Can a portion of the rent used for home office be deducted? I cant find the section on the forms and does one need to provide some sort of supporting evidence?

Afaik only if your employer demands you being in home office x-days per week.

You also need a dedicated room that‘s more or less only used for office.

Also then you dont get the flat reduction of professional expenses anymore and you need to prove everything.

Might be worth it, but rarely afaik. Also often times (at least what I read) will simply not be accepted.

Just did my partner’s taxes, was pleasantly surprised to see BLKB providing eTax documents for free.

Just got my neon eTax documents as well (also free, for neon invest users).

Does anyone else have problems with the ZH tax tool? The data for the accumulating ETF I have in my portfolio has now been published on ICTax, but the tax tool has trouble getting the data.

Syncing data through the eTax document tells me every time that no data has been published yet, and when trying to add the ETF manually it either says “search not available” or “no data has been published for this fund yet” and after many tries it has successfully added the ETF with the correct gross return.

Does anyone know how to input stocks in the Zurich tax tool received as part of the salary? In the Wertschriften section where you explain where you got the stocks, there is no salary option

Depending on your salary statement you might just have them as buy.

They don’t really care what the “reason” is, you can put gift or buy. Add a comment if you want to clarify.

Aren’t they listed in your salary certificate as part of your income? Once they vested and you keep them, just treat them like any other stocks.

I used the full annual activity statement for 2022 taxes and had no issues getting the DA-1 refund.

This year you’re required to upload a Beleg for each individual position in your DA-1 WV - are they crazy? I’ve now switched to the dividend only report and uploaded the same documents for every position…

They get from me 8-10 copies of the same pdf…

Do you use the activity report?

yearly activity report.

It’s your responsibility to submit a true and complete tax declaration, but yes, you don’t necessarily need to wait for ICtax values. You can either just leave a general comment to say that not all values were available yet, or you can manually correct the entries when ICtax is missing (which in most software solutions means you need to fully manually add that security as they don’t let you change entries with a security ISIN). But, why? That makes sense as fiduciary doing mass declarations, as an individual you gain nothing. The tax authority will still wait until the ICtax values are available before they confirm your self declaration.

I like not having to wait until the final tax bill (which can take a year) to know the likely tax amount. If I fill out the tax declaration when all or at least most ICTax values are available, I can use the automatic calculation to see how much I still owe, barring any mistakes/corrections, and plan tax payments accordingly.

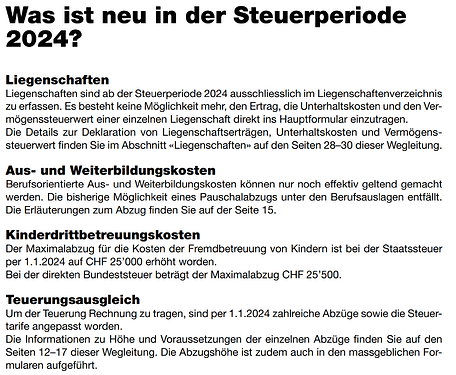

For people in ZH, it seems they changed (at least) these 3 things:

- no more CHF 500 deduction for training/education

- minimum amount for donations lowered to CHF 100

- 0.3% asset management costs are deducted automatically

How do you know this? In the online tool?

Can you still manually put in the 500 for training and it will be accepted, or they just flat out refuse?

Thanks for this info.

Is the tool already live or there was some notification ?

In the Wegleitung, they mention that from 2024 forward, only effective costs can be deducted.

The tool is live. I received the login code yesterday.

Just adding it here for reference (link):

On this topic, a friend the other day told me that his employer pays for X amount/year for educational expenses. He thinks he can deduct the costs from the tax declaration even though the employer reimbursed him. I told him that’d not possible, but I secretly hope to be wrong. WDYT?