Hi everyone, I have just moved all my Vanguard VWRL from DEGIRO to InteractiveBrokers.

I’m wondering, this should not affect the tax in any way is that correct?

Is there a specific way to handle this during tax declaration?

(also I’m now planning to sell all of them to buy VT instead and benefit from the DA-1, so probably the transfer was not needed, but at least it should be faster to re-buy VT.)

Yes. Wouldn’t even in other countries, because nothing happened.

So it should not even show in the tax declaration?

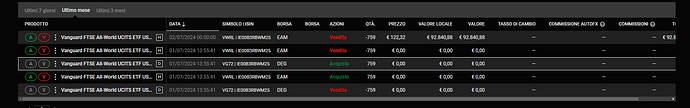

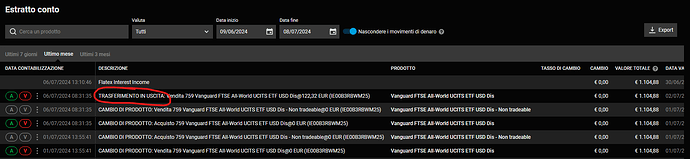

I’m asking because looking at some of the DEGIRO operations, I see multiple entries related to the transfer, and one makes it look like they were sold.

So I was wondering whether this would need extra attention during the tax declaration.

Thanks for the reply by the way!

I see. I don’t think they were actually sold, they probably just used a generic entry type to describe the decrease of position.

It was well between dividend payments, so anyway nothing to care about if you file taxes in Switzerland.

In the balance it actually shows as transfer so you are most likely right.

Thanks for the clarification

I need to sell all of my 759 shares of VWRL, which are in EUR, to then buy all VT (in USD).

Based on the following information about currency conversion IBKR behaves weirdly when converting currency and immediately buying with a cash account - #4 by fittim

I should sell everything, convert all EUR to USD manually (since amount > 6666USD), wait 2 days for the conversion to settle, and then buy VT.

But I have 2 doubts now:

- After I sell, will the money be available right away to convert into USD? Or should I wait before doing the conversion? If yes, how long should I wait?

- Is there a way to know exactly when the conversion is settled? I would not want to risk that I wait 2 days, and then it is still not settled when I actually do the buy, and auto-conversion kicks in.

Thanks in advance for the help

Have a wonderful day

These quirks apply only to a cash account. If you change to a margin account, you can do all transactions just in one go. It will take time for them to settle, you might even have to pay some interest for the negative balance in case of settlement dates mismatch, but it will be done.

Additionally, if you change your base currency to USD, you can convert all currency balances to USD with one click (Close Balance or similar).

Most likely a transfer by you from one broker to another is front end transaction.

However in back end - they actually just buy and sell same number of shares. This should not impact you but maybe this is how it was actually executed.

Would this amount be considered negligible/less risky than staying out of the market for few days?

Just to be sure I understand it clearly: in a margin account the auto-fx conversion will not happen even if the cash has not settled because it will instead use the margin, correct?

How is the margin calculated by the way? Does that also need conversion (if for example base currency is CHF and I’m buying in USD), or it does not matter? (which from your reply, I believe the latter)

Current margin rates for USD borrowing correspond to a bit less than 0.02% per day, so I would say negligible considering possible market movements.

Also this wasn’t mentioned, but there shouldn’t be any conversion issues if you use autofx (but higher conversion cost).

Edit: nevermind still the issue that vwrl has T+2

Didn’t know that VWRL trades two days to settle. Why is that?

Currently only US switched to T+1, rest of the world is still T+2. That might change in a few years (EU and UK are discussing it)

Is it true for funds or also for ETFs?

This applies to securities traded on centralized exchanges. Mutual funds work different, although the settlement is also typically T+2. I think I saw T+5 mentioned for some mutual funds.

I was about to switch to a margin account but then I saw that there is this requirement

“Your Liquid Net Worth must be greater than your account equity.”

I think I am misunderstanding this because it sounds weird to me, but does it mean that if, for example, you have a total of 100k in stock, you should have more than that liquid, like cash in bank?

In which case I definitely do not pass this requirement as I keep most of my wealth invested

My understanding is that invested stocks and ETFs are considered liquid, in contrast to real assets (eg a house) that take time to sell.

So it means you should have other liquid investments elsewhere, to be able to quickly transfer some more money to IBKR in case this account gets towards a low margin; but I don’t think you need as much outside of IBKR as inside IBKR.

It’s not related to the margin account. You have put wrong numbers into Financial Situation dialog.

Liquid Net Worth includes stocks, bonds, funds, cash, etc - everything that “can be exchanged for cash quickly”. And excludes for example real estate.

So obviously the value of assets at IB cannot be higher than all your liquid assets, because they are completely included in it.