There will always be times where a factor underperforms, be it market, size or value.

Risk can’t just be described by StDv. There are other risk factors. That’s why value, size, momentum, low volatility etc. factors exist. CAPM explains 60% of the difference in portfolios. Add size and value and you get to 90%.

That’s why Warren Buffet “outperformed” the SP500.

If you don’t know anything about factors, there is really no point discussing with you. Not going to waste any more time in this thread. Maybe I should just stick with Bogleheads.

But explain me this: wikipedia says they have delivered a net annualized return of 39% from 1988 to 2018. So 1’000’000 invested in 1988:

1’000’000 * 140% ^ 30 = 24’200’000’000 (24 billion)

The compounding seems a little too steep. Run this for a few more years and you will exceed the market cap of the whole stock exchange market ![]()

The chances of making 66% gross return in a year are maybe 10% (probably much lower, but let’s be generous). And let’s span that over 30 years. If they were really just lucky, then they would have a 1 in 10 ^ 30 chance of achieving this.

I really doubt rentech & co invest based on factors. They are into high frequency trading AFAIK, that’s a whole different world where they study stuff like market microstructure.

Yep, that’s why it’s afaik an employee only fund, they probably return capital every year to avoid becoming too large, still very impressive…

Sometimes it’s not even enough being an employee. DE Shaw is another famous one, they don’t let low level employees to invest in themselves AFAIK.

As has already been said on the thread, active stock picking takes a lot of time and specific knowledge.

If you start picking stocks, make sure you have the following in mind:

- owning a stock is a shared ownership in a business (classic, but worth repeating)

- as such, you’d better have a good idea of where this business is going and what is a reasonable price to pay for it?

Your returns will be determined by the following (assuming the number of shares stays constant, make necessary adjustments otherwise):

- Returns = Price (Sell) / Price (Buy)

where Sell and Buy are the moment where you sell and buy your stock.

This is obvious as well, but let’s start from here:

Price = P/E * Earnings

and of course Earnings are equal to revenues times margins

So Returns = (P/E (Sell) * Revenues(Sell) * Margins (Sell) ) / (P/E(Buy) * Revenues(Buy)* Margins(Buy))

Rearranging everything, you get :

Returns = P/E expansion * Revenues Growth * Margin Growth

where :

- P/E expansion = P/E(Sell) / P/E (Buy) => You know the P/E(buy) it is your entry P/E. For P/E(sell), take something conservative. 15 for most stocks, 5-8 for bad businesses.

- Revenues Growth = Revenues (Sell) / Revenues (Buy)

- Margin Growth = Margins (Sell)/Margins (Buy)

In other terms, if you have no clear idea of what the revenues and margins are going to be in 3-5 years, and what is the likely capital needed to reach those revenues, you are going to have a hard time investing successfully. More important, you need to know the reasons why these numbers are going to be this way.

But someone with a good background in accounting and general knowledge can, with a lot of time, find some interesting companies.

If that’s what you want, good.

If this is not what you want, but you still want to go active, I would advise to go with an outstanding manager having a track record of 15+ years like Terry Smith from Fundsmith. 18% annualized since inception of the fund in 2010, and Smith had very good returns beforehand in other structures as well. Plus they are based in the UK which should be practical for you.

If someone can do it, i’d put a piece on Smith (disclaimer: I have some money invested with them).

And if you do not want an active fund, well, there is nothing wrong with indexing.

Again, nothing wrong with indexing (far from it). But get your arguments right. No active manager cares about beating the market every single year. But they care a lot to beat the market over 10 years. This is often done by not losing money in a bear market, or making a lot of money during high times.

Among the sur-performers, many underperform 30-40% of the time, and still beat the market by a large margin (see for instance the various performance tables of this classic article.

It is like the Tour de France bicycle race, you don’t expect the winner to win every stage of the race. There has even been some years where the winner of the race did not win any stage, but still was the most consistent racer.

And finally, assuming 50% chance of outperformance is assuming that the returns are only due to luck, which is self-defeating from the beginning. I concede that if there is no skill at all, you’d better not pick stocks. Or at least call it gambling. But if there is some skill (which depends on OP), then the calculation does not hold.

One has to check if that 39% is a compound annual return. I wouldn’t be surprised if it wasn’t.

It only makes sense to provide an annualised rate. Otherwise it’s just weird. Wikipedia says it’s annualised, but who knows, maybe they got it wrong.

If they return capital every year, as suggested by @nabalzbhf, then I wonder what it even means to deliver a 39% annualized return.

Come back after shopping and 25 replies!

IB does have lower costs for US shares, as much as didn’t want that to sway me, confess it did. Right, fees are minimal Vs amounts invested, so ideally should have minimal weight in investment decisions

Time is a factor. Could use to earn more day job, but day job not as interesting. Enjoy research and finding out what makes companies successful. Wouldn’t need individual company research for tracker ETF, knowing me, probably do it anyway out of interest!

Tracker ETFs are 75% of entire portfolio, 25% individual stocks was a little play at trying to make better return than trackers

Basically could make more money using time elsewhere, but enjoy research. Returns similar to trackers, so not losing anything but time and constantly refining and improving. Get buzz when find discounted stock with more value than price. Maybe just keep as hobby

I don’t think they return capital, they probably pay out huge dividends and do not accumulate. And if they do not allow reinvesting the dividends, then you cannot take advantage of compounding. Maybe they let employees of a certain level to invest up to e.g. 1’000’000 and you get a few hundred thousand return every year, but have to put this money elsewhere. (just guessing here, I have no idea)

That’s what I meant by return capital (isn’t it what dividends are?).

Speaking of passive vs active we had a thread about this:

Return of capital differs from dividends

- Return of capital (ROC) is a payment, or return, received from an investment that is not considered a taxable event and is not taxed as income.

- Return of capital occurs when an investor receives a portion of his or her original investment, and these payments are not considered income or capital gains from the investment.

Nice of you to bring up this valuable quote. I guess in a situation, where more and more people switch to indexing, the last hope of large scale smart investors to milk the dumb investors would be the pump and dump scheme. That is, inflating the market, luring investors in, then causing a crash, hoping for indexers to lose their nerves and sell, so that they can buy cheap. Then repeat the cycle.

The easiest way to cause such a crash, that I can imagine, would be to raise the interest rates. But I guess as long as the governments have to pay interest on their debt, they will do what they can to prevent it.

…or start a war ![]()

Regarding Renaissance Technologies and the Medallion Fund, there was a book by Gregory Zuckerman: The Man who Solved the Market. It tells the story of Jim Simmons and how they set up their fund and their arbitrage philosophy (although no detail is given on the actual strategies used).

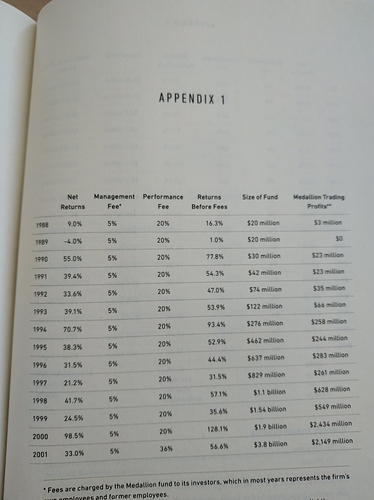

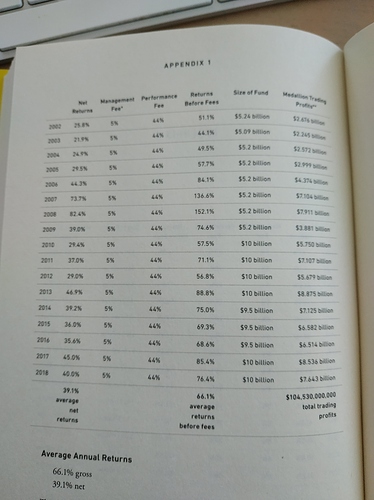

Find the gross (before fees) and net (after fees) performance of the fund in the table below.

They let the fund compound until a point where they choose to not let it grow anymore and just return the gains to shareholders ever year. So for instance if you have invested one million USD in the Medallion Fund, you would receive on average every year 390’000 USD after fees.

They limited the size of the fund because past a certain size, the fund would be too big to exploit the market inefficiencies they are specialized in.

Funny anecdote: at the beginning, the outrageous 5% management fees were not due to greed. They were just there to cover the costs of all the computer equipment needed to run the fund strategies. Of course this has changed afterward.

Mind blowing stuff. Ok, they’re not infinitely scalable, but they manage to keep an edge over the market for over 30 years. Todays smart watches are more powerful than high end PCs back then. There is the internet, deep learning. Still, they are able to make 80% return in one year. Crazy!