Also, TER needs to be considered combined with the tracking difference. If a very low TER ETF has a high tracking difference it may still perform worse than a higher TER ETF with an excellent tracking difference.

Tracking difference is after cost, so the TER is deducted already.

I don’t understand. Are you saying tracking error includes TER?

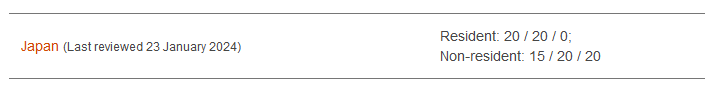

I don’t fully understand those numbers. The USA should have a L2TW of 15% for Swiss residents. The same for Canada. I know that IBKR will apply the tax treaties correctly for both countries. For Japan, Swiss residents should only pay 10%.

It looks like you already subtracted foreign tax credit in Switzerland. But how did Japan end up with 5%? Non-treaty withholding tax of 15% minus 10% treaty rate tax credit? Have you tested this or is it only assumed?

yes sir, tracking difference that is.

Ah yes, misspoke, I meant difference.

OK so you can just compare tracking difference and be done with it, no need to look at the TER? Didn’t know that.

But only if you compare two funds tracking the exact same index.

I did comment that L2TW is after tax reclaim. WHT tends to be 15% for those markets, so is the recoverable part.

I’d like that. Source, please. I get substracted 15% since years and could reclaim only 10% most of the years.

Indeed you did. I missed that.

The reason you can only reclaim 10% is exactly because that is the treaty rate. A good source for all international withholding taxes is on pwc.com. For Switzerland specific official rates there is an “overview” pdf on double taxation agreements on admin.ch.

So you are with IBKR and they use the non-treaty rate?

Thanks. I’ve read those sources some years ago, but still don’t get it.

The PWC source mentions 10% for companies, but the summary shows 15% for private investors. Can you pin point to the part where the 10% should apply? Or even better in the DBAs?

The colorful “Japan” is a hyperlink. You can click on it. The other countries and the withholding taxes by Japan are listed within.

Don’t be too smug about it ![]() Can you pin point the part where the 10% should apply, or not? With a reliable source?

Can you pin point the part where the 10% should apply, or not? With a reliable source?

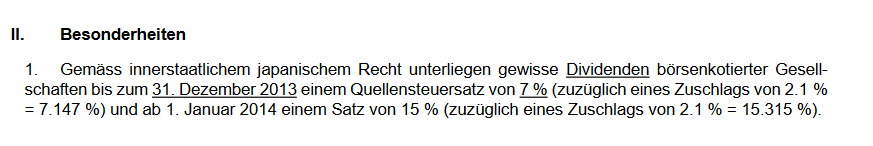

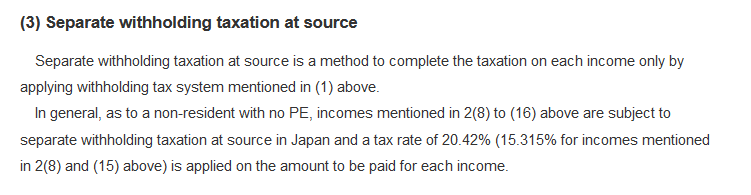

I’m aware the DTA states 10%, yet here it mentions the 15.3% that I get withheld.

Same here. I quote the English translation, my Japanese isn’t good enough for reading tax code:

Aren’t there many countries where the withholding tax is fixed and may be higher than the treaty rate? I thought the US is rather the exception than the rule (and brokers need to be IRS qualified intermediaries for W-8BEN).

In those cases, you’re eligible to get a refund from that country. The time and effort required for this depends on the country.

I think e.g. Swiss-domiciled funds (and possibly also individual companies) have to pay out net dividends. I.e., the withholding taxes are paid directly by the fund, not by the broker. I’m not completely sure about the exact process but with such a system, it’s impossible for a broker to apply a reduced treaty rate based on the tax residence of the investor.

Sometimes things are rather straight forward, but some people give me the runaround, by just not looking at information. Putting up even better sources doesn’t work. Reflecting the demand to do their thinking for them works.

You want to say you have actually seen the 10% in both sources and chose to go back and screenshot the unrelated resident and non-resident section? I don’t believe you and some humility would do you good here.

Regardless, since you now did dig into some sources: Why should the DTA not apply? Art. 10 Abs. 2 (German) states clearly that:

I didn’t see any caveats in the vicinity. Also, the information you posted refers to the non-treaty status.

Probably. I tested that Canada works the same (IBKR files an NR4). But for European and Australian securites you can only get a withholding tax voucher.

In german/french only

for PDF of all withholding rates according to Swiss Treaties. ooen the pdf named “Vertragliche Begrenzungen der ausländischen Steuern”

DBA Japan

https://www.fedlex.admin.ch/eli/cc/1971/1720_1725_1725/de

Are you being rude? Why?

I simply can’t make the connection between the 10% in the DTA and the 15% from the other document titled “Übersicht über die Auswirkungen des Abkommens”. IB withholds 15%. Therefore, I took the net 5% as granted so far. So for me, it’s not straight forward yet at all.

What am I missing? Is IB making a mistake? Can these last 5% be reclaimed seperately? Since you seem to know so much more, why not give a hint?

It states explicitly that the withholding tax get’s reduced to 10% for everyone that is not a pension fund or major (>10%) shareholder.

That Japan applies different withholding taxes for public and private companies has no bearing on what the treaty demands. It demands a maximum of 10%.

This is further supported by the fact that you can only claim 10% tax credit in Switzerland. Because that is what Japan can legally withhold.

That IBKR doesn’t care and also doesn’t help you with reclaiming the excess withholding tax is a you-problem for everybody else (IBKR, Japan, Switzerland).

Switzerland links the form for having the correct withholding tax applied (below page in German, but can be switched to EN):

Looking at it, it can work similar the US and Canada. You send your form to the Japanese tax office and the Japanese dividend paying company. Then they will only withhold the treaty rate.

The problem probably is that IBKR holds the securities as a broker in an omnibus account. So neither do you get the US-Japan treaty rate of 10%, nor can you claim, that you are the actual owner and get the 10% of the Switzerland-Japan treaty. You get the 15% non-treaty rate.

According to the document of the National Tax Agency JAPAN you posted you can also reclaim it later:

https://www.nta.go.jp/english/taxes/withholing/Information/13002.htm

But it requires also filing the first form, and also suffers from the same problems. You could of course try with a printout of the dividend statements from IBKR, but well…

Thanks for the clarification. Your second link is for non-dividend refunds, but I got a form for dividends.

I’m not convinced whether it’ll be succesfull, but I guess I will give this a try in the coming days to see if and how long back I can get these 5% net L2TW down to 0%.

Doing taxes is supposed to be fun, filling this kind of forms is not.

What you can do to estimate cost of specific etf is going through their yearly report and look how much dividends they had and how much was withheld.

Thanks for the advice. I checked the VT annual report but couldn’t figure out which dividend values are relevant to be honest.

Even though it’s difficult to get to final number easily, I think the real difference between VWRL and VT will amount to 0.1 to 0.15% per annum after taxes in terms of their tax efficiency and tracking differences. I don’t worry too much about TERs because they can be misleading sometimes.

I tried to recreate some of calculations from the original google sheet and the Bogleheads Wiki post using the assumptions of % for L1WT and assuming 0% L2WT for both ETFs. I came to similar values. Total costs of 0.35% for VWRL and 0.13% for VT. However, I did not account any TD. I read people mentioning index providers use maximum withholding tax rate and comparing TD of IE and US domiciled ETFs is difficult. TrackingDifferences.com shows the average TD over several years but not for US domiciled ETFs. I found those values only on Trackinsight.com but only for the previous year.