It depends in which canton you live, but not neglect wealth tax. It may add up to 0.1% of your wealth in taxable account, but it is really depending on cantons and amount of money you have. Pillar 3a doesn’t have that tax. Combined with the saving on distribution highlighted by hedgehog and the viac solution is at least breakeven. You are trading then freedom of money for reduced taxes…

I am convinced that the fees of the pillar 3a will go further southwards. So you are maybe paying .53% now, but probably half of this in 5 years. Please do not screenshot this statement.

I am at the beginning of my journey to FI and am wondering what place the pillar 3a has in it.

The current cheapest product has a 0.53%TER and can invest in up to 97% stocks. (viac.ch)

Considering this, does anything change from the first calculations made by nugget?

True the current portfolio of viac isn’t optimal but in the future that might change.

I understand that the advantages of a pillar 3a account are better the higher your tax bracket is, is there some kind of cutoff amount, where when you earn more than X, you should start contributing to 3a?

for my reasoning not much has changed. everything boils down to weighting the tax benefit versus the 0.4% less in fees that you can achive if DIY the same money instead.

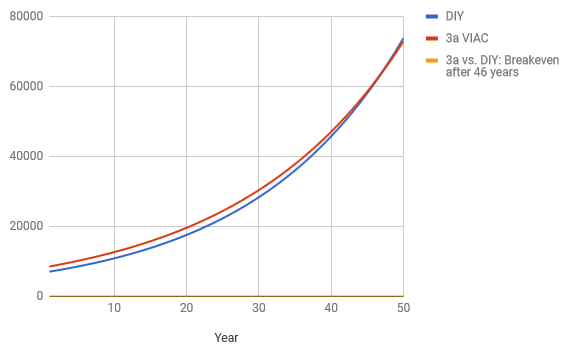

here is a small scale calculator for the development of 1 year’s contribution.

Assumptions:

you deposit CHF 6758 the first year

you get back 1500 at the end of the first year

VIAC gives 5% interest, costs 0.53%

you DIY solution gives 5% interest, 0.1% cost, no tax refund

then you are break even after 46 years

allow you DIY 1% better performance, break even is after 14 years

so the range of outcomes really cover everything from “3a/VIAC is better” to the opposite.

to get beter results, include dividend taxation, you DIY expected return, your VIAC expected return, your tast, etcetc

Hi Nugget thanks for the update!

I was playing around with your calculator and changed some things around for me.

The DIY solution I am considering currently costs 0.25% pre tax(Vanguard All-World UCITS)

Only changing this variable yields interesting results in favor of 3a.

But I see now that there is no real way to calculate this exactly. It all really depends on the portfolio performance.

The way I see it, is that you only calculated the returns for a single payment of 6768 CHF correct?

So for me it basically comes down to this: contribute the maximum 3a every with viac (for now) and investing the rest of my planned savings including the 1500CHF tax relief into a DIY solution.

Am I missing something here, isn’t this what everybody should be doing to maximize profits?

Of course the positives of this strategy would be completely eroded if 3a underperforms the DIY solution continuously. But this doesnt seem to be the case for now with viac.

no not much. the general conclusino is that on the short term the favor is on 3a, because of the significant tax benefit. on the long term however, costs are higher, eating away the tax bonus.

depending on your parameters, break even comes earlier or later.

I personally argue the complete control over my funds would be worth even a small disadvantage in returns for my DIY.

in case we had a US-style system with a tax sheltered account and ~free choice of funds, i would be more into it.

Let’s make a poll:

- I use 3a

- I don’t use 3a

- I used to use 3a but not anymore

0 voters

you can replace “use” by “contribute to my” to be more precise

Sorry, I can’t edit the pool. I think only @Julianek has such powers.

Even I cannot edit this poll because it contains some answer. (It makes sense, because imagine if I could change the poll in something totally different but votes remain the same… I could transform Nugget and 1000000CHF into incurable stock pickers! Muhahahaha)

I agree on this, unfortunately Switzerland pales in comparison with the US with the kind of things you can do for retirement. Maybe some day we will have something similar and I can use my 3a funds for that ![]()

Oh no, now you know who I really am ![]()

btw poll, not pool

I never got into the pillar 3a topic. Is there some pillar 3a performance data available? For comparison the S&P 500 had the cumulative CHF return of 128% in the last 6 years, 15% annualised. How do the 3a stack up?

You can see the viac performance number here:

edit: global 100 is what you want.

Basically it doesn’t look so good compared to the S&P

3 yrs annualised 6.4%

5 yrs annualised 8.7%

10yrs annualised 5.7%

Compare that to VWRL (my current choice)

3 Years Annualised 9.83

5 Years Annualised 11.63

Hmm I might have to rethink 3a ![]()

please reflect the CHF-USD course if you mention this number!

anyways, 3a is inherently flawed, no matter what you do with it: a third party (3a issuers) try to cut a slice of your tax benefits. on top of that there is horrible legislation and limitatinos to it

Not so fast. First we take your pillar 3a fund:

According to the chart, since inception on 2004-01-01 until 2018-03-31, it had a total return of 140%, that’s 6.3% annualised.

According to JustETF, in the same period the iShares S&P 500 had a total return of 125%, 5.9% annualised.

It does not look bad. Actually, in this PDF they write what this fund consist of. It actually consists in 32% of iShares S&P 500. And also in 27% of SMI!. I guess that explains the crappy returns from the last 5 years. SMI had a CAGR of only 6% for this period. In a way I find it silly that a “GLOBAL” fund invests 40% in Switzerland.

But that being said, in the long term this ETF should not provide much worse results than VWRL. So maybe I should really consider it…

I did… that’s why I wrote “cumulative CHF return” ![]() I used JustETF as source, there you can choose the currency.

I used JustETF as source, there you can choose the currency.

Well, from this comparison above it does not look so bad. In my case, I would save around 35% of taxes on the 6700. What other costs are there? Btw, is the custody fee already factored in the return chart?

Ah I see, I was going with what they stated the annualised performance was.

Anyway so this is getting interesting. I made some calculations with the annualised performance numbers for the last 5 years.

Scenario 1: DIY investing 6768CHF p.a. with VWRL @ 11.63% for 5 years =47’664.88 CHF

Scenario 2: Investing 6768CHF p.a with Viac Global 100 (3a) @ 8.7% and investing the 1500CHF tax relief p.a. in VWRL for five years = 54’325.58 CHF

Going with a 6.3% cummulative return for Viac I still land at 51’358.63 CHF!

Seems like a no brainer to me?

3a offerings are only going to get better and I guess at some point we will be able to choose our own funds to an extent.

That’s wrong. You can’t invest the whole 6768 CHF, first you need to pay the income tax. I would say, you should be able to invest between 4500, if you earn a lot, to 6000 if you earn a little.

It’s like this:

Scenario 1: pay the tax on 6768, invest the remaining 5000 in VWRL

Scenario 2: invest the 6768 pre tax in pillar 3a, when paying out pay some kind of conversion fee, I guess?

I intentionally left income tax out of this because I can still invest 6768 and pay income tax, I don’t see the connection here?

For me these are 2 separate things no? Plenty of people max out their pillar 3a

But anyway the 3a Scenario 2 gets even better if you factor in a reduced investment in Scenario 1 because of income taxes.