You will get more yield and more (well, not less) safety with bank’s medium term notes. But at the expense of liquidity.

Right for the taxable account , it could be an option

Most of my bonds are in 1E or 3a. I don’t really buy them in taxable

I understand now what you mean

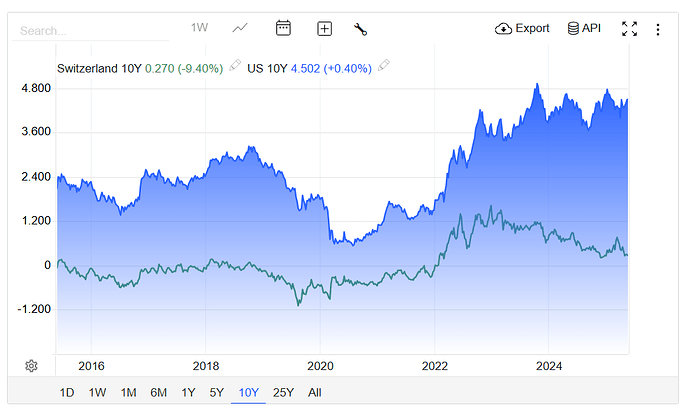

Even though interest rate in beginning of 2009 months was close to 0%, the number that matter here is actually the CH10Y bond yield at that time.

It was around 2% and that’s why buying a 10y duration ETF of Swiss 10Y bonds at that time was interesting

But now that the yield has gone down, there is no way we can get such returns

there is, if you go even more into negative territory

If you buy a 10 yr bond or 10 yr bond ETF today then unless you plan to sell it before expiry / duration period, there is no way you can have a higher return versus today’s 10 yr yield which is 0.44%

The scenario you explained would only increase the value during the period if interest rates were to fall, but by end of 10 yr period , the value will come back to par.

Isn’t it?

Your comment on yield curve led me to some insights which I never really had

It seems ever since US yield curve inverted and later flattened and yet not really steep, hedged bond ETFs have a bit of an issue where hedging costs are very high but the yield spread is not enough to compensate.

For example if the hedging cost depend on 1M interest rate differential, it means it’s going to be about 4.25%. 10 yr bond yield in US is 4.45%. This means post hedging effective yield would be 0.20%

Does it mean that investing in foreign hedged govt bond ETFs might only make sense when yield curve is steep for the underlying currency ?

That part only applies to individual bonds (and special funds such as iShares iBonds). A normal bond ETF keeps buying new bonds that match the fund’s criteria and the effective duration usually stays in the same ballpark.

If rates keep falling over the 10yr period, the total return of the bond ETF over this period will likely be higher than the original yield-to-maturity. Unfortunately, the inverse is true as well, of course. If rates keep rising over the whole holding period, the total return of the bond ETF will likely be lower than the original yield-to-maturity.

There is, if someone buys it from you for more than “it’s worth”, i.e., with a negative yield.

Let me add some color to why I started this discussion. As mentioned earlier, most of my bond allocation is within 3a & 1E. It about 10%.

I am fine if the yields are low because purpose of bonds is to provide stability. But I think when the YTM goes below the cost of the holding them (0.34-0.39%), this becomes a bit questionable. Finpension does not offer free cash allocation. So the only option to NOT hold negative effective yield (post costs) bond ETF is not simply switch to Equities or Real estate.

Another problem is that the GOVT funds have moved quite differently (CH and Ex CH), so i feel that ex-CH is supposed to recover. But if i look at YTM of ex-CH fund, the YTM is less than 0.2% , so i am wondering how can it actually recover. Ideally if you hold bond ETFs long enough they do recover, but I have doubts on hedged foreign bond ETFs because hedging costs eat away all the recovery that comes from higher yields.

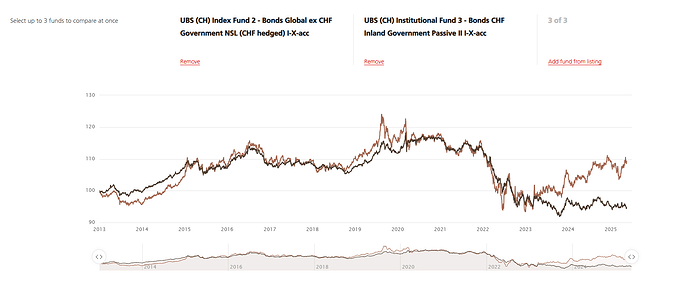

Following are two funds as proxies. They are not exactly the same duration but i could not find better comparison. I am wondering if ex-CH fund have low yield, it would still need to get back to its CH counterpart ?

I’m not sure if it makes sense to hold low yield CHF bonds in 3A, 1e.

Better just hold cash outside the tax wrappers.

Well if I am holding the bonds anyways, would it not be better to keep them in 3a ? Lumpsum tax at withdrawal would be optimised in that way.

Maybe I misunderstood, but I thought you said that holding them in the wrapper costs more the the return on the bonds. In which case, I’d hold them outside the wrapper (assuming the costs are eliminated once outside the wrapper) or hold cash if that has a better return.

Ahh. Got it.

Yeah that’s what I was thinking too. In negative yield scenario it might be wise to move them out

Will do some math

I will wait for the exCH govt bond ETF to recover though for a bit though. I think it might have been moving in wrong direction due to path of yields in CH vs US in last few months. CH yields are dropping while US yields are moving up

If you believe in falling USD value relative to CHF then holding CHF cash may be a good option, even if you get 0% interest rate (esp. if rates go negative again).

My concerns about USD value and also other currencies being forced to devalue and follow suit led me to invest in gold, commodities and real estate.

IMO, the recent US tariff moves have increased the risk of stagflation (which I was already concerned about prior to the tariff announcement).

Actually I am not worried about currency moves because bond ETF is currency hedged. I have no way to know how USD will move and I don’t really care much.

I was referring to US bond yield and bond prices. Specially 10Y which is a big part of global ex CH govt bond index.

As US BOND yields didn’t reduce much while Swiss yields did, it caused a situation that long term Swiss Govt bonds recovered in value but long term hedged ex CH bonds didn’t. This is what you can observe in the chart I pasted above.

I need to decide if I should exit the exCH bond ETF as yields (due to hedging) have reduced a lot and hence not really interesting. But I am not sure how to read YTM for hedged ETFs. I feel they are not always accurate because of hedging costs, forward rates etc.

For unhedged versions YTM is a good indicator of expected return. But I don’t know if that’s really true for hedged versions or not.

Yeah it’s not helpful, it’s yield before hedging.

Interestingly enough UBS Ex CH Govt bond fund seems to have YTM adjusted to include costs I think.

Because otherwise they wouldn’t be less than 0.20%

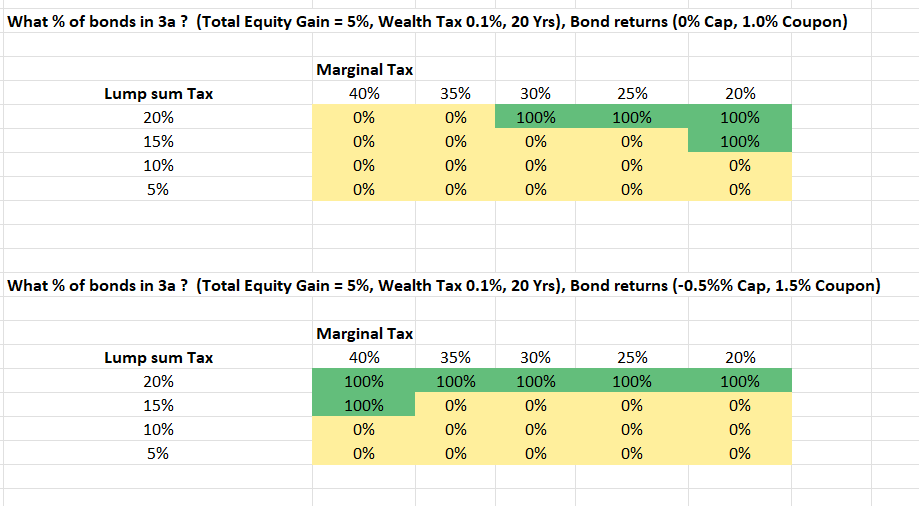

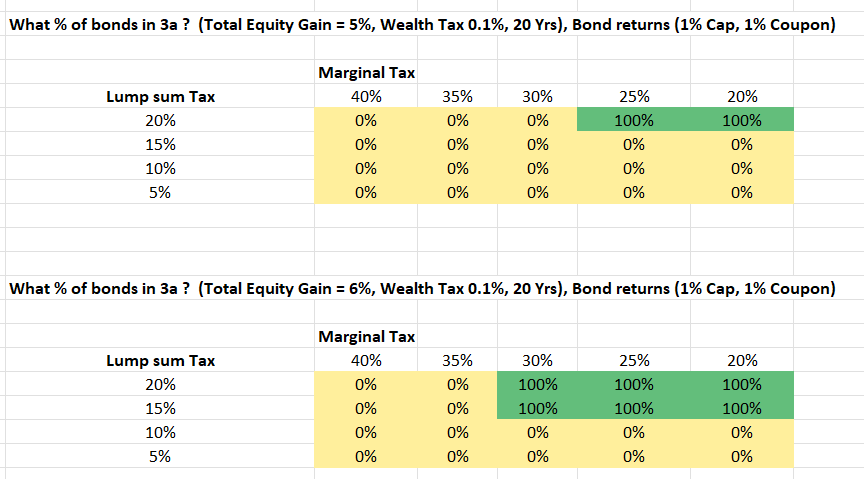

So, I did some math.

Problem statement -: If an investor were to invest 20K (10K in MSCI WORLD & 10K in CH Bonds), where should the bonds be placed?

Assumptions -:

Total TER would not be impacted irrespective of where you place what because assumption is 0.1% costs for Taxable account & 0.40% costs for Pension account

Dividend yield for MSCI World is 1.85%

MSCI world when placed within pension account have 0.1% advantage due to WHT

Time period 20 years

Goal -: Maximize total value post tax at end of 20 years.

It turns out , the answer as usual is complex and depends on Wealth Tax, Marginal tax, expected returns from Equities & Bonds and the breakdown of Capital gains vs Dividends

Conclusions based on scenarios I ran

- If 3a regulations do not change and investors can withdraw staggered, I think keeping Bonds in Taxable account seems to be advantageous because lumpsum rate will remain low for individual tranches.

- For 1E accounts, since lumpsum taxes can be higher, the choice is a bit more complex and depends on marginal tax rate

- Personal surprise for me is that it seems dividend yield is a bigger driver than the capital gains tax

Note -: If anyone has a different view, I would love to hear.

Did you also consider tax on pension withdrawal? If you make 1000K on gains in the pension fund and have a 5% withdrawal tax, that’s 50k in taxes, compared to tax free gains outside the pension.

Yes, this is what Lump sum tax is referring to… it is charged on withdrawal after 20 yrs