Indeed. I doubt we can find high trade volume and AUM in CHF hedged share classes but am eager to be proven wrong (and I’m not sure the AUM of the share class actually matter that much if the fund has a good amount of AUM as a whole). I’m actually not yet sold on the concept of bond funds (but am willing to be convinced otherwise) and am planning to build an individual bonds/fixed deposits ladder when I get to the point that it enters my asset allocation. Very low returns but that’s what the risk free rate in CHF is currently, I’m willing to live with it since its purpose is capital preservation.

No as my emergency fund is already 10k in cash.

It doesn’t make sense for me either. The fund that @mabi has posted has made a -3% return this year. Yikes. Better keep cash with 0% TER and -0.75% penalty pa.

What about Swiss High Yield instead? SwissRe, Nestle, etc? Native CHF accounting, on paper they look quite good, even if dividends are taxable and risks might not be the same as with obligations.

You said that you think there will be a crash in the equity market soon, why should these not be affected by the crash?

Risks are completely different. Risks with equity are way higher and with the current price levels even more so.

This. They’re not the same product at all.

If you want to shift your stocks investments toward something more conservative, I’d look into defensive stocks (which Nestlé is, I’d probably not classify SwissRe there). Be wary that they are stocks and can still drop quite a bit during a downturn. There is no free lunch.

Yes, I am also eager to be proven wrong with a good CHF hedged bond fund which has a bit more volume… Still I had a look at today’s volume of AGGS and it was around 50k, I have seen worse (I have a Swiss RE ETF from UBS in my portfolio with 10k volume per day). AUM of AGGS is 178m and as far as I remember the very strict minimum to consider buying an ETF should be 100k. So yeah if anyone has anything better to suggest in the same bond category/type please do

I still believe that in case of a market crash these bonds like most of the bonds would likely go higher allowing me to rebalance by selling part of my bonds to buy lower VT for example. So the fact that they might be loosing some money some years could be negligible in that case.

Look at spread rather than volume, there are usually market makers for ETFs.

Well some would say “sounds like a buying opportunity” ![]()

Just a wild guess here but could it be that this bond fund had a negative return this year simply because of hedging? CHF/USD has gained 3% looking at its 1 year chart.

@mabi : as @nabalzbhf already said - looking at spreads is better. Volume ist not really relevant.

Regarding AuM for a shareclass, if there is a “parent” shareclass with some volume, asset manager often open new shareclasses for as less as 5 Mio. AuM. So i wouldnt bother about that. If the parent shareclass hast more than 50 Mio. AuM, it should not be at risk of closing either. I hope that helps… eventhough i wouldnt consider bond funds right… it might be a good idea waitng for the interest rates to come up a bit more…

That’s a strategy.

If and when the FED is going to increase the interest rate (end of Q1 2022?), I think it makes sense to keep a percentage in cash to buy in. Same as March 2020.

The hedging can’t have costed 3% this year - as it is the difference of the short term interest rate… so at the most 1% right now

Do you look at the spread for a typical day? For example today the spread was 5.24 - 5.25, or do you look at it for a year (5.20 - 5.42)? I don’t know much about the spread but I understand that the smaller the spread the less volatility and hence safer it is, is this right?

If the spread is tight, it means there are market makers behind.

Indeed, afaict the drop is due to bond yield increasing due to inflation expectation, so that’s the interest rate risk in action. (And yes there’s a 1% difference between the CHF and USD funds, as expected).

Volatility is not a good measure of risk.

First, it only looks at one part of the risk, the fluctuations of returns, it ignores all the other risks such as credit risk, default risk, illiquidity risk, etc.

Second, it looks at past returns, which we all know are no guarantee for future returns. It assumes that future outcomes are normally distributed, but in economics, improbable things happen and probable things fail to happen - all the time.

Third, risk is a subjective topic and volatility is an objective measure. Each investor has different things that are risky for him. E.g. for some people illiquidity might not be risky as they have enough funds and don’t need to liquidate funds for an emergency, for others illiquidity might be a huge risk when they need to possible sell at the worst point to pay for an emergency.

Fourth, even a high quality security with low volatility can be risky if you overpaid for it. For riskier investments you should get a higher risk premium (higher expected return) as a compensatiom for taking the risk, but if you paid too much, there’s not much upside potential.

In the past I have found this resources to better understand the investment in bond:

Episode 138: Approaching Fixed Income Bonds and Modelling Expected Returns

Expected Returns of Currency-Hedged Global Bond ETFs

In the end I came to the conclusion that the bonds have a place in the AA in terms of reducing volatility (not talking about risk here). You can achieve positive returns through a combination of maturities, corporate/government bond and other factors, which also leads to risk premium.

However the setup of this strategy is quite tricky and I don’t have a particular need for searching lower volatility, hence I am not including them in my AA. I consider the sizable 2nd pillar as investment with low volatility and continue focus on a 100% equity allocation on IB.

Still mostly vt and selling some puts against KWEB for some extra income (20 dollar strike price)

I had asked for a source but got no answer. I believe this statement, which was liked by some, is indeed very important in this discussion: How many companies are indeed unprofitable and survive only thanks to cheap credits?

Does anybody have numbers?

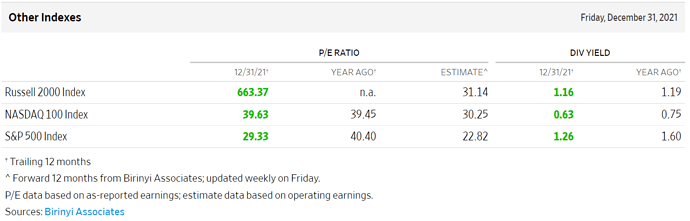

Perhaps one way to look at this is the current high P/E ratio? Here the S&P500

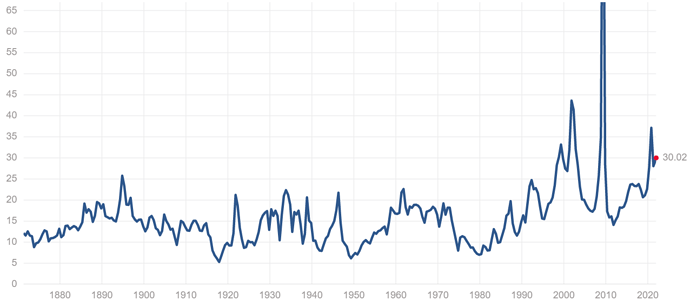

Here is how the Trailing 12 months measure looks vs. history:

T12m Valuations are very high but look a lot better prospectively if you believe the earnings forecasts.

In any case what is the alternative? If you are near retirement and are planning on a tight budget (high withdrawal rate) then increasing the % of bonds or cash in your portfolio may make sense.

Otherwise if you are investing for the long term then increasing allocation to assets with close to zero yield (or even negative) does not seem like a low risk option, in my opinion at least

I have no numbers, only anecdotal experience with some unlisted SMEs in Switzerland. Some of them are still handled like we’re in the eightees and everything’s easy. They put more efforts in the Christmas gift they send to their clients than the quality of their work, and they’re still afloat and getting government contracts.

A crash is rarely a good time for society in general but I feel we really need one to weed out unfunctional businesses, the status quo we are maintaining is, in my opinion, harming best practices and newcomers in the markets that should theoretically compete with less efficient businesses. So, no data, just a gut feeling coming from me.

I - shamefully - only also have anecdotal evidence. As a general rule, 80% of all businesses flop, but those don’t usually make it into the SP500 in the first place, so they fold earlier.

Yet, I’m following a bunch of companies that are still there and are not making any profits (Coursera, Crowdstrike, Uber, AirBNB, and for a while, Tesla).

Yet, there are huge names in the “losers’ list” that will need a mirror to their inability to execute:

It would be nice to have a 500-company list and not just the top or bottom 20-25.