No they often revise data later. Accumulating is worse than US distributing for US equities in every case i’ve checked in the past

Thanks a lot for answering. Just a Question. You mean it is worse in terms of what exactly?

Dividend yield? Declaration to tax?

I am asking the Question since I have one accumulating fund which is WOSC (SPDR small cap - IE based) and was wondering whether I will only be taxed on dividend gain and not capital.

It is in the list and therefore I was assuming it is fine. Am I missing something?

Thanks a lot for answering. Just a Question. You mean it is worse in terms of what exactly?

In terms of tax, duh - see the title of the thread

wondering whether I will only be taxed on dividend gain and not capital.

Yes. But you’ll get double taxed on dividend, that’s the problem that US funds help alleviate, besides also having lower fees and being much cheaper to trade

For example, assuming you pay 40% marginal tax rate here and 100% US invested fund: with a distributing fund you pay 15% to US, get it all back from CH and pay 40% to CH. With an accumulating IE fund: you pay 15% to US and 85%*40% = 34% to CH, for a total of 49%, or 22.5% more taxes than with a distributing fund. And then there are timing issues: they normally tax you for whole year’s (or half-year’s) dividend depending on whether you held the fund at a particular date, so you can owe a lot more swiss taxes than necessary by buying at a bad time.

Just to make it clear: I already have a IE distributing fund (VWRL). I understand that taxation is similar for a distributing or accumulating IE fund. Is this correct?

As far as WOSC (small cap IE00BCBJG560) is concerned . I am bit surprised to see that the taxable dividend for 2017 is 0,53 USD while the Client brochure I received says that it gave 1,44 USD per share. Any idea?

Amazing summary.

I am still wondering whether to buy directly from an american broker and move from VWRL to VT for instance. Am I right to understand that through DA-1 you only get the remaining tax back from the tax declaration ie. several months after?

Also what About the form W8-BEN if I own the Shares together with my Partner?

Thanks a lot

I am autoquoting myself but I asked the question today to the Swiss authorities and they replied the following regarding accumulative funds:

“The amount of USD 0.53 is for the income tax and has to be added on the tax declaration as taxable income. If a fund makes no distributions, he qualifies as a capitalization fund. The accumulations are calculated according to certain specifications. See the number 3.5.1 In circular no. 24 of the FTA (just in German). The reinvestment of USD 1.4433 is therefore irrelevant for Swiss tax purposes and only applies to the UK/Ireland.”

Therefore with a dividend of 1.44 USD in an accumulative fund it seems that in the end you only pay the income tax on 0.53 USD ie.35%. Any comment regarding this?

Must have been a glitch in the system or miscalculation in your favor, enjoy it in this particular case. Considering its TER though you’re still likely better off with something like VSS.

@nugget why in the excel VTI has a lw2 dividend withdrawal? Isn’t it a pure US ETf and you can use the da 1?

Hey Grog, good observation. When I made the document it looked like in the screenshot of the initial post, i.e. some user modified it (as i asked for). I added a line accounting for the DA-1, as far as I think it’s correct. that gets VTI down to a whooping 0.04% total costs!

as far as I remember this table points out that your VTI dividends will be widthold 15% by IRA. Yes, the DA-1 should allow you to credit these taxes in your tax declaration.

Hi @nugget

Thank you for this very informative thread.

In your previous post you mentioned:

And in this post you explain why you would select a US based VXUS instead of some IE-based alternative.

I was thinking to start with investing in the following ETFs: VTI+VXUS, but then after reading your summary above (“if your fund holds mostly non-US-domiciled underlyings, consider the IE domiciled fund”) I was considering finding a European alternative to VXUS. Specifically, instead of VTI+VXUS I was considering VTI+ MSCI EMU + MSCI Pacific OR VTI+MSCI EMU + MSCI Pacific ex-Japan + MSCI Japan. It would be nice to know your views on this.

Also (beginners question) does every ETF have “accumulating” option and a “distributing” option to select? How do I know if the fund accumulates or distributes?

Thanks

Hey runner,

thanks for ready my guiide ![]()

the short answer is there is no short answer to the US vs IE based question. there is a list of pros and cons, i myself went for the US based EM ETFs. my main reasons were that i like the US based vanguard funds, and that unlike with IE funds i can get down to 0% witholding tax non-declared with my swiss tax authority.

does every ETF have “accumulating” option and a “distributing” option to select?

no. the majority does ot have.

Thanks so much @nugget !

I will probably also stick with the US based EMFs (VTI+VXUS) just for simplicity, unity and convenience (to have all vanguard funds)

One last question, how do I know if a fund is “accumulating” of “distributing”? e.g. are VT, VTI and VXUS funds “accumulating” or “distributing”? (sorry for such a trivial question)

All US based ETFs are distributing.

Super - thanks @glina !

id think so too, but better check for the fact sheets. they specify yearly/ semi annual / quartely distribution

Hello everyone,

Any reason not to choose VEA+VWO to cover for ex-US developed markets and emerging markets (all cap)?

I read about perhaps making sense to choose the funds whose domicile lies in the assets-covering country, but how do you do that when the assets lie practically around the whole world?

Since these assets lie outside of the US, are there maybe better options with iShares or such - “better” regarding tax optimisation?

you can buy whatever the f**k you want, your money, your risk

this is mostly only a concern about the US, less for other countries, first, market’s very fragmented outside the US, most countries are less than a few percent weight, and second, the tax savings for non-US are not that big actually, i’d buy US or IE fund for ex-US, it doesn’t matter much which domicile

Hey no need for such a reaction, just asking for advice from the more experienced. ![]()

Thank you for Pt.2.

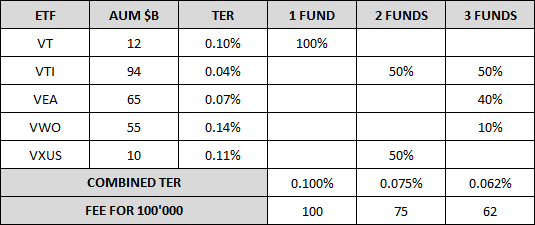

That’s a bit over the top, IMO. It’s a good question. The only reason I see is simplicity, not needing to rebalance. If you go for VEA + VWO, you get:

- higher AUM of ETFs, more liquidity

- marginally lower TER

- more flexibility if you decide to overweigh

BTW I made a comparison chart for our wiki: