To me it means nothing if we don’t know the numbers, like you can have 9k in bitcoin, 1k in 3a, 1k in cash. It’s not the same to be 90% Bitcoin with a net worth of 2 millions or be 90% in bitcoin with a networth of 20k …

A Bitcoiner never tells his stack ![]()

I do not want to disclose that. That’s why I haven’t participated in the net worth thread (just some old numbers few years back). It may cause problems to the future me. Internet never forgets.

agree…

I’d guess a minimum of 5 million total assuming that property is 1% and minimum cost of a property is 50k.

I was just about to say - with that stash I’d erase my online presence in whichever way I could. ![]()

(including here, but please don’t leave ![]() )

)

Absolutely understandable ![]()

Why? BTC is totally fine if you declare it on your taxes.

still… I may be a shrimp.

It took me over 2 months to delete all my bitcoin (and crypto) related tweets and all the postings like Facebook, Reddit etc. two years ago. After that I knew it’d be easier just to delete the accounts.

nooo… this is the only place I have some “social” interaction. On all other platforms, I’m consume only.

And as I’m most of the time in home office, I would had to talk to my wife… ![]()

There are bad people. Getting my bitcoin is much easier and safer for them than stealing the VTs on IBKR.

Edit: I see this discussions are off topic… sorry mods.

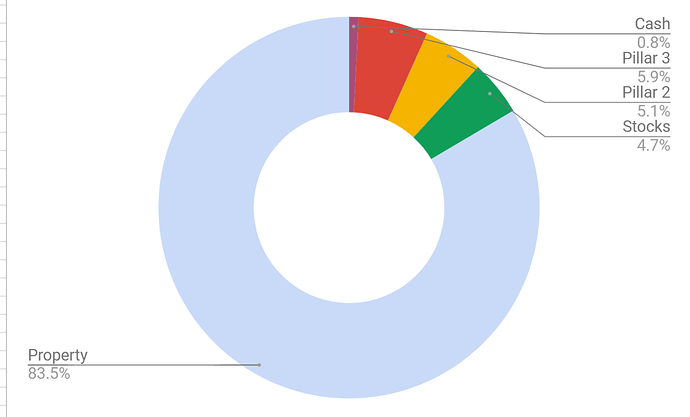

Here is our allocation at the end of Year 2024.

Majority of our assets are in the home.

During the purchase of the home, we liquidated a bunch of our crypto assets, stocks and withdrew our pension fund partially. Therefore the allocation is extremely skewed.

I know it is not the most optimum allocation, but we wanted to have less bank loan on the property.

Well, you’ll have time to build up the other assets. And who knows, maybe you got lucky and sold stocks and crypto at the peak!

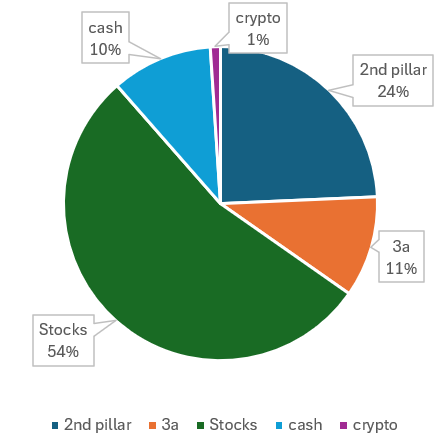

We’re somewhat similar:

Coming 'round to the organic growth of the 2nd pillar with no action on my part (other than working, of course!).

54% stocks = VT only ?

He is VWRL kind of guy ![]()

VT & Chill is not for Greeks. They like VWRL & relax

About 50% VWRL, 40% IUSA and 10% FUSD ![]()

3a is in the Finpension Quality ex-CH, so that’s stocks too, and my 2nd pillar is detailed in my post above but I treat it like bonds (actually better than bonds) like many here do.

Plus a ~5% in BRK.B which I keep in another account for my kids.