The current size. Just as we don’t use projected value of stocks in x years but their current valuation.

I would recommend to use current value but apply some reduction to account for lumpsum tax.

ok, thank you a lot!

Interesting.

What percentage of taxes are you targeting ? 7% ?

Actually I live in ZH and don’t know at what % would I end up with total 2nd pillar payout in future when I actually retire.

For time being , I just use 10%

To be consistent, you’d also need to correct the 3a amount by the estimated tax %, no? (with the current system/rules; who knows how it will change in the future)

And then also the selling fees for any stocks/ETFs (very low with IBKR; higher with others).

It also seems skewed to me that you would adjust in one way for future events (taxes) but not the other way (anticipated return). Sure, it is better to play it conservatively and then end up with more than you calculated for. But then you could even further subtract custody fees for stocks (if you have any) as you have to pay them as certain as you have to pay tax in the future.

For the time being I use

w/o future events in my charts. But once I get closer to retirement and need to start actually planning the withdrawal, this will change.

I think lumpsum tax is substantial amount.

Selling fees or custody fees is part of the performance and is generally not very high. On IBKR we are taking about few CHF

I account 10% both in 3a & 2nd pillar. I know 3a tax can be lower due to staggered withdrawal but I think at some point of time, staggered might not be there, so I just left everything at 10%

But you don’t/can’t know what it’ll be like in the future, otherwise would you (also) do an estimate of 5-6% CAGR for stocks? My 2nd pillar has a target CAGR of 1%, I’m personally not even looking at anything other than the absolute number I can see on the portal for insurees.

I am not talking about future, I am talking about current situation. We need to remember that 2nd pillar amount is not tax free. It’s always going to attract withdrawal tax. For smaller amounts it doesn’t matter but when pot is big, then net asset value starts getting impacted

For example if you withdraw all of your 2nd pillar tomorrow, what’s the lumpsum tax you will pay?

That could be a way to use as estimate

For me it might be less than 10% now, but I am just being lazy to do the right calculation. So I just use 10% because I know at some point it would definitely be more than 10%

I do this allocation without considering tax, but in my cashflow model, I do include taxes.

The withdrawal taxes in some cantons are quite simple (as they are not income based) so can be factored in. Those where withdrawal is taxed based on income require more assumptions/modelling.

IMO it’s different, it doesn’t depend on time (unlike doing an estimate of future return), and you could leave Switzerland tomorrow and cash it out. And while the tax can change, it’s still fairly stable.

Estimating future returns of various assets is way harder (plus to make sense you also need to take into account future savings as well, etc. a lot more uncertainty).

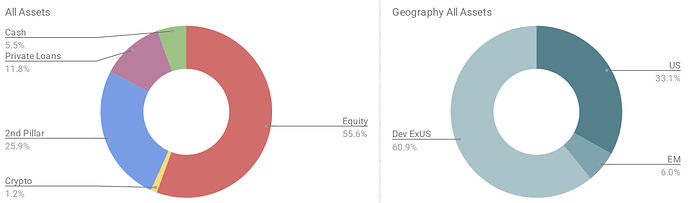

75 % ETF & Shares (including 3rd column)

16 % Cash

9 % 2nd column (10% deducted, simple, thanks!)

Finally purged most of my individual stocks (*).

Here all assets:

Zoom on equity:

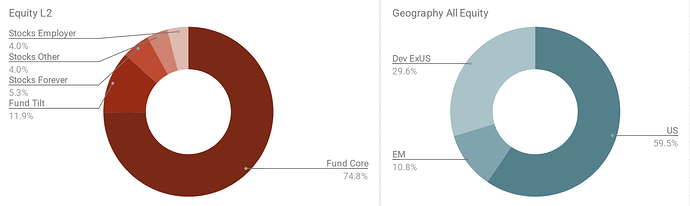

- Fund Core

- IBKR: VTI + IEMG + EXU1(**)

- FP/VIAC (3p): Dev ExUS mix

- Fund Tilt = Fundsmith + AVUV + AVDV

- Stocks Forever = BRK.B

- Stocks Other = PLTR + NVO

(*) And naturally perfectly timed BABA 1 day before it shot up 15% ![]()

(**) Recent add, since 3rd pillars are no longer enough to cover Dev ExUS target (~30%)

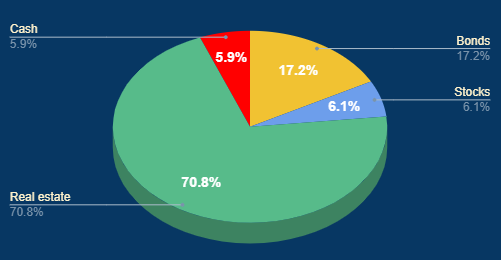

- real estate includes the house we bought in 2025, in which we currently live and an extra apartment

- bonds include pillar 2

It’d be interesting to have an AI collate this info, as well as the NW thread, and come up with the size of RE in peoples’ asset allocation. I get a gut feeling it’s very large, and in my mind confirms the idea that one won’t get rich with monthly contributions to VT, except maybe from 2012-today.

As long as RE is not generating cash-flow it’s only for bolstering ones net worth number and not for contributing to any FI(RE) target.

What makes you question the 7% p.a. (before inflation) return of VT? Of course you can get rich. RE just shot up, just like Gold, Nvidia or Bitcoin.

Any compound interest calculator ![]() Plugging my numbers in in terms of years, contributions, and expected return p.a. (6-7%) I see my savings reaching “good nest egg” level, but not enough to allow for FI or RE.

Plugging my numbers in in terms of years, contributions, and expected return p.a. (6-7%) I see my savings reaching “good nest egg” level, but not enough to allow for FI or RE.

First we’d need to define “rich”. ![]()

I think if one starts early enough,

good spots can be reached way before the official retirement age (assuming a decent savings rate).

(Yet of course we were very lucky with past 10-15 years, so recency-biased there)

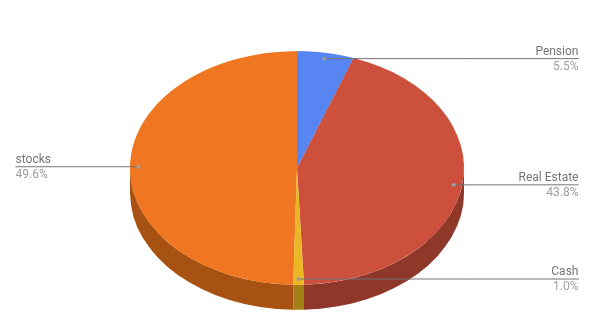

RE is typically zero or very large since in Swizerland, unless you are rich, RE will make up a large chunk of your assets.

However, RE is also typically bought with mortgage debt and so you don’t see the other side of the balance sheet.

Someone with a 1 million house and a 250m portfolio has a gross wealth of 1.25m and 80% RE allocation. But in reality, with an 75% mortgage, he has only 500m in net assets.

Real estate has been a winner in the last decades because we had increasing assets prices on falling interest rates and these returns have been leveraged.

Stock market returns have also been stellar even if un-leveraged.