That’s what I am hoping for /![]()

I think 6% real rate of return is most likely top end of expected return even with 100% stocks

40% annual gains chasing is not realistic for anyone. Of course that doesn’t stop anyone chasing that

Except if you are Renaissance Technologies ![]()

I agree with most of your statements* except your (non-)competitiveness claim over a 20-30 year time horizon.

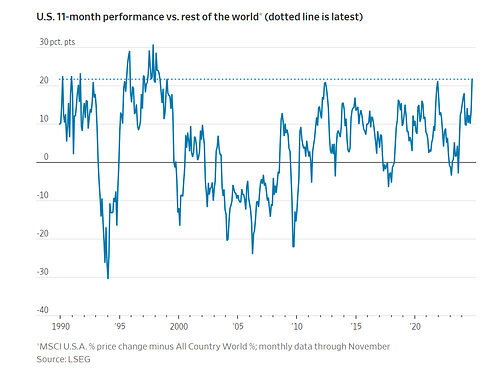

Timely chart from (today’s) WSJ:

Source: https://www.wsj.com/finance/stocks/why-this-frothy-market-has-me-scared-295c07c3?st=6pXCWo&reflink=desktopwebshare_permalink

Looking back there have been other times … and looking forward, nobody knows, as the future is by definition unknown.

Edit: Oh, and I would add another point to your list, which we have discussed before in several different topics on this forum: “The Relentless Bid™” of passive flows into US index products.

* And about 80% of my pillar 1 assets are US based/denominated, albeit not indexed but actively invested.

It was discussed a bit here: https://www.youtube.com/watch?v=ohQvbUmH1zQ

Guys, Inflation is over and we are back in a TINA World. TINA worlds are great atbfoest, but become toxic once assets are priced for TINA (whichbwas. The case right now).

Why don‘t you take the obvious route and diversify away out of the TINA bubble? Hold a static percentage. Of TINA vs. non-TINA Assets and call it a day?

What is a Non-TINA Asset you ask? Anything with an upfront defined return (no stocks, RE), no material FX nor default risk and no duration. Meaning: Cash in hard currency.

Just move from 100/0 to 60/40 and hold the 40 in rock solid CHF at a mediocre intrest rate. You already secured the next 10 years return, so you can hedge it now with a 40% Cash Position…

Don’t have enough, believe me if I did I would. It pains me, no, I HATE holding 100% equity EVEN in a year like this one, but I’ve bought that the bullet needs to be bitten for ~12-13 more years, so will just take steps to phase out 2-3 years before. A 10-15 year bear market will be a financial disaster personally, and as @Abs_max saying it will go down in history as “an amazing opportunity”. Sequence of returns risk is, considering current sacrifices, a big concern of mine and one I’ve given a lot of thought in.

I guess that’s what I’ve been doing by accident the last couple of years: selling from portfolio and paying into pillar 2. I get a 1%-2% annual return along with a one-off tax benefit.

Hi,

I know this will be somewhat controversial here, but with more and more reports of US stocks being overvalued [1], recent stellar rises, and concerns about Trump’s upcoming team incompetent leadership, I’m considering down weighting US stocks in my portfolio and generally being a bit more defensive in my investments temporarily.

Has anyone here considered doing this? How did you go about it? Thinking about it, it isn’t that easy to protect from a fall in US stock prices, as that would affect a lot of things all around the world, especially in the western block.

Looking forward to hearing your thoughts!

I don’t think one can really protect themselves against a US stock market collapse given the size of it

But in general my personal strategy is following

- limit equities to 65% of portfolio

- Limit US stocks to 50% of the equities portion

I am not doing this for now because of market conditions. Most likely I would stay with this sort of allocation for longer period of time.

Well you could just buy a put option on a us index (e.g. S&P 500). The option premium you pay is essentially your insurance premium. If the event doesn’t happen until the option expires, you just roll it to the next option.

Concretely, how do you do this? Are there any good “everything but the US” ETFs?

You just split up your regional allocations.

Or add VXUS, which is exactly that, everything but the US.

Actually for me it’s a bit of history, so it was easier

But VT + CHSPI + FLXI does the job because I am overweight CH & IN.

Otherwise VTI + VXUS would be needed or their equivalents

I guess the only sensible way to protect oneself against a return of the stock market would be to get into trend-following funds (managed futures). Higher cost but with the possibility to have high returns during volatile times.

Unfortunately I have trouble to weed out the good from the bad and to actually choose a fund. It is definitevely not as simple as just getting a bread and butter boring ETF.

Has anyone done this selection process ? Since I am getting closer to my lean FIRE number, it becomes more relevant to me to decrease volatility, without killing return potential (as far as possible).

I would then go towards a replication fund.

Either DBMF or the ucits mutual fund version (quite a bit more tax efficient). They apparently will also release an ucits etf version of it next year.

DBMF has a solid track record and over a billion aum.

Can you give a link or something more concrete. DBMF does not give a lot of results as a search (even combined with managed futures).

Thanks

We have a managed futures topic here even: Managed Futures

That’s the fund page of the US etf with info documents on the side iMGP DBi Managed Futures Strategy ETF | iMGP Funds

here is a summary page of the mutual fund, with teh different share classes: https://www.imgp.com/documents/iMGP_DBi_Managed_Futures_Profile.pdf

and the ucits fund page https://www.imgp.com/en/imgpfunds/fund/LU2572481948

You’ll find it on IB, by typing in the ISIN without the letters, so 2572481948 for the R (retail with 1000$ min) share class.

4 posts were split to a new topic: What is your investment strategy for 2025?

I always say that I am not a fan of All World because it has a lot of trash in it. And indeed, personally I only hold US and CH, and it’s the latter that’s really saving me. So thank God for that. I suppose Euro Stoxx also performed well, but point remains, VT has a lot of crap in it and when US does poorly so does VT. For Swiss, home bias is a decent thing. Lest not forget our currency tends to go up and up over time.