You are out to prove the opposite of hot hand phenomenon. whatever happens, just keep us posted whenever you invest. some where between you, Schiller CAPE, and @glina, we can find the right market timing model!

This is why you should do whatever feels the most uncomfortable at the moment. You wont cash any risk premium without taking risks, it is as simple as that.

I’d lump sum and ignore the next 10-20% drop that will inevitably come. And yes, today is an awesome day to buy ![]()

buy what? ![]() I have cash ready for small (upto 10K) fun fund and open to buy individual stocks/etf-exotica for the first time in life

I have cash ready for small (upto 10K) fun fund and open to buy individual stocks/etf-exotica for the first time in life ![]()

UK small cap recovery bet stocks if you have the stomach. But you shouldn’t take my advice, I’m reckless

I literally invested my pension fund on the highest day since end of February.

Perfectly executed! Only to see a 5% drop within 3 days

any particular names or just dash of CUKS type ETF?

US SCV climbing down the ladder too, not sure to take a bite now or wait a couple of hours or till tomorrow. (can’t get my mind off them)

You know how do you beat the market? Just buy 3x leveraged inverse ETFs like SPXU the day I’m doing a lump sum.

I will always announce it here, so you’ll know when to buy.

you are in-a-strange-way lucky, I’m serious. I had to wait for >1 year to see my investments in India go negative. And it is still negative after 3 years. The sooner you see red, the sooner you start to understand your tolerance levels. No point being all green for first 5 years and then lose your shirt, your pants, and your mind.

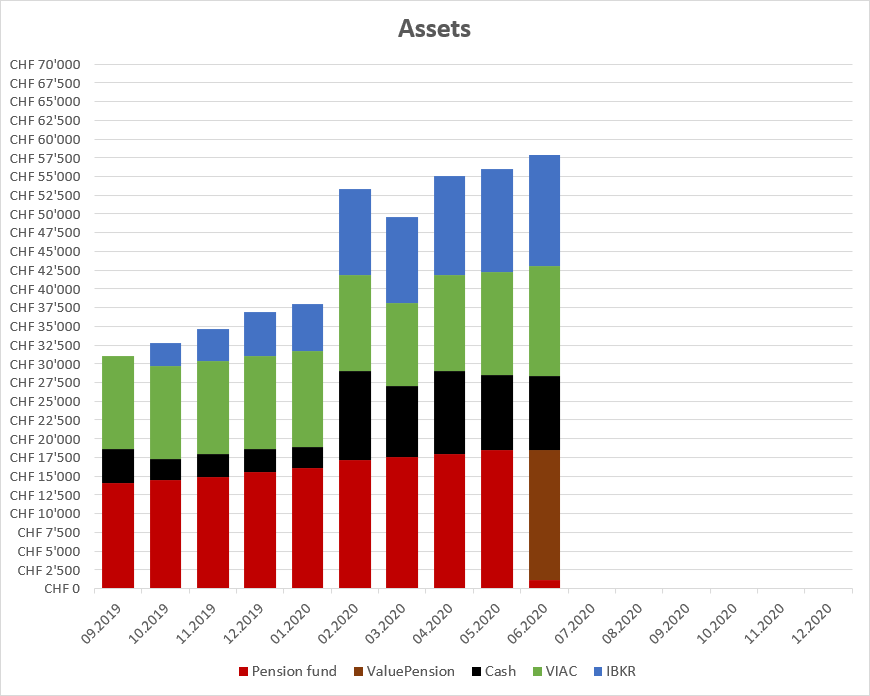

The market is really testing my risk tolerance. Btw I didn’t tell you guys lol. ValuePension invested more than 100% of my assets. Now I have -1% cash and 101% stocks

I asked about that and they told me it would sort itself out with the next rebalancing. But I don’t rebalance, so I’ll keep my 1.01x leverage lol.

I’m sorry that I forgot to post about it! I bought 1.2k $ of VTI today at 157.82$ right after the opening.

That will probably lead to a circuit breaker today. Right now VTI dropped to 154.00$ 2 hours after I bought it, already down -3%.

Just be happy that I don’t have any lump sums to invest anymore. Otherwise you would see a -25% drop within 2 weeks.

Keep us updated whenever you‘re about to buy.

(However, please plan ahead and allow enough time for me to sell in advance)

I’ll do it next time 24 hours before I buy.

If you are smart, you’ll sell everything and go allin on SPXU or other 3x leveraged inverse ETFs

Who the hell needs moving averages or CAPE? All you need is me!

@Cortana I was just looking at SLYV and itching to buy some. And I come here to see if you posted something. Not disappointed.

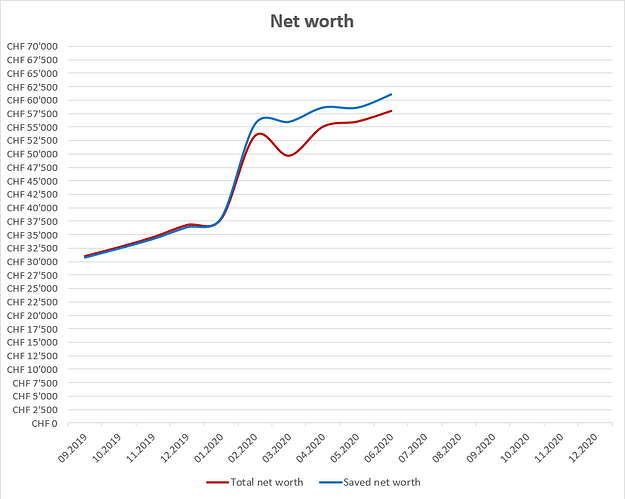

When I look at the big picture it gives me peace.

I might be the worst market timer on the internet, but I guess I’m still doing fine.

Any updates? Who uses ValuePension for 2nd or 3rd Pillar? Is an app coming? How is the reporting? Any downsides?

I’m using it for my 2nd pillar since 2 months. No app, but I don’t really need it. There are no further contributions, so it will stay like that for 40 years till I withdraw it at age of 69 or 70. I’m still loving the fact that you can set your own rebalancing bands. It’s currently at 100%, so there won’t be any rebalancing in the future.

Still waiting for the 3rd pillar solution.

Politics won’t change change anything. Has politics ever given the little man more freedom and scope to make financial decisions - unless that happened to benefit big corporate interests as well?

Pension fund contributions are mandatory - as such, the funds keep flowing into pension funds, among them the largest insurance companies (AXA, Zürich, etc.). And you can’t even choose choose pension you’ll contract to, since the employer will do it for you (lingering question: do you believe that your employer contracts with the pension fund that is most beneficial to you?)

Pointless for me. I don’t even have to bother looking into it, since only the top 10% or so of earners (among employees) are eligible. 127k/year an upwards. I’ll never reach these income strata from employment income (legally) in this life.

(Well, maybe if the figure doesn’t get adjusted and we see a hyperinflation)

I asked them once again to include Japan and Canada in their fund selection. Otherwise it’s still uncomplete! They have CH, Europe ex CH, Pacific ex Japan, USA, Emerging Markets. But those 2 are missing!

It’s not a big deal as you can take 3% SMI, 10% EM and 86% MSCI World ex CH to replicate VT. But I’m slightly deviating from VT and thus in need of those regions to be satisfied.

Just got the answer.

In short: Canada and Japan aren’t correctly listed in CHF. There is a CHF-tranche, but they have issues with the data-feed (no CHF price available from CS). So they can’t automate the trading. They are trying to simulate the CHF price using the FX rates from CS.

They don’t want to use the JPY or CAD dominated funds, like VIAC is doing. They don’t want to screw the customer over the FX spread costs of 0.75%. VIAC is doing this on purpose with the other funds, eventhough the CHF-dominated fund would be available.