The conservative investment is kinda unfortunate, but for the coverage, remember that we also have the 1st pillar, which at 15k/year income covers almost 100% of the prior income and at 90k/year income about 1/3rd. Although sustainability of AHV has its own concerns.

Unfortunately very true. The company I worked for has this exact issue when they decided to change pension funds.

You go in at 100%, get out at 100%. There are exceptions if you represent more than X% of the fund; that would trigger a partial dissolution. But it’s unlikely to happen, unless you’re a huge company, and in that case, you don’t need a collective pension fund.

2025: 4%

2026: 5%

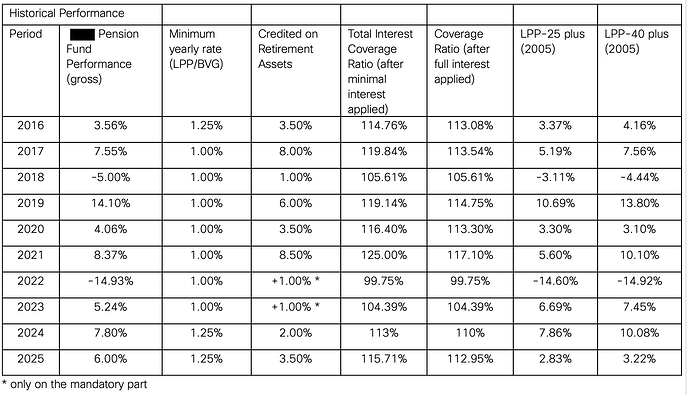

Funding ratio hasn’t been published yet but it was at slightly above 120% end of September.

Apparently, Profond wanted to offer higher interest rates in 2025, but is not allowed to do so due to legal restrictions and has now initiated legal action. Does anyone know more about this?

Rechtliche Rahmenbedingungen schränken die Verzinsung ein

Profond ist es wichtig, die Anlagerendite unter Berücksichtigung der finanziellen Sicherheit an die Versicherten weiterzugeben. Wie in den Jahren zuvor, verzinst Profond auch 2025 das maximal Mögliche. 2025 wurde die Verzinsung durch rechtliche Vorgaben eingeschränkt. Profond sieht die Verantwortung für die Entscheidung über die Verzinsung jedoch beim Stiftungsrat und hat deshalb ein Gerichtsverfahren initiiert, um die rechtlichen Rahmenbedingungen überprüfen zu lassen.

I tried to figure out, but they don’t publish their “Wertschwankungsreserven” target right? (checked the fund regulations, but they only explain which principles are used to compute them, not the actual number).

Is this what they

- applied “at start of 2026 for the money that was there in (start of) 2025”, or

- will have applied for the money there in 2026?

If the latter

- do they set the “this year’s interest based on past year’s performance”, or

- they have some crystall ball knowing how they’ll perform in 2026 (and set the interest accordingly)?

(Because my fund announces the interest for previous year at the start of this one, thus confused about how you framed it)

My spouse reported the same numbers. Any chance you just saw it online after receiving login for a new portal? ![]()

Yes, some funds set the rate upfront. They aim for some stable base return, and then increase that when the current funding allows.

Wife reports 7.25%, MPK. Nice…

The target reserve is different for each pension fund, and can change over time.

I had a look at Profond’s latest annual report (2024) and they declared a target of 14,19%.

If at the end of 2025 they were at 111.1% coverage then they have not reached their target; however because they are between 75% and 100% of said target they’re still allowed to distribute additional interests (see art 46 of OPP2/BVV2). The confederation had to clarify the interpretation of this rule several times in the last few years since some funds were clearly stretching the meaning of “additional interest”.

5% is the interest for 2026. So they seem to set it based on the past year’s performance (or probably rather the resulting funding ratio).

2-3% for 2025, same as in 2024… I need to find a better job…

Still waiting for coverage ratio. But I believe it is well over 100%. Will update.

I’m changing employers in March, leaving behind the amazing UBS Pillar 2 for a mediocre plan at a big tech company.

I’m considering entering the “gray area” by transferring the funds to Finpension to get that 99% stock exposure.

Here is the situation and potential risks as I understand them:

- Death & Disability Benefits: According to the benefits documents of my new employer, these are tied to my salary and not my pension pot, so there shouldn’t be any negative effects.

- Buy-in potential: I just have to be mindful never to do a buy-in above my legal maximum, by taking into account the vested benefits account.

- Is there anything else I’m missing or should be careful about before moving to Finpension?

- Assuming I do it, will I have to declare the vested benefits account for wealth tax? I assume no.

P.S: I’m sorry if this is not the correct thread. I think this topic has already been touched in this thread, so I thought it make sense to reuse this one.

Mandatory “it’s not a grey area, the law is clear that the assets must be transferred to the new pension fund” as explained in this post: Finpension (2nd/3rd pillar investing) - #277 by Wolverine

What is lacking is good enforcement mechanisms, there is a change of law in the making that would change that if passed.

Iirc the buy-in form asks you explicitly, I wouldn’t lie on the form.

One risk is that the new law passes and your VB account gets transferred over during a market downturn.

I opened a new thread for the discussion on second pillar split:

Correct. No. It isn’t part of taxable/declarable.wealth wherever it is.

Consider splitting it. Send one part to Finpens I and the other part to the new pension fund. Sort of for splitting your gains, benefits etc.

Also the new PF will not hassle you as much if there is at least some amount incoming.

Don’t buy in if you keep VB outside.

Split between 2 foundations - preferably by mandatory and non mandatory. Can transfer mandatory to new fund in future if needed. In case of buying primary residence (or reducing mortgage) , you can take money out of VB with above mandatory portion - this provides you optionality if conversion rates of mandatory and above mandatory portions continue to diverge further.