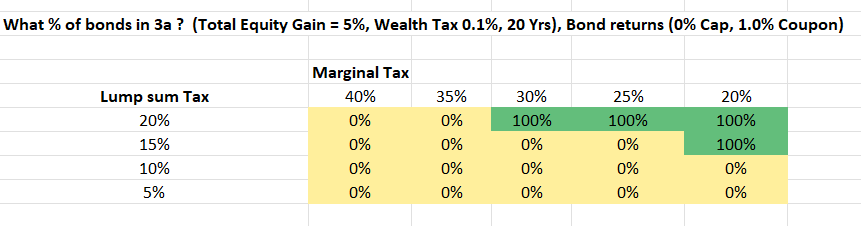

Help me understand it, if you look at any given column, if the lump sum tax increases, then this would suggest to me that it is preferable to avoid gains in the 3a and so I would expect to have more bonds in the 3a and more equity outside it, bu tit seems the opposite is happening in your tables.

ah, yes, brain failure on my part.

I have to say, i did similar math one year back, i kind of concluded that its better to leave bonds inside 3a. I think i didnt include all variables then.

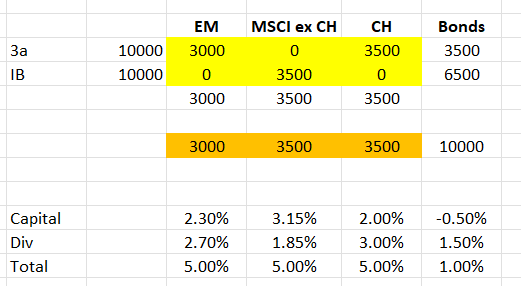

One other element, what about dividends on stocks, if you assume a 3% dividend yield, then would this change things, as outside 3a, this would then be taxable.

yes, I used MSCI world as a proxy. Depending on what you hold as Equity portfolio, the breakdown of capital gains & dividends would change.

For example, lets say you have 3000 in MSCI EM, 3500 in MSCI World & 3500 in MSCI CH & 10,000 in Bonds, Following would be optimal distribution for Scenario with 5% equities total gain, 1% bonds total gain (1.5% coupon) for 20 yrs , 35% Marginal tax & 20% lumpsum tax

Yes I agree

I was think about it. It seems hedged foreign govt bond ETFs have three elements

- coupon payments

- Currency exchange

- Interest rate change in Foreign regimes

Currency exchange impact is muted for hedged ETFs due to hedging. Over a long term if currency devaluation is similar to average hedging cost, this should be a net zero sum game.

Interest rate changes (reduction) will definitely change the capital gains of Bond ETFs as it pushes prices up. But it depends how much of it also impact currency markets.

My basic understanding says -: US bond prices goes up if demand of bonds is high. But if the demand of bond amongst foreigners is high then in addition to prices going up, USD also becomes stronger.

Not a big bond-holder/fan, but I hold some in my Vested Benefits at Finpension/Viac, with 10+ y investment horizon.

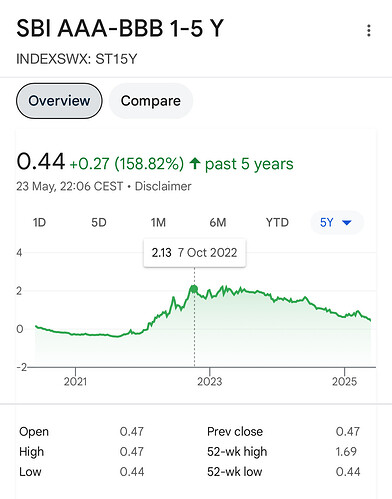

What do the bond-pro’s think the expected returns will be in the next 3-4 years of this ETF?

My “simplified” thinking is that CHF interest rates have dropped quite steeply since late 2024, and expectations are that even negative rates are coming soon. Such a fund with 1-5y “high-interest” bonds should be increasing in value in the short-term (1-2y), but it has gone nowhere YTD. (+0.4% in 4 months).

See the massive drop in value when interest rates increased for example in 2022-2023.

Background - I want to reduce my bonds with almost zero net returns (0.4% fees!) and rather just hold cash, but don’t want to Cortana-style-sell before a big price spike up.

If I could answer that, I’d get my bikini-clad assistant to message you the answer as I’d be too busy partying on my mega-yacht.

As Howard Marks often say „bond investing is fixed outcome investment“ unless issuer goes bust, you know what you will get.

For SBI AAA-BBB 1-5 Index, the current Yield is 0.44%. So this is what you should expect for the period of duration (3 years is modified duration for this index) starting now. You need to deduct the costs of execution (tracking error from Swiscanto). Anything that is known at this point, is already priced in this yield.

It could be that yields fall further if SNB takes more drastic actions. In those cases we can see more capital appreciation. But this no one knows yet

Until the end of 2021 , this index had negative yield which means if someone bought the fund at that point, they were not expecting positive returns anyways. However the yields rose to 2% by Oct 2022. So I would expect 6% return for a 3 year holding period (Oct 2022 to Oct 2025). In the chart you showed it is actually more or less what happened. Anything on top was capital appreciation due to yield reduction.

By the way, I was thinking if yields in CH are so low, does it mean that borrowers are issuing new bonds to take advantage or this is simply speculative change by price action in secondary markets ?

Should these low yields not boost investments in real estate or corporations?

Got it.

Maybe Switzerland should simply issue some debt and finance their defence problem. It seems like whole world is trying to give us money ![]()

Shouldn’t you have bonds equally in taxable and 3a? How else would you be able to rebalance a, say, 60/40 portfolio in 3a?

Or would you keep 3a allocation constant and rebalance only the (most likely significantly larger) taxable portfolio?

Why do we need to rebalance specifically 3a, shouldn’t we look at full portfolio?

Taxable + 3a ?

What I meant is if you have 100% bonds in 3a and no bonds in taxable, and stocks crash, you would need to use 3a money to buy stocks to restore 60/40. You can’t take it out, so you’d need to start having stocks in 3a. If the opposite happens, you’d need to buy bonds in taxable. Which is fine of course, but the “100% bonds in 3a” strategy won’t stay “pure” for very long.

Yes that’s correct

But since 3a money would be smaller than taxable account , I think rebalancing wouldn’t be an issue.

To be honest I don’t really rebalance anyways. I just manage it via new contributions.

For time being. I don’t have that many bonds that I need to be 100% bond in 3a . I was just trying to estimate where is the best place to leave bonds if yields stay low. I was intuitively thinking the answer would be 3a but actually I was wrong as shown in table above

Exactly, always think in terms of your total portfolio

Came across this video which explains a bit on why the actual returns from bond investments might end up with different than YTM at time of purchase.

This means that we cannot always assume low YTM equal to final return. Hopefully it’s useful watch

Thank you everyone for the highly instructive thread!

I own some CSBGC3 and now the Average weighted YTM is -0.12% (total return YTD 0.07%). Am I right to expect the price to slowly fall, assuming no change in the interest rate of the SNB? In this case, it makes sense to sell and switch to cash as soon as possible - correct? Trying to get a low spread, somehow…

Thank you!

Yes, without a change in interest rate (YTM, not directly the SNB policy rate, although it should be relatively close), the price will fall (also keep in mind that YTM is before any taxes or fund TER).

The YTM may fall further (seems likely if/when SNB reintroduces negative rates), in which case the price of the fund will increase. I can’t predict what the best option is. I myself don’t consider CSBGC3 interesting enough to hold.

My lowest risk allocation is a SBI AAA-BBB 1-5 fund, which has a 0.48% YTM. Not much, especially after fees and taxes (and some credit risk) but at least not as low as CSBGC3. Going futher up in risk, SBI AAA-BBB currently has a 0.73% YTM and SBI Corporate has a 0.94% YTM.