Pandas, I think that you should sort some things out in reallife first. Then start posting here again.

They don’t offer a proper Swiss tax report.

You can declare all holdings and all transactions in your tax return.

Or try to include a summary account statement - which is what I do. Though in principle that might not be 100% correct. For instance, even my IBKR base currency were CHF, I believe it would be 100% correct to use the tax administration’s official exchange rates, rather than IBKR’s own (and that applies to each and every dividend payment).

Yes, but irrelevant, as you have to declared the account or its holdings yourself anyway. Exchange of information is no substitute for declaring yourself.

I use the canton Zurich web app to fill in my declaration. I only attach the default IB Activity Statement, where you can see my positions SOY and EOY, as well as all trades. Then I fill in the missing dividends from the ICTax Kursliste. Since every title I have is on that list, I assume they should be able to very easily verify that it’s correct. It’s public knowledge.

But I don’t know how they react. They still didnt evaluate my 2017 declaration !

Do you enter every order you made in the list?

I think you can limit it to the amount of shares held at dividend payment date (according to ICTax), then you usually have to add (for ETFs) 4 entries per year

Yes, I enter every trade. This way the software can determine how many shares you held at each of the 4 dividend payment dates.

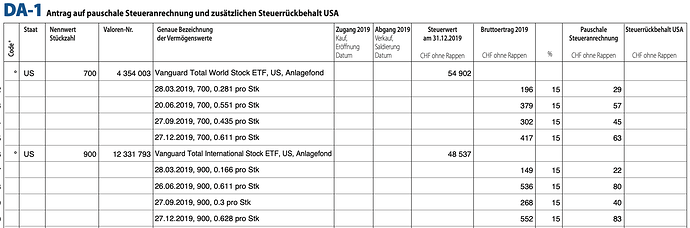

Anyway, a picture is worth a 1000 words ![]()

Notice I made no trades in 2019, so it’s maybe not as helpful.

@OogieBoogie you mentioned SQ is a bank on Feb 14, can I use it to get my salary there and also have an EUR account open ?

You also mentioned in that attached image you would pay 19.55 francs for a 5k investment in VUSA. However, I see SQ says there is a 9 CHF lat rate on SIX. Can you please help me understand the discrepancy?

Thank you!

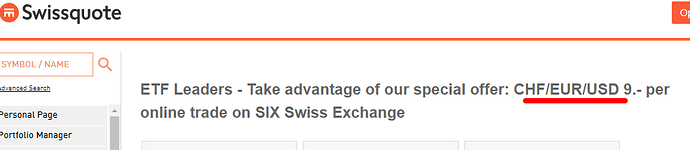

Not all ETFs can be traded for the fixed $9 flat rate. Also, you have to pay stamp taxes because SQ is a Swiss broker. Furthermore, be aware that in the ‘make a trade’ window in the online broker, the $9 flat fee is not displayed but the costs as if this Flatrate would not exist. In the end, though, if eligible, you will only pay the flat rate + stamp tax etc.

As of earlier this year, to trade Xtrackers ETF one must pay the regular share trading price.

What you say about the 9.- is not accurate. The total fees are visible in the lower right hand corner of the dialog. If you pay 9.- then that will be considered. What you mean, maybe, is if you have trading credits at your disposal? These are taken into account only once the trade has been completed.

This is on their website:

So VUSA traded on SIX should be 9 CHF flat + stamp tax

Can anyone clarify how stamp tax is calculated - eventual monthly/ annual limits etc.

Thank you

That’s really cute but it only costs 0.3$ to buy VT on IB ![]()

Hi @glina,

How confident are you with keeping larger portions of your money with IB / Swissquote? Let’s say all money above your household’s 6 month emergency fund, are you comfortable to have that invested with a broker? ( not thinking about the actual product here , just the broker)

I am considering this approach and the most crucial thing is the broker trustworthiness, I can live with higher costs.

Thanks !

Regards,

IBKR has been founded in 1978, is listed on NASDAQ and is one of the largest brokers worldwide. I’m pretty confident that it is safe.

Does anyone have experience with changing country of residence while having money invested ?

I just moved from Ireland to Switzerland this year and have some ETFs with Degiro

Also, in the future I might live between Switzerland and another European country.

I was literally just on the phone with SQ about this for a friend last night (!) as we were wondering why the fees in the lower right hand corner were so high. The service guy told us that the $9 would only show at a later point in time after completion of the transaction. (Which I thought was quite weird but what do I know…)

As I do not use SQ myself, I have never done a transaction so I can’t confirm but that was the official SQ answer.

I checked again and it actually seems to consider the 9.- flat fee.

Say that you want to invest for 10kchf.

That accounts for approx. 15chf stamp fee, which is 0.15% for a non-CH domiciled ETF.

Add 9chf for Swissquote.

Then the SIX fee, which would be around 3chf.

The dialog says approx. 28chf and that is about right.

So how much is the fee now? 9 CHF for every US ETF?

There is a list of ETF traded at SIX.

iShares, UBS, Vanguard, etc. Xtrackers was there until about two months ago.

Many traditional index funds can be bought for 9.- flat as well.

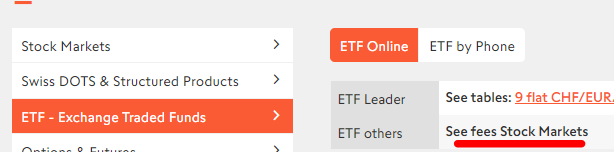

As far as I understand, it’s 9 chf flat only for SIX market

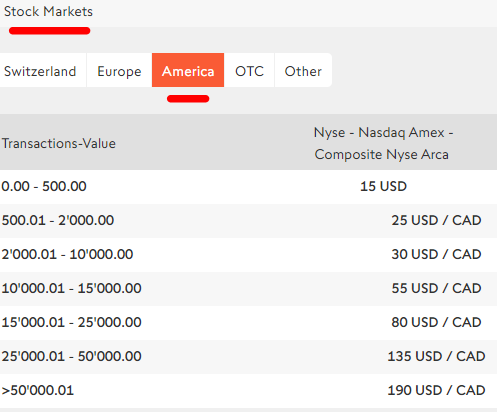

If you want to buy from any US market:

They ask you to look at Stock market prices:

Seems a bit much.

I’m finally ready to start investing, after opening SQ account some time ago (had no time at all to think about it).

I think I did my homework and I read a lot on the topic on this forum, but still I would like to get some answers/example portfolios/strategies from people using SQ - keeping in mind:

- Lowering the costs as much as possible with SQ.

- Tax-efficiency.

- Simple strategy - 1 up to maximum 3 ETFs (probably something described in Investing / Brokers FAQ).

So, my questions to people using SQ are:

- Which ETFs do you invest in?

- How often (monthly/quarterly/etc.)?

- USD/EUR/CHF denominated? I guess the best would be CHF to avoid exchange costs, but I would like to know your opinion.

Thanks in advance for your hints!