four periods saw the S&P 500 surge double digits over the year that followed. The fourth was a disaster, because it preceded the financial crisis that led to the Great Recession.

https://seekingalpha.com/article/4546583-hot-inflation-report-burns-bears

Bottom signal.

Time to long it.

Or time for the mother of all crashes as for mr Bury.

I think 4 cases is a small sample and high frequency trading and all the put calls around key points make those 4 historical cases less relevant in my opinion.

I am not saying that we should expect a plunge to 1900 for the S&P500 but neither we are out of the woods…. Perhaps markets will sideways and rebound or retest 3500, I think there is enough turbulence ahead for a retesting.

But it does not matter! I will continue to deploy my accumulated reserves until exhaustion (planned for end of Q1 2023), then monthly DCA from paycheck