Can you believe it? With environmentalists in power?

I wouldn’t call the Green party in Germany environmentalists. They are conservatives with a green cape - trying to tell others what to do while driving around in a SUV. The people in the green party today are mainly opportunists and have nothing to do with the original ideas of the founders.

Pecunia non olet.

The Greens know that as well.

How do you use it?

I think it’s not 100% like that, but I have a similar feeling ![]()

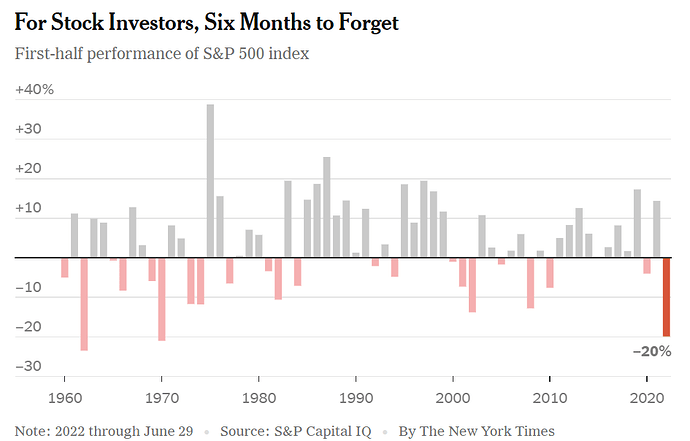

If you consider the macroeconomics and don’t even look at the TA, you could see it in Jan 2022. The FED trapped was one of the biggest signs.

Why not use a mixed strategy? I stopped buying VT and anything else since Jan saving a 20% drop.

When a reversal is going to happen, I’ll start again. If it’s a false breakout I saved anyway 20% downturn.

Do you see any possibilities for the economy to recover anytime soon? I don’t.

let’s test the pre-covid crash first ![]()

But it doesn’t have to. Stocks market is not about the current state of economy. It is about future expectations, keyword “discounted cash flow model”. Yes, interest rates going up is clearly bad for future value of stocks, and everyone knows it. That’s why it was most probably already priced in in January. Keyword “efficient market hypothesis”. This hypothesis is good enough for me not to try to beat the market.

When expected things happen, stock market doesn’t move. It moves when expectations change or something unexpected happens. That’s why we had a crash on February, 24th, when Russia invaded Ukraine. That one has recovered quickly, but another crash happened on March, 7th, when it turns out that Ukraine is not going to surrender any time soon. And other ones when the impact of Russian war in Ukraine and related increase of oil and gas price and economic sanctions was realized.

Now imagine Putin dies of “heart attack” in his head, what will happen?

Another thing is that compounding magic doesn’t happen because you buy low, but because you reinvest dividends. Now you already missed some.

And yet another thing. So you were buying stocks when their price was high and now you don’t buy because they are cheap. If you have a strategy (put 100% of investable money in VT), then you should follow it through good and bad. Shifting to lower risks when things are going bad will reduce your investment returns.

You may not believe me, but I can propose you to make an experiment. From now on, split all money that you have available for investment in two halfs (or in any other proportion you are comfortable with). Invest one part like you did before (in VT only ?, reinvest all dividends) and another part like you feel it. Then compare the results in 2 years (or better 5).

I can do it on paper ![]()

In a bull market it’s not so difficult. I saw a video of someone using a monkey for stock pinking and it gave positive returns after 1 year or so.

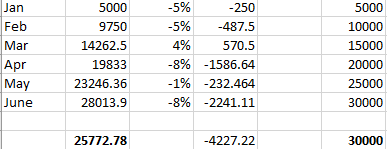

At the moment I compare the decision of DCA to wait and keep cash, or to whatever other strategy someone may choose.

Different strategies based on what you think of the future.

If for the next years the market will be in downtrend or stagnant, are you keep doing DCA? I guess so, but the dividends are not going to make a big difference.

This first half of the year was the worst since 1970 and there are signs of a reversal.

Just did a quick calculation with 5k invested in VT the first of each month since Jan 2022 (I didn’t add dividends) and calculate the profit/loss at the end of each month:

I’m not worried about losing the first part of the uptrend, because I agree with Burry that we are just half there. To be clear I would not use this strategy in an uptrend.

A good strategy in fact would have been to de-invest everything, like several people I know did it, but it’s a bit too risky (for me at least), so at the moment I keep a good percentage in cash, but another part is (unfortunately) still invested.

This is not going to change your mind, but we are here to share ideas/opinions, right? ![]()

I was talking about 2 years, better 5. If you want to benchmark your strategy, you can try to play different scenarios with https://www.portfoliovisualizer.com/ through 2008 crash, which was the second worst crash since the beginning of the 20th century. The most important question: how you decide when you are coming back to the market?

Yes, and hopefully also justifying them better than “all my friends do it”.

and I’m talking just about the first 6 months of this year, and probably of the next 6 months…I’m not going to stay in cash for 5 years.

This is the key question, that I partially answered in the previous post.

if you want to read it correctly, I mentioned someone who did a strategy, that I didn’t describe, so you cannot judge, because you don’t know the results, while for my part I didn’t say I’m copying a strategy of a friend, because actually they are doing differently.

Now I understand why @kraphael stopped to reply, while he was describing some interesting arguments.

Which is sad because getting information in real time about such strategies/tactics give datapoints that can serve other investors. We’ll require good benchmarking (because feelings are tricky and we can have the feeling we’re doing great while actually lagging our natural benchmark - not writing this specifically for you, just as a general concept that makes benchmarking paramount if we’re going to deviate from the standard “buy the haystack and buy it with all founds dedicated to it as soon as they become available” strategy).

Questions and pushbacks are to be expected, that’s how we get convinced (or not). You don’t have to share but if you do, I’d expect them and take that as an opportunity to test your potential blind spots and cement your plan: we truly know something when we’re able to explain it to others and it makes sense to them.

For the time being, I’m interested but cautious. Surely there’s a way to profit from what the market is doing because it’s been pretty predictable on its general behaviour since the beginning of this year. It’s been pretty wild on short term spikes and throughs, though, and we don’t know how long it will last so must be ready for a quick rebound. If there’s a way to increase the odds of profit while not taking on significant risk of big losses, I haven’t found it yet. Maybe it’s me lacking skills or knowledge but I was very confident I could do it and that the recent market behavior was very obvious and gamable, and I couldn’t.

I’d be interested to hear about your own attempts and from anybody who has managed to act on their interpretation of the available information and won so far (though, as others, I’d require more than just general comments because on a general comment/personal feeling basis, I’d be convinced I have beaten the market, while my spreadsheets and benchmarking say I haven’t).

Honestly and without trying to insult or something - I don’t see it. The answer for me would be for example “I return to the market when the price/index crosses 200D exponential moving average”. Then you can go back and backtest if this strategy would have worked in previous crashes (2003, 2008 and 2020) better than sitting and waiting.

Maybe ask @MrRIP how that turned out for him two years ago.

It’s a paid service. If you are interested in this kind of tools but don’t want to spend any money:

SuperIchi is a free indicator in trading view but a bit harder to read.

Red line below blue line and green cloud: Trend is bullish

Blue line below red line or red cloud: Trend is bearish

Weekly or biweekly candle chart works best with stocks.

It gave a trend reversal for msci world on mid January

I am still waiting for a bottom ![]()

1-2 hours per week is enough, depending on the amount of different assets you own. Just one broad marked ETF is not more than a minute, honestly.

I am down YTD - 14,3% (mostly because of cryptos where I ignored my own process and hodld instead of selling them and some “clever” investments in Russian stocks that I can’t sell anymore), still a little bit better than just staying fully invested in the broad market(- 20,9%)

I meant trying to understand what’s actually happening in the market, including what is the money that is making the market move and who’s sitting on the sidelines by being invested in what, relating to what’s happening in the world (for example, the main driver right now would be US inflation and the positionning of the FED for me, but that could change so I would have to keep alert to many other things happening in order to anticipate that).

Pure technical analysis is quick but prone to false positives. It’s hard to tune it right so that it benefits us on average given any market conditions because market conditions change and predicting the future is hard. It’s more useful in the short term but then again, it would require being tuned to the current market conditions, which would require a good chunk of news following and data gathering that would take time.

Thanks for the constructive answer

I guess it would be really rude

What if this time is different? Backtesting is not going to help then. It would be still an assumption.

I know that was bad timing…and tbh I still don’t get what was the trigger

Thanks for the answer. I’m waiting as well.

TA is not voodoo.

Right now there is no sign of a bottom neither a reversal and you can check whatever indicator you want (not in isolation)

In addition there is macroeconomics part.

I have no kids ![]()

In the last 6 months there is no doubt that DCA was less profitable than staying in cash.

Let’s talk again and check our strategies in the next months.

I’m genuinely try to be propositive here and I can be wrong, but what it seems, that others have the absolute truth on their side

ok, you are right, you need a certain passion for macro economics, global politics and finding good companies to watch, but I guess that’s what we all are otherwise we wouldn’t spend time on this topic

My hands are bleeding.

well looking at the bonds market we see they are pricing in a 2.51% rate by September, so a 75 to 100 hike is basically guaranteed.

Markets trades the October rate at 3.2% (means another 0.75 hike after September) and a 3.66 rate at December.

April is still at 3.6 and it only goes down at September 23 (3.1%).

So i don’t see a cut before Q2 or even Q3 2023. Expect more downside in stocks…

Where do you check these rates?