So you stake DFI on cakedefi?

Will have a look at it.

Apparently… (and unfortunately…![]() ) I didn’t trust the cakedefi a lot (at the time I was checking the last time there were some strange news about their CEO or something…)

) I didn’t trust the cakedefi a lot (at the time I was checking the last time there were some strange news about their CEO or something…)

I have open positions in so many places that honestly speaking I am thinking only to eliminate few of them and not to open more ![]()

![]()

Btw I have also cake in pancakeswap - very good returns just pancakeswap has lost a lot of value in the last year….

Other interesting tokens maybe to look at earnings by staking could be the nexo token, celsius token and KuCoin token…. (You are upgrading your earnings as well by earning in those tokens)

by the way does anyone know if we can unlock our sign-up bonus reward in Crypto.com?

to unlock it you need to buy and stake at least 350 EUR worth of CRO, and order your VISA debit card. (Ruby steel)

However, normally Switzerland is not eligible for staking (and generally for earning products) in Crypto.com so I am just wondering if I will just buy 350 EUR worth of CRO for nothing and my sign-up bonus will not get unlocked…

Crypto.com Earn is not available. Staking for visa card is available and works in switzerland, but you will get staking rewards only after the 3.5k tier. 350 tier is enough to unlock the sign up bonus though.

Thanks for your reply.

Just a follow-up question on that.

I unlocked the sign up bonus successfully and I transferred it also to Crypto Defi for adding it up to my earnings. (Only the sign-up bonus not the 350 staked). Although I can see the amount of CRO coins in Crypto Defi - I cannot add them to my earnings pool (when I am trying there my balance of CRO shows empty)

Also are you actively using the 2% cashback visa card in Switzerland? Is it worth it?

This should help: All About Staking CRO on DeFi Earn | Crypto.com Help Center

I think so, yes. I use it mostly for online purchases, but it works in the store.

I finally found out after …a little bit of searching in CRO the reason why I couldn’t use my unlocked reward bonus for anything… it was a reward since a long time ago (about 180 CRO) which were still in the old ERC20 token format…

I had to convert them to CRONOS format via Crypto Defi / Cronos bridge… and then it worked fine… just if anyone has the same question…

I’ve recently found https://www.stakingrewards.com/ which seemingly has a good overview of different stakable tokens and their rewards. Might help when you DYOR.

Thanks a lot for this site. There is another site with all the staking yields listed and compared but I do not remember the name and also google could not help me yet with my losing memories, I guess I’m getting old. I’m researching quite some time now on Midas.Investments beside Anchor protocol. Even if I haver not founds something fishy about these I do not feel comfortable to change my USDC to them even if the yield in my current staking location (ASC) is really down from what is was.

22 posts were split to a new topic: Crash of LUNA and UST

every exchange is in on tether, cause it helps them pumping out leverage in gets them lots of fees.

I also think the are “sponsored” with tether or in any other form…

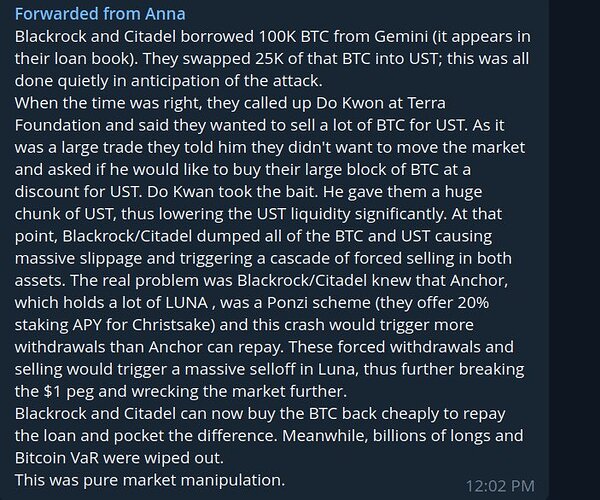

Giving you the thumbs up for the information, not for the fact itself. I’m not surprised that Blackrock was involved in such an activity. The money is still there - it’s just owned by someone else (Blackrock + Citadel) now ![]()

I dont believe this.

USDT is much, much more likely to have done it themselves.

Do you have more sources? I found the same info @SwissTeslaBull shared, on reddit, Twitter and 4chan

Maybe a quite naive question from my side…![]()

![]()

![]()

Generally, who is still selling at 80%-90% loss and further?? and why??

I mean in a situation that you are 90% down better to keep your position and forget it for ever (even if you risk to finally lose the last 10% completely) rather than realise 90% loss directly now…

Also how is possible in this crashing situation few meme tokens to keep better than ada, matic, avax, dot etc?

If you were a robot or an algorithm, you would see the situation as you should : You risk to lose 100% of what is left. Paradoxally, the panicking people see it the same way

there are still people in profit, short opening, shorts closing, margin loans that have to be repaid and gamblers…

Stablecoins should be regulated by Central Bank in my point of view, instead of being controled by Crypto Exchanges (Coinbase - USDC, Binance - BUSD, etc.). At least, we could avoid something like the TerraUST…

This is what could happens with MiCA in Europe.