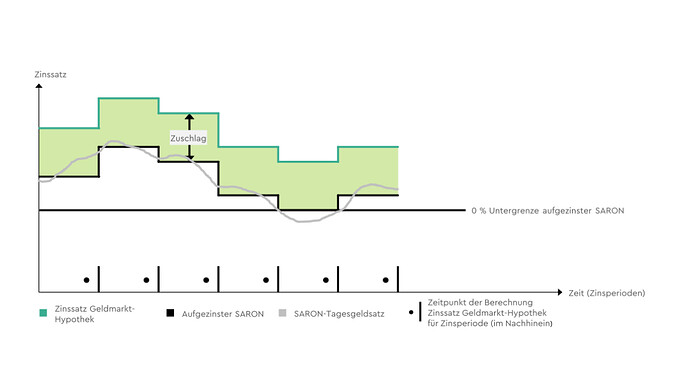

They still say the SARON margin is 0.65%, the total rate seems high because they do some kind of averaging over the past trimester (they claim the SARON rate is 0.86%, I guess they haven’t updated the text yet because it doesn’t add up but 0.42% average for the first trimester seems correct to me). If the margin is really 0.65% it is still a good deal over time, but the calculated rate lags quite a bit.

They calculate it end of Marc, for which the displayed rate is correct. Next one will be end on June for the period Apr-Jun (see their FAQ).

I have a mortgage with them (Saron) and also somewhat disappointed by their 5y/10y rates as I was considering switching to a fixed one. Seem I will keep going with Saron, which if SNB goes to zero next time is still the best case short term at least.

To get better than a broker you need to negotiate directly with a bank. I saw an application with 1.13% for 10 years this week (I cannot share the bank’s name). Not saying anyone can get that rate but that leaves some margin compared to these offers.

They announced a pause, but will resume - there is another thread discussing it.

I also got 0.65% from VIAC with three years commitment, but then they dropped before we could finalize.

Current bank has 0.75%

VIAC have opened up the mortgages again. I have a 0.65% margin on a 3 year SARON but I got this before the pause even though the mortgage only starts in July.

But I spoke to my advisor last week and he told me that they have opened up again but with a 150 CHF fee to study your file. This is because many people only wanted a rate from them to go negotiate with their current bank.

Oops this is bad news…

Anyone as already finished the 3 years period with SARON? Did they ask you again for your datas to check affordability of thebt?

Maybe with big asset pledge they don’t look too much. For anyone with big 3A asset I guess at 0,8% it’s still a no brainer

Hi there,

Just as short follow-up from my recent experience, I applied for a loan for VIAC this weekend an got rejected today.

I received a first rejection e-mail based on a fact that was completely incorrect and that would have been obvious if the person in charge would have read the documentation carefully.

I answered by explaining the discrepancy and the “advisor” persisted by saying that I won’t fullfill VIAC’s requirements anyways.

I am not going to lose my time arguing with them, but I feel that they are picky (as they probably have a lot of applications) and aren’t interested in my profile (“small” loan of CHF 400’000.-, and a factual situation that is a bit complex and not the “typical” basic loan). So they probably just went over the first argument they found to reject my case, which is obviously a bit disappointing, especially as I took some time to prepare my application and paid the CHF 150.- fee that I probably won’t get back.

What was that? Just in case other atypical cases can save 150.- / your gift to the community.

Well not sure it will be very useful but here is the detailed context.

My father and my aunt inherited from an old family house with two small apartments. They were co-owners of the house (2 parts, one part each). I live in the apartment that “belongs” to my father since many years, my father never lived there. I am going to inherit of his co-ownership part when he dies (inheritance agreement signed in front of a notary).

My aunt, who lived in the other apartment with my cousin, died three years ago. My cousin, who solely inherited of her mother, didn’t wanted to stay in the other apartment. I renovated the other apartment myself in 2023-2024 and bought the co-ownership part from my cousin in 2024. The payment was postponed with a deadline to pay until 2027. So basically I am already the co-owner of the house, with my father, although I did not pay for it (yet) and I am looking for a mortgage now.

So in the long run I will become the only owner of the whole house, as I own the part of my aunt/cousin through the sale of 2024, and inherit from my father’s part when he dies.

The first rejection email said that I was inelegible because “my cousin is going to live in the other apartment” (which is completely wrong).

Then they said that the fact that one apartment might be rented in the future is a criteria for dismissal, as I might not be the only “user” of the house at 100%. This is arguable, but still wrong in my case, as I do not intend to rent any of the apartments and will be the only “user”/owner.

I think it is useful to know VIAC might not consider cases where:

- there is a multi-family setup, where part may be rented (except maybe if your case already includes the renovation works to make it a single family home)

- where there are multiple owners with inheritance plans involved.

Thanks!

Then they said that the fact that one apartment might be rented in the future is a criteria for dismissal, as I might not be the only “user” of the house at 100%. This is arguable, but still wrong in my case, as I do not intend to rent any of the apartments and will be the only “user”/owner.

Doesn’t seem very professional from their part generally, but I get this part from them.

As I understand it, there are two separate apartments, including one that you just renovated but plan on keeping empty? And since you just renovated it, I assume there are no plans to “merge” the 2 apartments?

You might truly want to let it sit empty, but you have to admit this screams “I’m going to rent it first opportunity I got”. I can understand the argument “I don’t need the money and don’t want to deal with neighbours”, but why renovate it in that case? Anyway it doesn’t really matter what the actual reality is, what matters is what the bank believes.

No matter which bank you go to, I feel you will struggle to make them see this as a mortgage for personal usage, and not for rent. Unlike VIAC, most banks don’t mind per se, but you will probably have different lending conditions (higher own funds requirements, …)

I just received my answer from VIAC. They only propose to lend me 72% of the apartment value, not the 80% I asked. So I will pass

Anyone already arrived at the end of his 3 years period for mortgage?

Do they check again affordability, house value and 3A holdings? What was the margin offered?