I be interested to have an idea of the % or amount of your tactical cash reserve, as I like to do something similar.

My tactical cash reserve is currently at its maximum. The amount is CHF 125,000, which corresponds to 14% of my ETF portfolio.

Including 2nd pillar?

So you are not 100% stocks. But you are right, because you shouldn’t be.

I’m 100% stocks in my ETF portfolio, 2nd pillar is indeed a different story. Because I don’t get to define the 2022 strategy of my pension fund

Generally we are considering 2nd pillar as bond-like for portfolio calcs. This is because they guarantee or assume around 2% return. Even though we know Pension fund may invest in stocks (e.g. mine is around 35% growing to slightly less than 40%)

Here is the 2022 plan, part of the long term IPS strategy.

Stocks - representing 50% of assets

I expect a 10-20% correction on the markets in 2022 and I was saving 20% of past months savings in cash for buying this dip. Instead of the monthly investments I usually make, I only invested 50% and kept the rest in cash. In 2022 I will continue to buy monthly and also additionally to any -5%, as always, the following ETFs:

- iShares Core MSCI EM IMI UCITS ETF - 30%

- iShares Core MSCI World UCITS ETF - 30%

- iShares MSCI World Small Cap UCITS ETF - 7%

- iShares Edge MSCI World Value Factor UCITS ETF - 7%

- iShares Edge MSCI World Quality Factor UCITS ETF - 6%

- Cash ammo (used as described above, kept instead of bonds) - 20%

- 2A not included in the above, 3A 99% stocks are included as per accommodating above percentages.

Real estate - 50% of assets

Rented apartments in another EU country, delivering 5% yearly net returns.

How many short term plans does your long term strategy include? ![]()

Why?

(I’m not saying it won’t happen, just interested in knowing why this year and why 10-20% ![]() )

)

None, except what I described above ![]()

Because statistically it should happen (I know I can’t predict it, it’s just my personal feeling on which I am I assuming the risk of keeping more cash).

Statistically it should have happened already in the last few years. Since well before the pandemic I heard almost daily “the crash will come soon/next year”. It’s maybe tomorrow or next year or in 10 years, no one knows.

There will always be people predicting the crash and 1 out of thousands will be correct and in hindsight, everyone will think he’s a genius. Then he’ll write about his strategy and the parameters he used to predict and sell it to others, and the next time a crash appears, they’ll realize that it was pure luck.

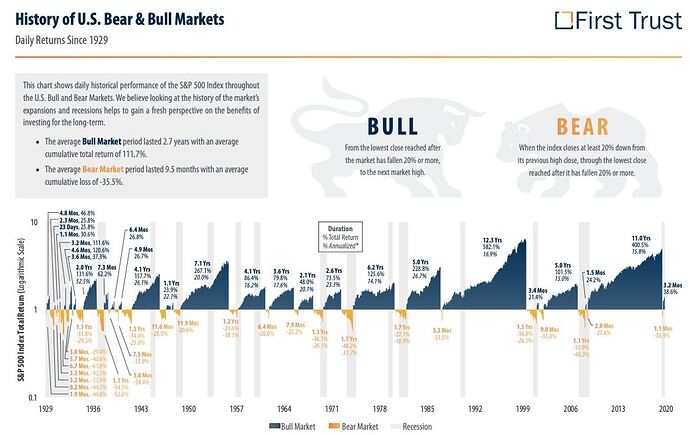

If someone asks me to show him/her one picture to convince him/her about long-term investing advantages, I think this one will be the best. However, would be cool to see the same for:

- Japan

- World

If the correction is expected, why not shorting then? ![]()

I have another question: If the crash doesn’t come, do you have a plan to move that cash into the market? And if so, when?

I said a correction, not a crash ![]() I will buy additionally on any -5% correction doing DCA over a period of time. Depends a lot on how the market will be.

I will buy additionally on any -5% correction doing DCA over a period of time. Depends a lot on how the market will be.

PS: here is something about the China real estate bubble and Evergrande: https://www.youtube.com/watch?v=WOufbsyMFk0&t=98s

wow that’s an eye opener, thanks!

Please read this article from vanguard. If keeping so much cash is also good for your wellbeing and mind that would be a valid personal reason for your strategy too.

Again, just ride the boat ![]()

I know this is just everyone showing their strategy and I respect everyone because I don’t know their personal feeling towards investing. But I really don’t understand this actively trying to time the market ![]()

Time is money (all your savings of all your life’s work).

If the next 5 years there is a drop of 50% and the 10 years are bringing in a net zero capital gain (which very well might be the case), you basically have wasted half of your time saving for the stock market - unless you have some firepower for the bottom to boost your earnings to (up to) 100% instead of zero in the same time frame.

It’s been an easy market since 2009. Not everyone has the patience/mental strength to ride out 10 years in (massive) minuses. And a good portion of the current active traders have never seen a bear market (except for the covid flash crash).

That is true I didn’t mention the timeframe in my answer. In my mind there is always my timeframe of atleast 30 years so that’s my bad. Where I don’t agree with you is the part about a 50% drop. Nobody on earth knows the date of this event. So should we base our decision on something that we can’t influence and not even predict? In my personal opinion I don’t think so.

Again in my head there seems to be something other than in yours ![]() . Not only do I always have my long timeframe in mind but also my strategy of DCA over this timeframe. So I will automatically buy the dips but also buy the highs which averages out.

. Not only do I always have my long timeframe in mind but also my strategy of DCA over this timeframe. So I will automatically buy the dips but also buy the highs which averages out.

Everyone should choose their strategy to their liking. It just feels wrong to me to time the market because all the studies I read strongly suggest against it.

It’s also a matter of balancing this possibility with the possibility that the market might still go up for a potentially long, but undefined, amount of time, in which case, having a decent part of your assets sitting on the sidelines also costs more of your time, working, that you could have otherwise spent in another way by benefiting from those gains.

Things look pretty orderly right now, nobody seems to want to crash the market and we seem to have learnt from past mistakes. I wouldn’t exclude a soaring 2022 year from the realm of possibilities.

Edit: I guess the outlook is different when you have accumulated a decent amount of assets than when you are just starting out, which is why I plan to shift toward a more conservative allocation as my net worth grows.

Edit2: and for full disclosure, I’m also totally a market timer, I just think it’s important to have precise signals to follow and not to rely on vague concepts like buying after a drop (not saying it’s what @user137 does, my understanding is that it’s not, but the idea that we may be able to intuitively understand on the spot that it’s time to sell high or buy low is very appealing and may sound attractive to some. I don’t think it works. The profits of those who time the market successfully come from those who time it poorly - the only way to secure a win is not to play and take the market returns by buying and holding broadly diversified cheap ETFs.)

Then you shouldn’t invest in stocks in the first place.

Or you should invest according to your risk tolerance.