I’ve looked into Finpension’s tax reporting module [source] and coded my own implementation. Obviously the numbers aren’t correct yet (but I use real data, just have to fix all the calculations). It’s actually very easy to do. When I get it to a end-user usable state I could release if for free and you can generate your own reports.

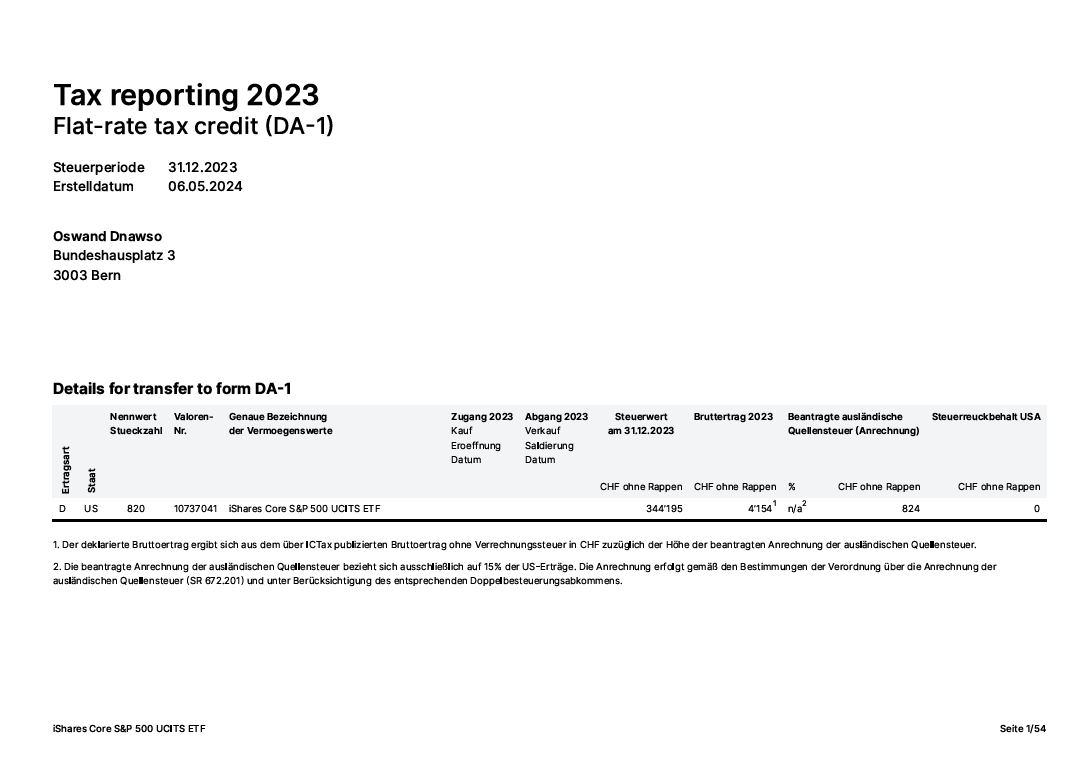

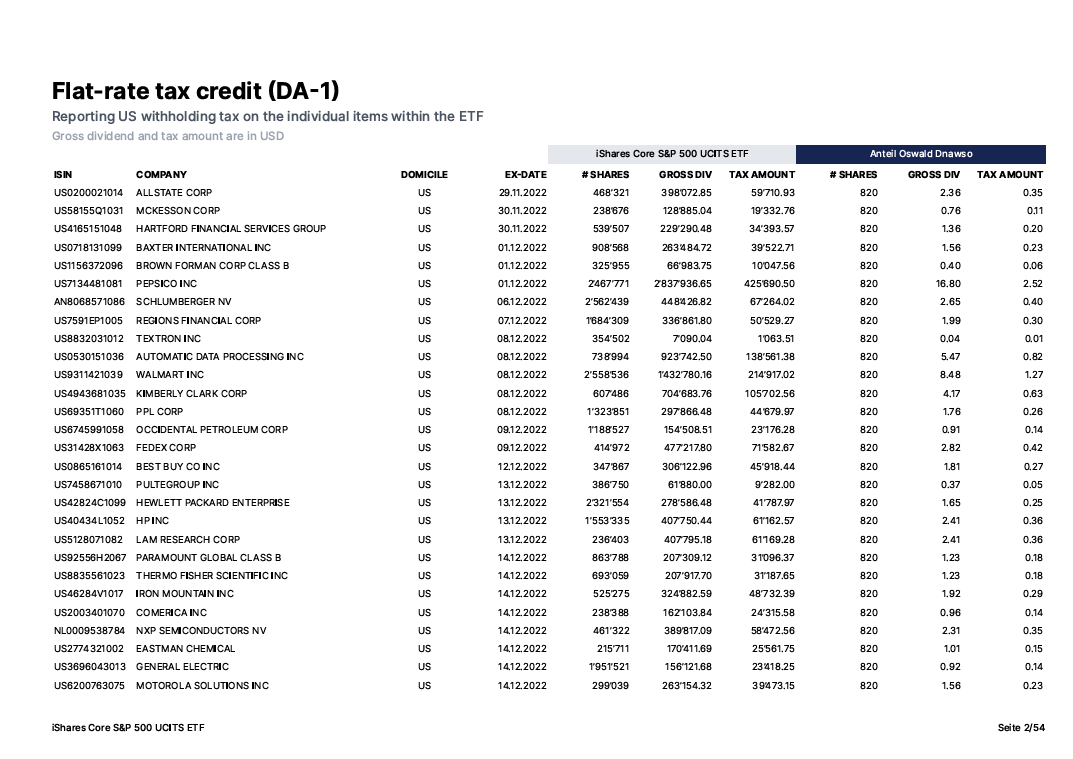

These are screenshots from a generated 54-page PDF. Kinda copied the layout from Finpension a bit, sorry…

Why is it 54 pages? It basically contains all received dividends, sorted by date.

Things I still need to implement:

- Right now I assume that outstanding shares don’t change and the ETF owner holds the same amount over the whole year. Obviously that is impractical, but it’s a first MVP. So that’s an important thing I’d have to tackle.

- Getting calculations right.

- Zugang/Abgang: @finpension It wasn’t visible in your article what is meant by that. Just a list of buys/sells of the asset?

- Dynamically fetch all data to generate reports for lots of different ETFs on the fly if required.

Where do I get the data from?

- Blackrock offers Excel + JSON with all required information, meaning: outstanding shares, what companies are in the ETF, their share, etc.

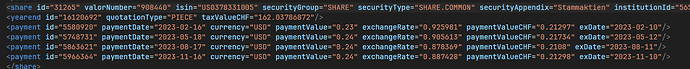

- ICTax’s database is completely open-source [source]. I downloaded the whole dump for the year and match ISINs with their database and get all data, even dividends in CHF. Nice stuff. This one for example is for Apple Inc.

- The same things can probably achieved with all other fund providers like Vanguard, etc.

Why? Seems like an interesting project + I learned a few new things like all the things ICTax has to offer.