also the exchange would not offer any stables if it was not profitable for them.

BUSD/USDT is at 1.013 at Binance. Fortunately this time I am net short on USDT.

Well if ETH has the same fate than LUNA/UST, then it will definitely the end of cryptos alltogether…

But this can only happen if there are problem with the merge this summer. I did not heard that there would be serious problems about that and I trust the ETH community to not go forward with the merge if there are too much uncertainties and rather postpone it instead

well, well… ![]()

we will see.

Crypto staking of non PoS coins seems to be largely a ponzi scheme, somehow supported by lending out the crypto assets (at lower interest rate than you are paying out to your staking customers) making it a weird P2P platform using crypto to somehow be revolutionary.

We all know what happened to a bunch of P2P platforms in 2020. I will this crypto staking app will go down 1 by 1

I might as well just post i here since it does not make sense to open a new topic:

Is ETH2 fucked since its not liquid and cant be sold?

I have wondered about the effect of ETH/ETH2 and the lockup/Staking rewards.

The discount on the pair seems logical since you take over some risk if you stake or lock up your ETH in ETH2. In case the merge never comes/has troubles, also you can’t really move the coins anymore.

The discount should get bigger over time, since 1 ETH = 1ETH2 but you earn on ETH2. So over 1 Year 1 ETH = 1.05 ETH2 since it basically has a built in inflation that can’t organically leave the market?

The discount should get bigger over time, am i wrong?

This also could get inflated over downturns when lots of liquidity gets drained.

I think, this will change with the official merge… as far I understood, this will lead eth:eth2 to 1:1. But I’m not an Ethereum pro…

yeah but honestly the merge is at least 1 year away, meanwhile you have 1 coin with inflation and the other with basically deflation (gas fees & Burn).

for me not an issue as a long term holder… I honestly see the prices right now as a candy shop to add (BTC and ETH) as I did the last several months ![]() (I’m adding more as I initially intended…)

(I’m adding more as I initially intended…)

i will swap some eth to eth2 once the ratio drops more for an easy 10% gain.

I also got quite some good returns from my ETH/BTC trade.

I sold a bunch on the way up and i will buy back (more) once we are sub 1k.

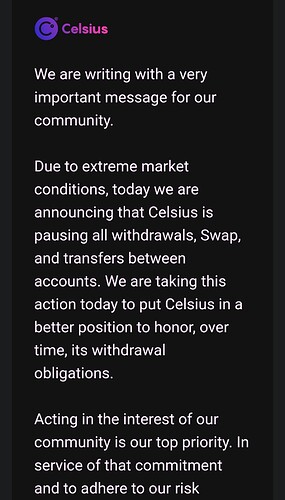

You really need to have faith in Eth to buy any at the moment, even more to stack any of these shitcoins… Contagion will not stop at Celsius, which means I really don’t see the transition to eth2 happening anytime soon

transition to eth2 is already happening… on the test networks quite successfully. It’s not dependent on the price.

I DCA… I don’t see the bottom yet, but I will not make the same mistakes I did 2013/18 and being mostly out of the market (and yes most of my funds go to BTC).

btw… ETH is a quality shitcoin! ![]()

i mean,. if you hold ETH anyway its a no brainer to just convert some of it to eth to farm the rewards and to get an instant reward (atm the ETH to ETH2 ratio is 0.92 on Kucoin) so you get about 8% more ETH on that trade.

But the ratio could drop even further…

Indirectly, if they change now and lots of people un stack it will immediately compromise the security of the network. At least in theory.

Just in case anyone missed this interview:

lovely. So they were all lending to each other.

Just a bunch of black boxes where you put money and get interest, taking that money to other black boxes where you put money and get interest.