What’s this? And what is its use?

It was a joke that dividends are “free money” ![]()

Especially BRK’s Dividend

7.5 months into 2024 I’m a bit puzzled into where to grow/diversify, unless I keep adding “more of the same”. I got about 30% stocks, 30% RE, 30% bonds as I want them to be.

- the stock market (as a whole or as SP500) is probably not giving me the return on a 5-yrs horizon that it “used to” (partly because the majority of it is hand-picked and I’m so great at it

, also valuations are quite elevated and we are at the brink of another Trump-era).

, also valuations are quite elevated and we are at the brink of another Trump-era). - On RE, Switzerland is massively overpriced and I can’t (don’t want to) drop 200-300k tickets in one piece on individual properties and have the hassle of managing them. RE Funds could be something but they are also overpriced (hello everything bubble

)

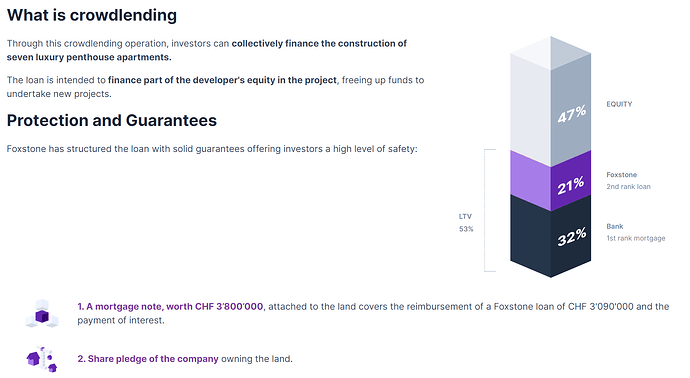

) - safe corporate lendings - I have some RE crowdlending via foxstone that ticks at 6% CHF yield, which is safe and okay-ish. New ones are coming with less yield, closer to 5.5% CHF.

- less safe corporate lending - I have some unsecured corporate bond options like Moonshot bonds that are netting 8% CHF yield but need a crystal ball for security and I’ve not been brave enough yet to trigger this

- I’ve seen HE Privé netting 8% in EUR, but there’s an FX risk

- P2P lending like Mint or Twino are promising 10%+ yields in EUR, but I haven’t yet explored these for risk

With the assumption that a “VT lump sum might not be the best at this stage”, does anyone have a good hint into where to look for more diversification?

and/or gold/precious metals.

and/or self development and useful skills.

and/or expanding one’s network.

Can’t be that safe and provide > 5% in CHF, or am I missing something?

I believe it’s a junior loan (not sure about the proper term) from foxstone that are on top of the bank financing but are 1.5-2x covered with the value of the real estate put in as collateral against the lending deal.

seems to be a no brainer/low risk thing for me, but pls correct me if I’m wrong.

Didn’t know you were another balanced investor here, thought I was pretty much the exception. Just wanted to give you a hint re. Real Estate. If you follow the same strategy on your 3A / 2nd Pillar, have a look at Tellco. They allow you to invest into their Real Estate Foundations. This without additional Trading nor Holding Fees. They further allow you to invest up to 50% of your 3rd pillar into RE.

I moved my “Non-Risk” Portion of 3A with them and invest it to 50% in Real Estate Foundations and 50% in Cash (currently at 1.6%; quite a good deal). Clearly, you need to remember that Real Estate Foundations are not Shares, meaning that they come with hefty entry and exit cost. But that is fair in a way, you just need to keep your funds there for the long run.

Other than that… you could probably invest 5%ish or so into the below:

Invesco AT1 Capital Bond UCITS ETF Acc | 41644584 | IE00BFZPF322 (justetf.com)

This thing goes nowhere when the going gets rough. The downside risk seems to be much higher than the upside potential.

At this point I’m fairly certain about the Foxstone crowdlending, so anything below a net 5% yield is not interesting to allocate cash to in the long run.

I will not try to convince you on the AT1 one. Just a small remark – the '20 Drop was a doomsday drop that recovered very fast (by Q1 '21 already. The '21 to '22 reduction was given increase in interest rates. Meaning that the course suffered as future returns increased. Even more accelerated the CS Crash. There was no loss there but things simply got re-valued at -20%; meaning that future return increased by that amount.

AT1s have a duration of about 2.5 to 3 years in Average. You will fast see that it delivers fairly impressive returns. Clearly, if Interest goes up another time (either overal interest rates or interests on AT1); there will be another short term bump but you will break-even on any of these in about 2-3 years max.

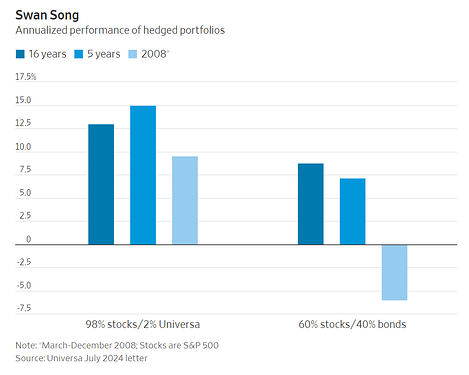

Came across this WSJ article today: ‘Greatest Bubble’ Nearing Its Peak, Says Black Swan Manager *

The Black Swan manager is Mark Spitznagel, somewhat famous chief investment officer for a fund that hedges tail risk. Nassim Taleb – of tail risk fame – advises at said fund.

Despite the sensionalist article title Mr Spitznagel comes across as pretty balanced. I personally liked these gems:

On predicting the next crisis:

(emphasis mine)

Portfolio performance hedged with their fund (Universa):

On the timeframe:

On how retail investors should act:

Ok, bulls & bears, discuss, but remember to remain nice to each other just like these cubs …

* (should be a gift unlocked article for those without a subscription)

I don’t know if I can take someone seriously, that sells products that protect against the stuff he warns you about…

Other than that, there are some tail risk products available to retail, that are pretty ok. Like CAOS etf. Although they are really deep OTM SPX puts, and will only move much if the market crashes hard and fast.

Much ado about nothing then.

I for one like the guy as he doesn’t take himself too seriously (as already quoted):

“I think we’re on the way to something really, really bad—but of course I’d say that ,” joked Spitznagel in an interview this week.

YMMV, of course.

I actually prefer Mr Spitznagel’s view over buying CAOS (or something similar) as he advises retail to not hedge (as they don’t have to sell since they won’t have redemptions like professional money managers) if they manage to stay the course.

In essence, he advises retail to sit it out.

Isn’t that the conclusion for all news and macro thoughts?

Maybe the distinction is – as detailed in the article – between professional money managers and retail ones. The latter can afford to do nothing, the former will have to sell and buy, depending on money flowing out and into their funds, regardless of whether those professional money managers think it’s a good idea or not.

Slightly off topic:

After a couple of years at a firm that professionally manages money – even if mostly for institutional investors – I’ve come to the conclusion that the (professional) money managers really have a shitty job. They have to sell on behalf of their fearful customers at the worst times and buy on behalf of their greedy customers at the worst times.

There’s only very little discretion for optimizing things, as the products are tied to indexes.

Anyway, I digress …

People are strange, I was talking to an acquaintance - a multimillionaire, retired now - about investing and they said that index investing is “too low expectations/too slow/too volatile”.

Not sure what to make of this comment considering this is a supremely intelligent person, successful in business, so I can’t presume they don’t know what they’re talking about. It’s just that the GLARING contradictions of the statement leave me a bit speechless ![]()

If you’d ask what IS this person doing with finances, the answer becomes weirder: they do private equity, angel investing, options, shorting. How can index investing be volatile when they are doing options trading and shorting?! And then, this person is set for life, their kids and eventual grandkids could also be set for life, so why not an all-weather portfolio, or even long-term bonds/bond ladder, CD or MMF…?

Or maybe multimillionaire brains work differently.

I would say that the most efficient way to build wealth in Switzerland is to build/own a successful SME. It is also very, very time and energy consuming. In regards to those financial prospects, index investing is low expectations and slow (relative volatility depends on how you assess the volatility of your business profits).

Options can be used as insurance, they can be part of a strategy that aims at globally reducing the volatility of the portfolio. Shorting can too (If I own an ETF and also short (parts of) it, my global exposure to equities is reduced). It really depends on how you use those instruments. Options and shorts can be used to play the role of bonds in some portfolios.

Same for PE and angel investing. Doing it with or without insider knowledge and/or actively or blindly following a fund manager can change both risks and prospects (in either direction).

I’d say it’s a matter of how they’re wired. More complex, potentially more comprehensive strategies (but potentially also not) might be better suited for them and give them more satisfaction with their portfolio. As for actual risk-adjusted investment success, we won’t be able to assess it as past a certain level, enough is, to say it simply, enough, and outside people won’t notice the difference between “underperforming enough” or “overperforming enough”.

It is very likely that their strategy requires way more time and inputs than passive indexing, which can be achieved by hiring a manager which also have their cost. I wouldn’t do it as a non-multimilionaire not willing to spend a consequential amount of time managing their assets.

Edit: as an aside, I would say that being gainfully employed, living under our means and investing the difference is an excellent way to build enough wealth to have financial agency in our life. Which, I would say, is “enough”.

It is by no means a way to build extraordinary wealth. If the purpose is to become a deca+milionaire / bilionaire starting from scratch, other means need to be used (and luck will be involved).

That’s where I am happily putting myself.

Other than that, all you said makes sense as it usually does. I know all that, but would see myself as simply preserving and slowly growing with minimal effort via fixed income. Wouldn’t bother with any other crap - but then conceptually and emotionally I don’t see myself as ever wanting to be filthy rich, because there is always someone filthier richer, so what’s the point. Having cheap tastes - not mustachian deadbeat cheap, just cheap - helps too.

People that build successfull businesses often times have actually no idea on how to invest and build sustainable longterm wealth.

They go full risk everywhere, because that‘s what they know, that‘s how they became rich.

If you tell them about the 4% rule or something, they look at you like you are talking chinese.

4% what is that? That‘s not enough profit for them. They are accustomed to many 100% from their business endevours.

They simply dont get the concept of slow and steady and that you should stop plaiyng the game, once you won.

But they still rather lose 100% on one investment and make 100% on another.

I know a couple people like this.

As was not said or implied in my message, but picked up by both you and wolverine, this is a person who founded, ran and sold their business. They were millionaires before the sale, after the sale even more so ![]()

I know a handful too, some are indeed financially illiterate when it comes to investing, but not that particular person.