Hi all,

Please help me understand what are the annual tax liabilities with B vs C permit.

Say for a gross income of 110k in canton St Gallen, city of St Gallen and same income in canton Fribourg, city of Freiburg.

I am currently under the impression that Withholding tax (B) is more advantageous.

Is there any standard deductions package for C permit holders ?

Thank you !

In general there is no difference is tax liability for B permit vs C permit when one files an income tax return. Hence deductions are same if you file an IT return irrespective of residence permit.

The main difference comes from the fact that certain people are not required to file the income tax return.

- for B permit holders , if salary is lower than 120K and there are no other source of income/wealth, then income tax return filing is not obligatory. You wouldn’t even receive a form.

- for C permit holders, no exception, everyone files tax return.

For people who are not obligated to file tax return, the tax is based on Quellensteuer rates. This rate is often based on cantonal average rate. Hence depending on Gemeinde Quellensteuer might be advantageous our disadvantageous.

I suggest to do a simulation of what your real tax liability would have been if you filed IT return and then compare it with Quellensteuer. Remember we are talking about income tax here.

You can use following link to simulate

https://taxes.helvetia.vlot.ch/v1/taxes/incometax?utm_source=website&utm_content=steuerchecks-pv

AHV and pension contribution is not impacted by B or C permit

3 Likes

To add to @Abs_max answer, I understand tax at source is based on monthly gross income. So for 100k gross, it’s based on 100k, isn’t it?

Normal tax is based on net income minus deductions.

For example, if you have 100k gross, you pay 7.5k for AHV, if you’re young 5k for pillar 2 so the net income is 87.5k. Then there’s maybe 10k in “standard decutions” for work-related items or health insurance.

So you end up with a taxable income of 77.5k.

This is to say you can’t compare 100k with 100k in the tax calculators for your comparison.

Thank you for the comment @Abs_max

Can you recommend any source to do this analysis ?

I have some dividend income, is there any threshold below which I do not need to report ?

Thank you !

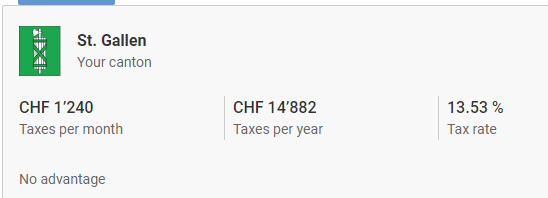

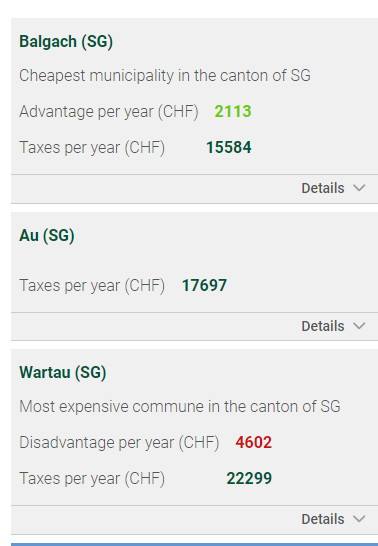

I used Comparis calculator and got the following:

- withholding tax is 14.8k / year

- regular tax can vary from 15.5k to 22k within St Gallen canton

B permit 110k single, no children, no religion:

C permit 110k single, no children, no religion:

Very good point,

So taxable income = net income - social contributions - deductions ?

I didn’t know this

Hi,

don’t use Comparis. It is made to have a general overview of the Tax situation, but it is not precise.

I suggest instead to download the official tax software used by the canton you want to investigate and run a simulation.

1 Like

Almost, it’s taxable income = gross income - social contributions (= net income) - deductions

1 Like

Thank you for the correction

I shared the link to Helvetia calculator. I use it to get an idea.

Remember Quellensteuer assumes only standard deductions.

Real tax liability includes other deductions like 3a etc. so you might want to simulate using Demo version of official tax software

In my case I think the standard deductions are better than my personal circumstance: no commute, no pillar 3 etc.

Can I still get the standard deductions package if I file for taxes ?

Tough to say what’s best for you. You really need to do a tax calculation. And remember once you try to switch , you might not be able to go back

So if it is important for you, ask a tax advisor. It might not cost much …

1 Like

Yes, I will call a tax advisor.

I think my comparison was flawed as @Brndete pointed out.

Thank you all for the info !

1 Like

Pillar 3 should be deductible any way.

You have to check for your canton. In ZH, you can deduct for example 3% of income for work related cost, your insurance premiums, 3k for food outside or (half that if there’s a subsidy from company) and monthly ticket unless you do home office.

So yeah, most of these will apply.

Generally these taxes are the same, except for small differences on local level. Since tax at source is based on 100%, it makes some small difference compared to normal tax whether you live for example in the city of Zurich with 120% or the around the lake with 80% local level.

Is your decision to apply for permit C based on a small difference in taxes?

I thought the differences were much higher:

in St Gallen from 14.8k withholding to 15.5k - 22k on C permit

I have to see what were my Social contributions for last year.

Also, not sure I have to declare dividends, I remember reading somewhere there is a 2k / year threshold on dividend income. Anything less they don’t care ( at least in case you never had to file tax before )

Maybe this will be the requirement for me to file taxes even if I don’t have C permit and don’t earn earn >120k

Shouldn’t be much higher in most cases, since source tax rates are based on the normal rates incl. the standard deductions.

Edit: this example is for federal taxes.

In ZH, it’s 3k or 80k in assets. The German key word is nachträgliche ordentliche Veranlagung if you care to search for more or check for your canton

1 Like

Thanks again @Brndete

I don’t speak any German so I used google translate on this document I found about St Gallen https://www.sg.ch/content/dam/sgch/steuern-finanzen/steuern/steuerbuch/art-105-129-stg/112_1.pdf

I don’t see they mention any dividend income threshold in here

From https://www.sg.ch/content/dam/sgch/steuern-finanzen/steuern/steuerbuch/art-105-129-stg/105_1.pdf

Erzielt eine in der Schweiz ansässige Person zusätzliche, nicht der Quellensteuer

unterliegende Einkünfte und/oder verfügt sie über in der Schweiz steuerbares Vermögen, so ist ebenfalls eine nachträgliche ordentliche Veranlagung durchzuführen.

Sounds like Sankt Gallen has no limit for additional income, and looks like it’s 75k wealth before you start being taxed.

Thank you !

No limit meaning that I have to declare from the 1st franc onwards ?

At least it looks like it from that document, maybe ask the tax office directly?

(in practice I’d assume they’d be lenient for the first few thousands)

1 Like

Yea, for sure I need to ask the tax office or talk to a tax consultant.

Any idea where I can find the tax on wealth ? or values from another canton to have a ballpark number