Been wondering, about to transfer 60% of my old 3A to FinPension (40% eaten by an insurance company), if it’s a good idea to go 1% cash, 3% Emerging, 7% CH and 89% Quality for the 3A going forward, given the bulk of my investments out of the 3A are in all-world.

I am currently 49% world ex-CH, 40% quality, 7% CH, 3% EM, 1% cash in FinPension but what’s the point if I am already all-in in all-world in my custody account?

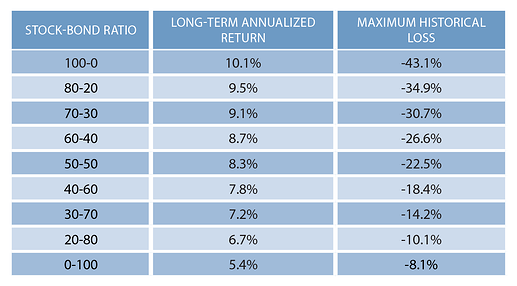

Another question, the Boglehead/Vanguard 3 fund portfolio does include a fair bit of bonds, which I happily saw are also available in FinPension. While bonds do bring performance down, they also bring volatility down (see first pic).

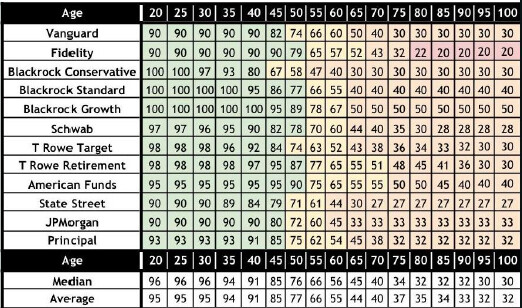

Someone on the Bogle forum took the trouble to collate the big asset managers’ recommendations on stocks/bonds/age ratios, and came up with this table.

I understand these are US bonds they’re talking about (and CH bonds seem to be extremely low yield), but what’s the forum’s idea about adding a 10-20% part in bonds (or even MMF) in a 3A, and if it is positive then are there any suggestions within FinPension?

I really feel quite unsure: if the 3A should be chasing performance or stability given its contributions are capped. I feel more relaxed about keeping a lot more money in all-world and accepting market returns in a liquid account (ie custody account) than in a locked account (ie 3A).