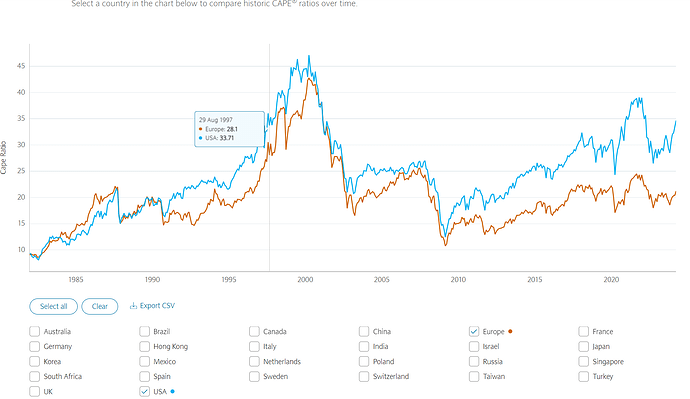

US stocks seem quite pricy (mostly because of ABC, Meta, Nvidia and so on):

Source of graph.

This suggests lower expected returns for someone investing in the whole world, market cap weighted.

Is this a valid argument to overweight non-US stocks?

(by e.g. buying VTI + VXUS and overweight VXUS).

In theory the total market portfolio (e.g. VT) maximizes returns and minimizes variance. So, messing with manual weights will create something suboptimal.

What is a sensible manner to come up with manual weights for VXUS and VTI, otherwise?

Bonus: VTI + VXUS seems cheaper and more complete than VT.