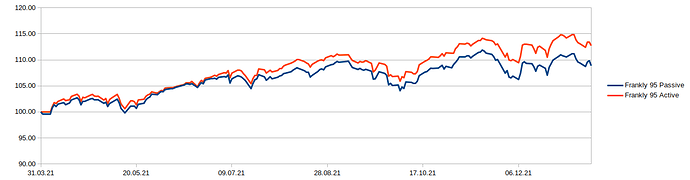

Alright, I have 200 days of data on the Extreme 95 active solution from Frankly. A comparison of the Active vs Passive versions of the Extreme 95 solution during that timeframe below:

As stated previously, the active version behaves “passively” enough, in that it follows the mains ups and downs of the passive version with similar shapes. My guess is that they’re using the same funds but weighting them based on their expectations. The outperformance is absolutely not guaranteed but it incurs less fees (no buying or selling fees, small though they are for the passive strategy) and, above all, allows for quicker buying and selling of shares (2 days vs 3).

I’ve initiated the change of strategy tonight and will be out of the market the coming days as the shares are sold, then bought.