Online Wealth Management platforms seem to become more and more popular nowadays, also in Switzerland:

- TrueWealth

- Selma

- Findependent

- Finpension (Soon™)

- Inyova

Although I would personally like such products, I can’t use them because of their high “management” fees (from 0.39%-1.2%) and limited investment options. In essense, you give them 0.5% of your assets every year so that they buy ETFs for you. You still have to pay ETF costs, swiss stamp tax duty, (high) FX fees and potentially some other hidden costs.

It’s totally clear that the fees of these platforms are never going to decrease, because it’s just not economically viable. TrueWealth has about CHF 1 billion AUM [1]. On average I’d say users have less or up to 100k invested with them (0.5% fee). So 1bln * 0.5% = CHF 5 million revenue (only)… And it took them about 10 years to reach this number.

Now, what this post is about… I like the idea of an easy wealth management platform with low fees. So over the last few weeks I did play around with a few ideas and have now come to the conclusion that it would be possible, but with a small twist…

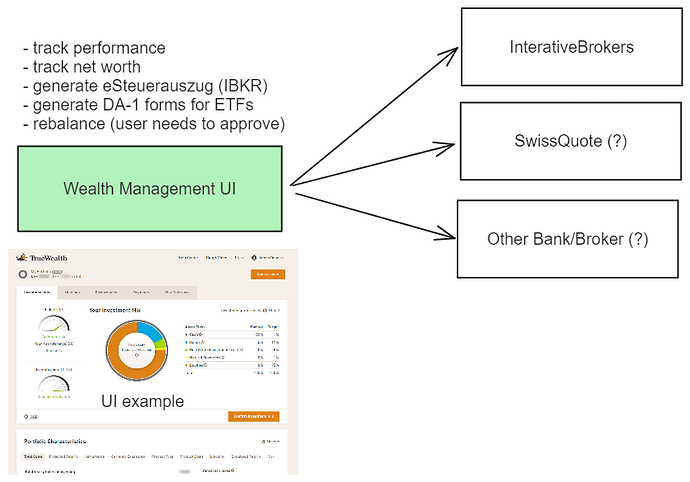

A wealth management platform/ui you just connect your broker account with. This means, the platform would visualize the information better (drill-down in ETFs, what asset class, currencies, sectors, regions, etc.) give users some presets if they don’t want to choose ETFs themselves and tell them (or help) when they should rebalance and how.

In addition, since the platform has access to the holdings, it could generate an eSteuerauszug (if the broker doesn’t offer it already), DA-1 forms [2] and maybe some other things.

Now, what’s the advantage to other platforms (assuming you’d connect IBKR to it)?

- No AUM fees. 0%

- No swiss tax stamp duty 0% (if it’s a non-CH broker)

- No high FX fees

- Invest in whatever ETFs and even single stocks you want (low ETF fees since you can buy US ones)

- Easy-to-use UI (probably™)

So it would be just a nice and more intelligent wrapper/UI around each platform you connect to basically, that’s why fees would be non-existent. You still pay the trading fees at your broker.

From a technical perspective I don’t really see a problem, it’s doable and has already been done by others [3], but the rest I’m not really sure about as there are some “problems”:

- Since this platform is just a wrapper/custom client portal, you still need to have an account at e.g. IBKR and send your money there. So it’s an additional step for new users.

- Trust. Are you going to trust a random middleman? Obviously your money can’t be stolen, since it’s just visualization and requires manual action from you to rebalance. But you would still share your portfolio data with the platform.

- Is there a market for it? Ideally the platform would cost something like CHF 100-150 per year, flat. It would also work worldwide, not only for Switzerland. The eSteuerauszug/DA-1 would just make sense for Swiss investors, obviously…

From an economical perspective, running that platform “basically” costs CHF 0. Don’t need to be licensed by FINMA or whoever, because the platform doesn’t manage/hold any assets, so no big legal expenses. The only thing the platform does is to consume APIs from the brokers (free), give the user a drilldown into the holdings and tell him when he should rebalance. Generating the eSteuerauszug I already know how it works (free), still investigating the DA1 (also free), but I’ll get there.

Do you have any thoughts? Is it worth for me to invest a bit more time into this idea or nah?

[1] Strong growth at True Wealth

[2] Reclaim withholding tax on Irish based ETF? - #40 by oswand

[3] https://passiv.com/, https://wealthica.com/