Don’t worry, a few years from now no one will remember this market hickup - it’s not that dramatic ![]()

you can look up the Bond markets yourself, but honestly i just looked at this guy and parroted what he is saying/showing:

We all hope so, but the first 6 months of 2022 were the worst since 1970 and the future outlook doesn’t look good either

…and I think many people remember the 1970s with high inflation and declining stock prices as more than a small hiccup.

(That’s not to say that „this time“ will be like the 1970s but there’s at least some economic parallels).

Would be interesting to hear from someone who actually remembers 70th. Any grandpas here?

Well, looking at VT we’re now about where we started off in 2020 before the whole corona madness. I never assumed the crazy stock market gains due to central bank money printing would be sustainable. Also, US job reports and earnings don’t look that bad for now.

And regarding inflation: We live in Switzerland, not the US or EU, fortunately. And I also don’t drive a gas-monster SVU ![]()

Me too ![]()

Even if the inflation will be lower than the rest of EU, it cannot stay that low with the present situation

Don’t worry, Switzerland’s central bank’s still got massive foreign currency reserves and rates to hike. Also, Switzerland’s got hardly any debt compared to many EU countries

Moot point - it’s just the drop started at the beginning of the year. Otherwise 2020 30% drop in two months sounds way more scarier than 2021 20% drop in 6 month ![]()

In 2020 there was the uncertainty of a global pandemic.

What’s happening now is the result of bad monetary policy (FED), War, energy issues (Gas), supply chain, (still) virus and so on.

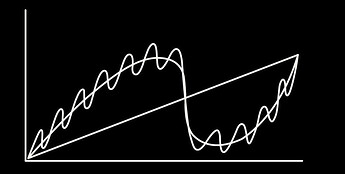

Let’s see if we are in the small or big wave:

- Crypto related interviewer

- Expert with a good past

- Expert with links to former president and his (its?) party.

- Start speaking bad about the actual president

- Keep insulting the Fed.

I don’t think I’m trusting this interview.

![]()

It was just for the exact minute that I posted were he briefly talked about late 70s crisis.

Anyway he said also something interesting.

Do you think the FED performed well? (inflation will be transitory…inflation is under control…)

What’s your counterfactual? Raising rate during covid, triggering a large economic contraction (probably would have stopped inflation indeed, but their job is to smooth those cycles instead of doing boom/bust).

Note: inflation is a very weird beast, afaiu a large part of it is about expectations (when people stop thinking inflation can be controlled it’s self fulfilling and turns into hyper inflation), so it’s somewhat part of their job to shape the opinion/perception.

I didn’t listen it that much, but it keeps talking about two things (apart for the insults etc.) let the interest do their job alone and let the market get filled with products (i’m bad at paraphrasing).

So if you are one of his cronies, you let the market do its stuff and if it goes bad it’s not your fault. For the second point I feel he wanted to say that they need to lower taxes to industries or other stuff (like blocking climate laws?)

Another hint that the interview might be bad is when the language is very simple (I understood everything immediately). It means the target is someone that get easily impressed by big words and repetitions (bad fed, bad president, bad bad etc)

I’m getting cynical, it might be the weather.

This is nosense - lose monetary policy couldn’t fix the supply chain problems. They used demand-driven recession recipe for the supply-driven problems. It was obvious it’s gonna end in high inflation. Monetary expansion in 2008 made sense - in 2020-2021 not at all. Printing money is not a solution to all economic problems and now we learn that lesson the hard way.

I am not an expert but economists say the inflation of 1970’s is very different from this one. One of the factors that make it different is the insane amount of public/private debt we have now in the west.

That’s why they can’t raise the interest rate and nuke the inflation: It would be worse.

So all in all, a very pessimistic scenario it appears. Dunno what will happen.

Again, we are lucky to be in Switzerland. This is a protected bubble.

Again not an expert just following lately a lot of economists from different countries but I think they are right: Everything (debt, prices, resources consumption, everything!) is super inflated. A correction is needed. Of course the SP500 will grow in the long run as has done since it exists but I expect it to go lower for some time before raises again.

When this autum/winter the energy starts to get very scarce to the point of restrictions and industry sectors halting, we will see how global economy does.

My gut feeling.

Why do you think they were trying to fix supply chain issues? Wasn’t the goal to soften the blow to the economy?

With hindsight (China/Russia, there were lots of unknown on the duration of the crisis) maybe there was a better solution (but then I’m not even sure).

But crushing the demand-side, companies folding, high unemployment, in the middle of a health crisis sounds like a pretty bad outcome to me (with even more uncertainty on the overall stability for many countries than there is already).

I couldn’t agree more.

It seems really impossible that hundreds of analysts seating at the FED could not figure out that printing money like crazy, while people forced to be at home, was a real solution….but it happened. I don’t think that you need to be an economists to understand what can go wrong. Was it done on purpose? ![]()

You can also check for every Fomc minutes from December…they didn’t get even one correctly.

Now they are in terrible spot. Whatever they do, they’ll break something. And not just in the US economy.

Adding also that the velocity of money is low, but still the inflation is not decelerating.

They said the culprit is the war…lol

![Stock Market Investors Don't Know This Is Coming... [SPY, QQQ, TSLA]](https://forum.mustachianpost.com/uploads/default/original/2X/2/2028c0d6fe1f7b4e5ded25d65770c2ef8d58ebf4.jpeg)