Regarding Renaissance Technologies and the Medallion Fund, there was a book by Gregory Zuckerman: The Man who Solved the Market. It tells the story of Jim Simmons and how they set up their fund and their arbitrage philosophy (although no detail is given on the actual strategies used).

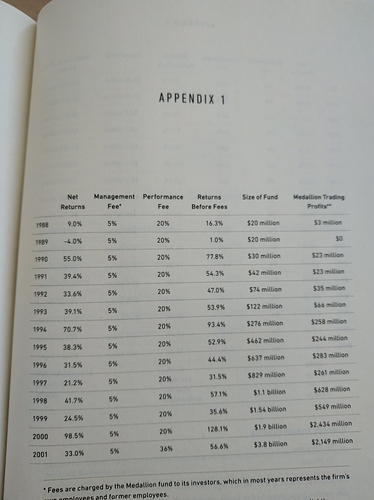

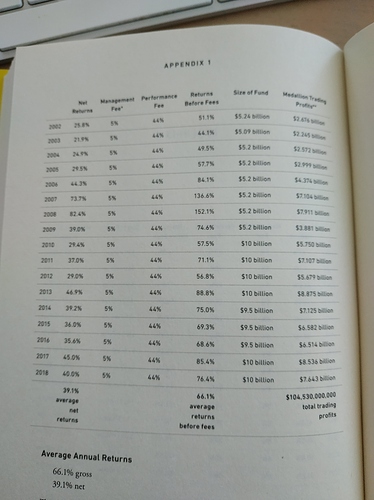

Find the gross (before fees) and net (after fees) performance of the fund in the table below.

They let the fund compound until a point where they choose to not let it grow anymore and just return the gains to shareholders ever year. So for instance if you have invested one million USD in the Medallion Fund, you would receive on average every year 390’000 USD after fees.

They limited the size of the fund because past a certain size, the fund would be too big to exploit the market inefficiencies they are specialized in.

Funny anecdote: at the beginning, the outrageous 5% management fees were not due to greed. They were just there to cover the costs of all the computer equipment needed to run the fund strategies. Of course this has changed afterward.