A friend of mine, also with a hard sciences background once told me that there is statistics, there is black magic and there is financial mathematics. I can handle statistics, and with this post I would like to use community’s help to improve my understanding of financial mathematics. I hope it will be also useful for others.

Do not consider presented data to be an investment advice or financial analysis. This is merely an example to understand how mathematical/statistical terms/concepts translate to financial terms/concepts.

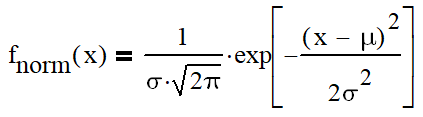

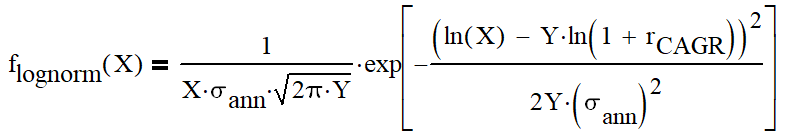

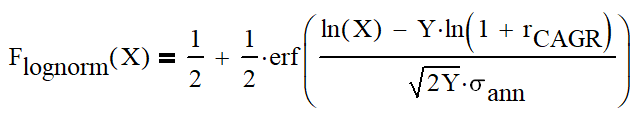

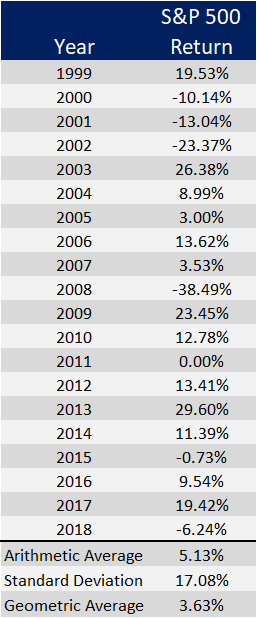

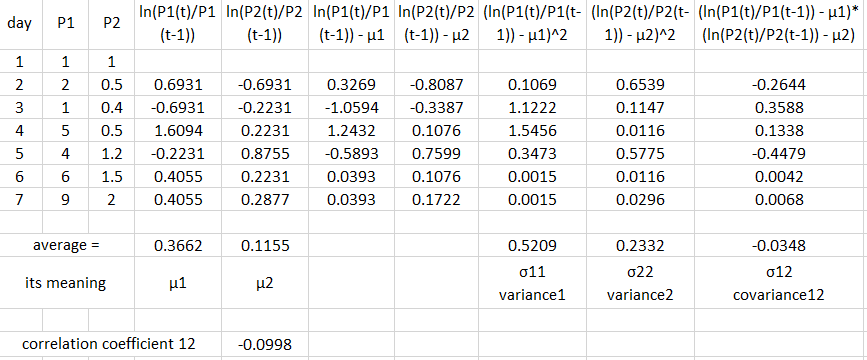

So, as an interest on investment is continuously compounded, the expected return on an investment follows a log-normal distribution (see e.g. assumptions of Black-Scholes model). Fine as a starting point, but let’s now what does it mean practically? As an example I took closing values of SPI TR index, which compounds dividends and was easy to find. So I have value data (P) for 8362 trading days starting 1988.

For all data points data I calculated decimal logarithm of “relative return” over last N days: lg(P(t)/P(t-N)). I used 1 day and 5, 10, 21, 42, 63, 126 and 252 days to approximate for 1 week, 2 weeks, 1/2/3/6 month and 1 year. To my surprise, histograms of all data sets were showing a pretty good Gaussian shape, except for 252 days (which I included anyway, see further). This is a black magic to me, as I see no objective reason why it would be the case.

I suspect that 1 year “rolling” return data were not independent enough, so I probably should look at discrete intervals if I want to have a histogram with a better shape.

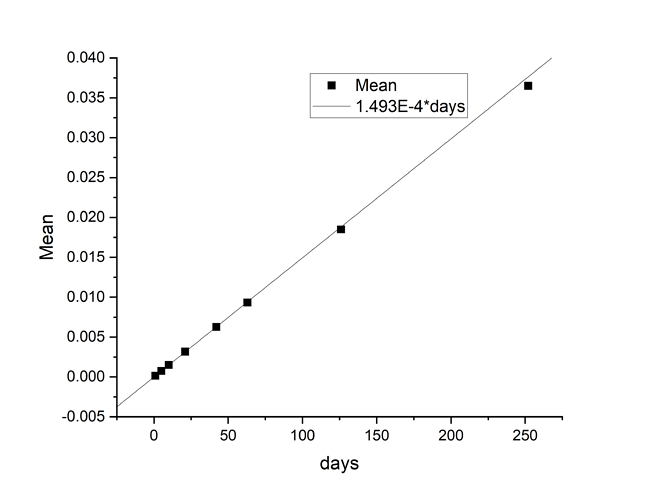

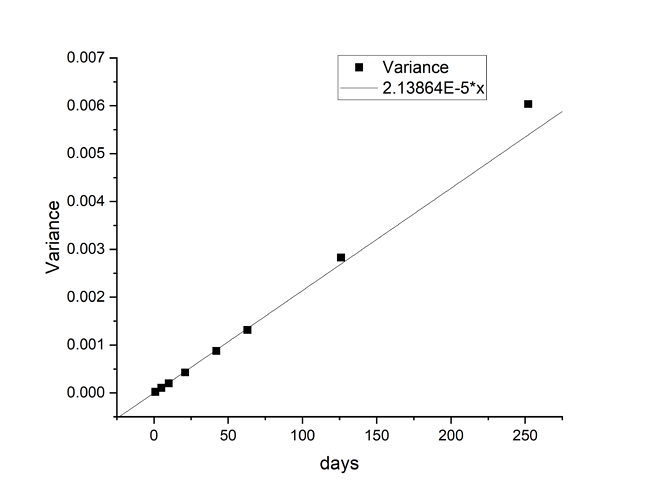

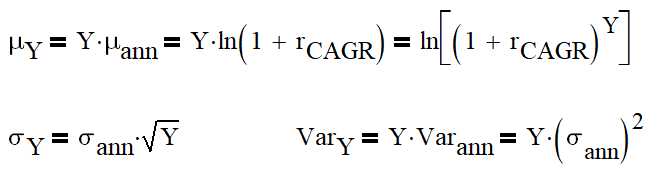

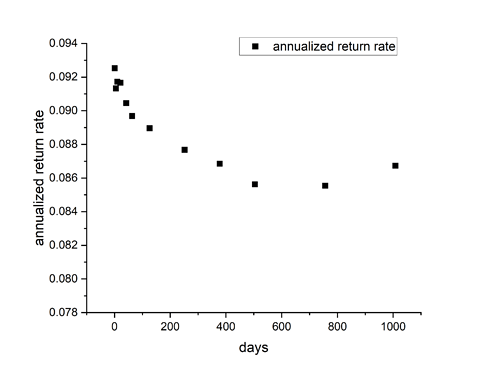

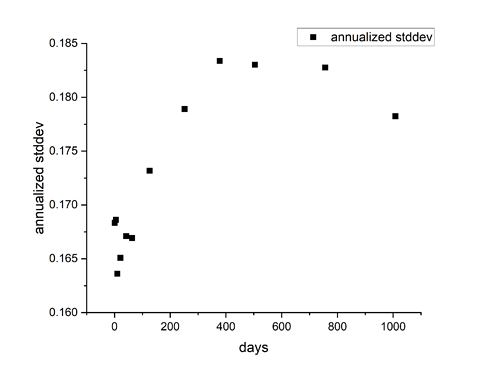

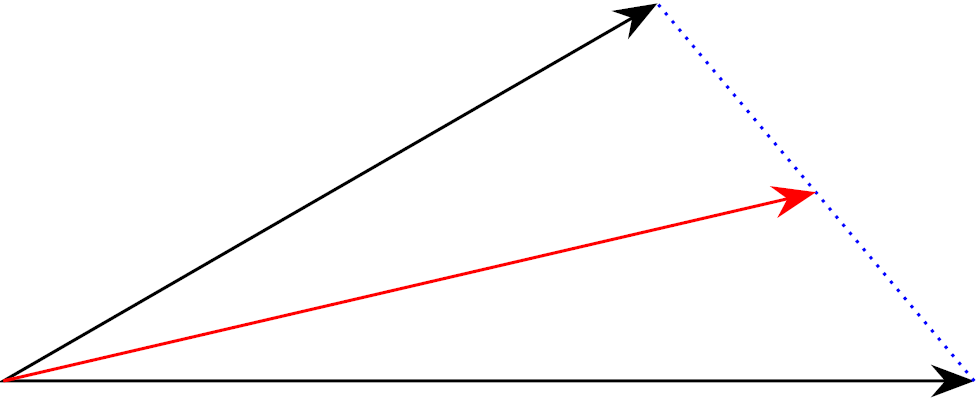

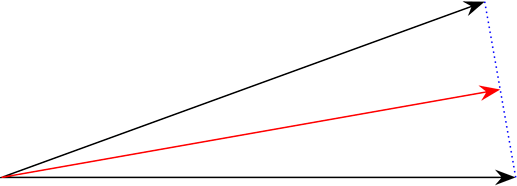

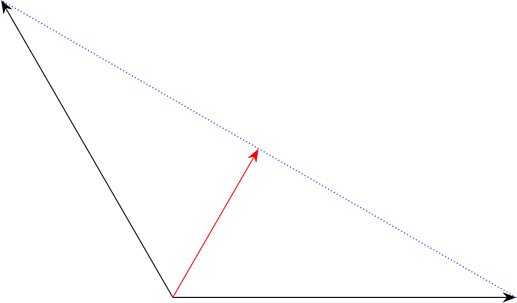

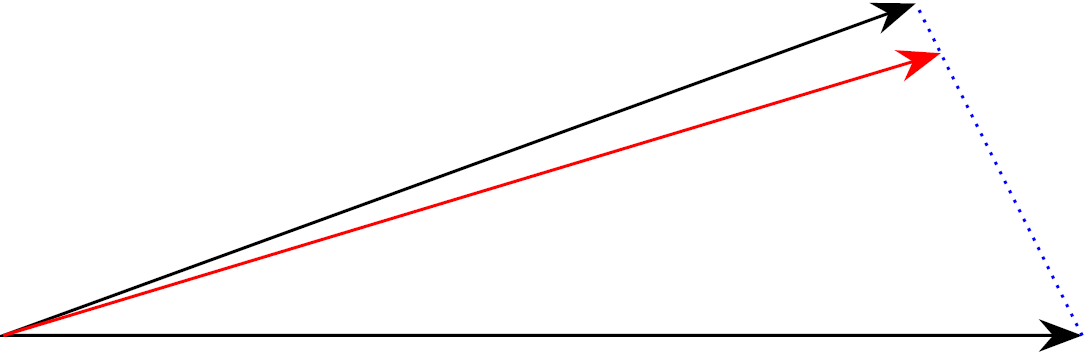

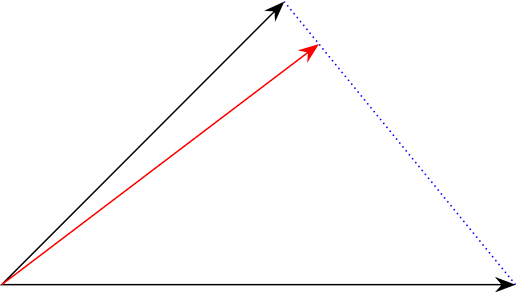

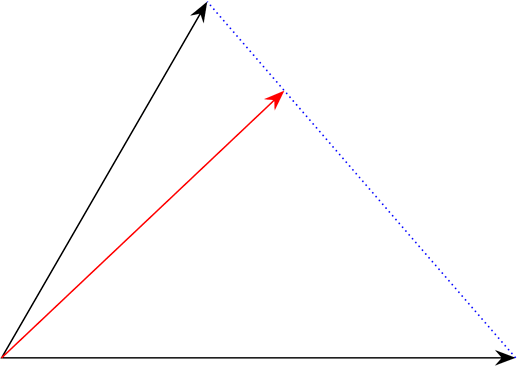

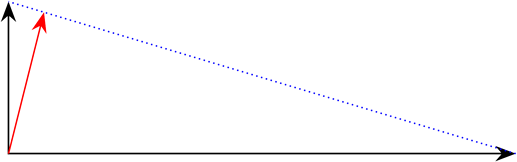

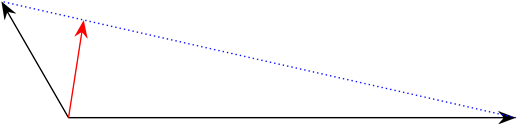

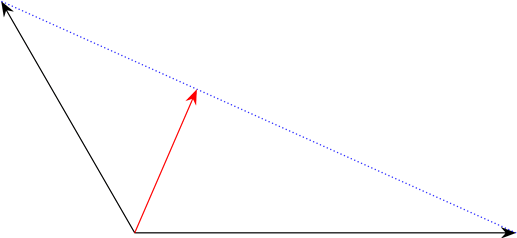

So, the mean value and variance of all data sets were showing a pretty good proportionality to the number of days. I calculated an average value of the proportionality coefficient (value/days). Here are values together with the proportionality curve.

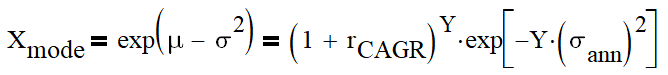

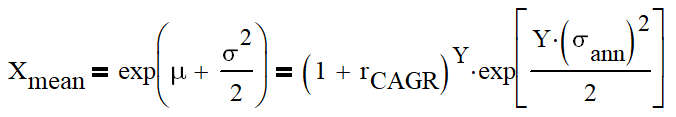

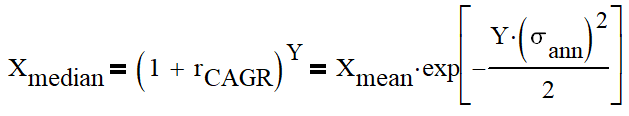

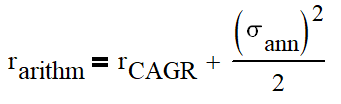

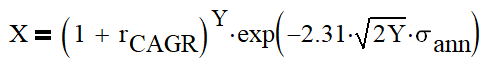

So, if we now recalculate mean and variance of the distribution to 1 year, we obtain the following:

1 year mean of log return: 0.037625868

1 year mean “relative” return: 10^0.037625868 = 1.0905

1 year return = compound annual growth rate (CAGR): 9.05%

1 year variance: 0.0053893728

1 year standard deviation: 0.073412

1 year “relative” standard deviation: 10^0.073412 = 1.184

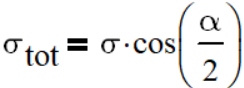

It means that there is a 34% probability that a yearly return will not be lower than 18.4% of mean and a 34% probability that a yearly return will not be higher than 18.4% of mean.

So my question now is: is this 18.4% what is called an (annualized) volatility of the asset? I read a lot about volatility, but was not able to find a more precise definition than “volatility is the standard deviation (of something)”.

Are there any other mistakes so far?

Many thanks for reading and commenting,

Dr. PI