Pretty weak correlation to future stock marke returns anyway. Good for retirement planning, not investing.

Even if you think the US is overvalued. Where to invest instead? The stock markets of all regions are highly correlated.

So if there is a correction in the US, all other markets will follow.

Momentum is an important factor not to be messed with

Pricy growth stocks get pricier longer than you can stay in value stocks.

Old chines proverb.

That‘s a common fallacy people make. Short term the markets are very correlated, but not as much longterm.

Markets can stay correlated while outperformance shifts, it doesn’t require a correction, just lower returns than what the rest of the world gets (i.e.: investors shift to investing in other markets).

JustETF suggested me this morning to Check India, which seems faring better than others.

I compared VWRL with Franklin FTSE India UCITS ETF and I got a +44% vs +12% (vwrl) in 3 years.

India is even more overvalued actually, which is kind of insane

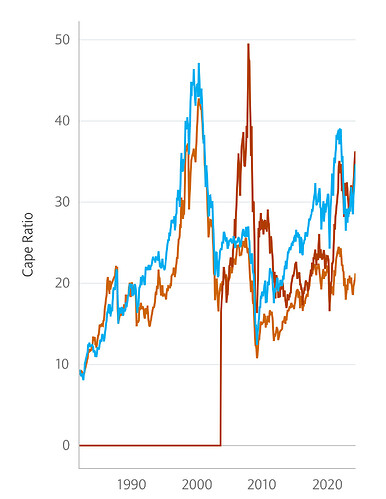

India is the red line, sorry for the shitty mobile screenshot.

So yes, it had a great return, emphasis on had. Now it‘s very overvalued.

As per some market commentary

- India is overvalued compared to historical PE ratios. The enthusiasm is coming from economic growth (realized and potential)

- US is overvalued due to the AI hype

- Europe is undervalued due to wars and energy crisis

The term overvalued is simply referring to PE ratios. CAPE might be better measure but still talks about past. For forward looking numbers, at least the forward PEG ratios should be considered because if earnings growth is high, then higher PEs can be justified. But it’s not so easy to find global data for PEG ratios.

I think - Basically the reality is nothing is overvalued or undervalued. If we believe in market efficiency theory, everything is rightly valued as per available info.

However everyone has their comfort zones and then they use that to justify their position.

Following could be few

- familiarity (often referred as home bias)

- historical performance gives comfort (even though it shouldn’t mean anything)

- available information (US markets are most likely the most discussed market in world), it almost feels like we live in US.

Your argument could have been made back in 2008 and any year after.

There’s a counter-argument that the rise of passive tracker investing means that you have a rising number of price-insensitive buyers piling more into passive US ETFs leading to a feedback mechanism which pushes the prices higher and higher, increasing the ‘outperformance’ and leading to more inflows. Until it goes out of hand and something pops it, but that process could take years or decades.

@PhilMongoose

I think about it a lot. But I am not so sure if this is how it works.

It appears that price of the stock is defined by the trading community and passive investing is still a smaller portion of trading

Otherwise what can explain the fact that top tech companies were major losers in 2022 while major gainers in 2023. If price insensitive buyers were setting prices then big companies should keep growing.

I am still not sure but that’s what I have learnt

I have one basic question.

I am aware that active fund managers find it difficult to beat their benchmark indexes

However I have only seen the data for some top indexes like S&P 500, Euro stoxx 600 etc.

Is there any research on performance of active vs passive for truly global funds ? Where benchmark would be FTSE all caps global index. Of course VT or IMID can be used as proxies for passive

I think we have extrapolated the regional market performance data to global allocation strategy. But is there any historical evidence for this?

Are there any active global equity funds to begin with.

Prince insensitive buyers do not set prices, they take them.

„Setting“ was used to refer to transaction prices. Maybe it appeared to be referred to as „ask price“

I meant that people who trade only daily basis are responsible for price discovery. Traders are doing this and will go long or short on stocks and that moves the prices.

Most index investors are long term investors. It should set a base demand though which would keep some sort of support.

There is: https://www.spglobal.com/spdji/en/documents/spiva/spiva-us-year-end-2023.pdf (page 21 and further)

I chuckle at this ongoing discussion re US, ex-US.

People, don’t try to do economics and finance like they are sciences, they’re not. Economics and finance half understand the past and use it to guesstimate the future, getting it wrong most of the time. Real sciences understand the past data and design stuff with it until it works (ie predicting the future). Edit to give a few examples: nobody in the world had built a functional nuclear fission bomb before 1945, yet pulling together data, theory, pen and paper and chalk and blackboard simulations, some of the best minds on the planet and giving them unlimited resources made it happen. That’s predicting the future. Or as Richard Dawkins put it “science works, b1tches”. Economics is some sort of phrenology mixed with tea leaves reading, and finance is greengrocery with computers ![]()

Economics and finance have emotions baked in, and money is a huge driver of emotions in humans. In fact most humans are pretty freaky when it comes to money. Look at us here for example ![]()

Just going market cap weight fixes everything, anything else is trying to outsmart the market.

We could try to argue what market cap to use. free float? That‘s the default. Or total market capitalisation?

Sifma market cap for the US is 45% for example.

Wouldn’t know to be honest, hence not even trying. Personally using global market cap weight as it was the Boglehead recommendation.

And that‘s completely reasonable. I don‘t think anyone is actually trying to argue against that being a good approach. And I would also recommend that for the majority of investors. Although looking at literature having a home bias seems to be optimal als well. So home bias + VT would be the default in most cases, in my opinion (Just VT is also absolutely fine, if you aren‘t convinced on the home bias literature existing).

I personally use something half-way between free float and total market cap and settled on 55% US.

what’s the difference?

Let’s say you start a company with 100% equity. Then you put it on stock market via IPO. Now you have total 1 million shares (50% owned by public and 50% owned by you) . Each share is worth 100 USD

Free float = 50% which is tradable publicly and not held by insiders, worth 50 MMUSD

Market cap = 100 MMUSD

For example Hermes free float is less than 40%. A large portion is held by family and is not available for public trading.

Almost all indices are built on free float. What @Tony1337 is trying to say is that if you look at the size of US companies and rest of the world including full market capitalisation, then US will be only 45% of the world. The reason is lot of international companies have lot of ”restricted” holding still.

There are two ways to look at this. When you decide your weight for US, should you only look at what is publicly traded or the total worth of those companies. Different people look at it differently.

I have to be honest, I don’t think lot of people across the world are owning 100% VT or alike allocations. Reason is most people have very strong Home bias. It’s natural to invest locally. International comes with all sort of risks and hassles and tax issues. Of course it comes with benefits too. Even Jack Bogle have many videos where he said he just invest in US personally. That doesn’t make him right or wrong. It’s just what he did.