I’ve been assuming the question was directed toward @FI_yes_RE_maybe but just in case, everything is manual for me. Both because I like it that way and because I don’t have the desire to develop the skillset required to automating it while still understanding what’s going on behind the scenes.

Alright, folks, it’s update time and boy are these times, well, interesting. September was a down month, big time, as I assume US market participants finally came to terms with the idea that the FED was going to tighten for real. That is, until the first days of October but they seem to have settled again.

Situation at the start of the month

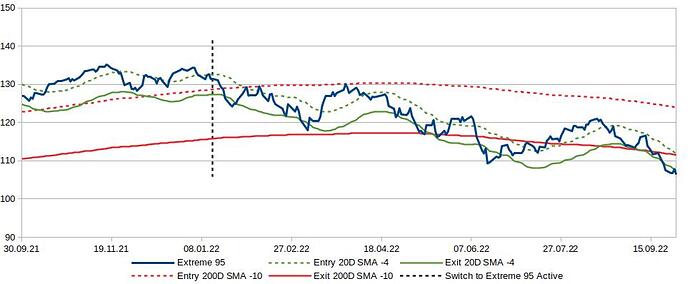

The 20D SMA -4 strategy was invested.

The 200D SMA -10 strategy was out of the market.

Triggers

The 20D-4 strategy proved excrutiatingly resilient to triggering its exit and only got divested on the 27th. It just barely stayed so at the start of this week.

The 200D-10 strategy didn’t get close to triggering its entry. As expected, it is way less subject to volatility, allowing for potential greater relative losses on a miss but also greater peace of mind by not being subject to the daily swings of a market like the high volatility one we’re having now.

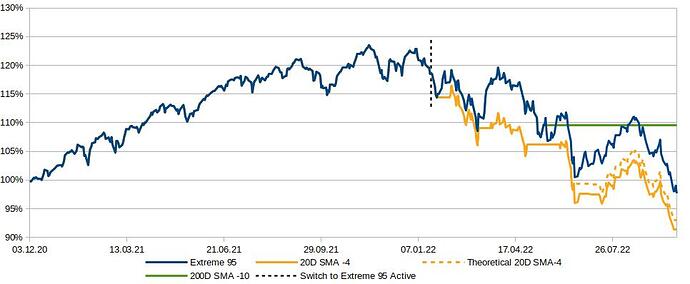

Time-weighted returns

It’s still too early to draw conclusions on that front. The 20D-4 strategy is loosing for now and will have some work to do if it is to get ahead out of this specific downturn.

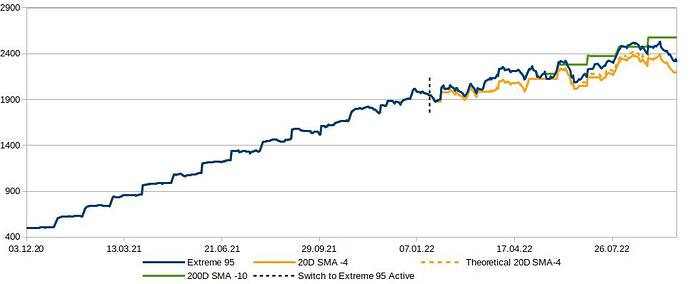

Real data

Not much to say. Looking from this perspective, being out of the market and having new contributions actually taking my assets higher looks good, though I’m a bit detached from it these days.

Mood: not gonna lie, I’m not sleeping much with the kind of gyriations we are having right now. Not really because of this experiment, nor because of the buy and hold part of my portfolio but because I’m trying to grow a small betting position I have on the discrepency between where the market is and my lecture of it. Trying to read the market is excrutiating.

|

20D-4 |

Th. 20D-4 |

200D-10 |

Bench. |

| TW Returns |

|

|

|

|

| CAGR |

-4.6% |

-3.7% |

4.9% |

-1.2% |

| September 22 |

-7.3% |

-7.3% |

0.0% |

-7.6% |

| YTD |

-25.3% |

-23.9% |

-10.4% |

-20.1% |

| Max DD |

|

|

|

|

| All time |

-26.0% |

-24.7% |

-11.3% |

-20.9% |

| September 22 |

-8.4% |

-8.4% |

0.0% |

-8.7% |

| YTD |

-25.6% |

-24.3% |

-20.5% |

-20.5% |

Red all around and new lows. Let’s see if we are heading into Downtober or Octuper!  As of right now, all bets are off.

As of right now, all bets are off.

![]()