RSSB, RSST, NTFX, GDE…for every $ you invest, you get additional exposure (leverage) to gold, bonds, futures…Do you use them? What’s your opinion? How is the tax treatment here in Switzerland for us? Is Wisdomtree (NTFX, NTFI, GDE, etc) better for us than RSSB or RSST?

This is still to be seen how exactly. But the leverage is done via futures, so mostly longterm capital gains, if there are distributions. For MF some will be short term cap gains and normal interest/dividend distributions, which are taxable.

I have a significant portion of my investments in RSSB and RSBT. I think they are really good funds.

I will sell a big part of them before year end though, just before ex-date and then see how it will be taxed for this year. Dont want to gamble on the tax treatment too much.

Also on the Wisdomtree funds vs. RSSB:

RSSB is 90% VTI + VXUS (they literally use the Vanguard funds) + 10% cash, then they get a 10% extra exposure on US through S&P futures and a 100% exposure on bonds through futures.

So 100/100. this is like a 50/50 portfolio levered 200%. Wisdomtreee splits their regional allocations and then have 90% equities (but large cap only), 10% cash and 60% bond futures. So effectively a 60/40 portfolio levered 150%.

This in and of itself is already a relatively big difference.

RSSB should have more expected return, just due to the leverage alone.

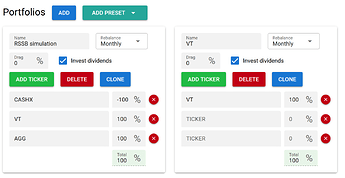

You can simulate these funds in portfoliovisualizer with something like AGG and a minus cashx position.

Thanks. I am very interested in these stacked products. The only question remaining is taxes in Switzerland for me. I hope new listings appear and their AUM grows to acceptable levels.

I think aum is fine already. They are growing quite fast. Also we in Switzerland don’t have big problems with funds closing down. As we don’t have capital gains tax on selling.

While I am warming up to the idea of return staked funds, would it not be more tax efficient to buy the underlying funds separately(using margin loan on IB)? Given that we can deduct the margin loan interest from taxable income here in Switzerland?

I would also like to have a different stock basis, especially for RSST. I am not a fan of the S&P 500 ETF. But how would you replicate RSST (Stock and Futures, 100/100) and RSSB (Stock and Bonds 100/100) without much effort and risk (margin calls)? How much can one save?

I would be interested in a 110% stock ETF but I could not find any. Personally do not fully understand why an ETF would be leveraged into stocks + bonds - implicitly taking a loan (through leverage) to invest into a loan (ie a bond). Exaggerating a bit but that seems like taking credit card debt to purchase Govt bonds. Probably the idea is to invest into longer-term bonds with a short-term loan (ie a term-spread gamble) + diversification through exposure to longer term interest rates (negative correlation with equities). The same applies to stocks + gold. I’d prefer taking margin to invest into high-yield assets…

Depends a bit on the fund and how big it is in your portfolio.

For example for RSSB you would need to roll your own futures (5 different futures contracts) for the same implementation. Futures are also tax efficient for us.

If it’s 10% you could of course add to 10% of VT 10% of margin and buy some AGG with it. That’s more tax inefficient though.

Also managing your margin is not so easy and straight forward. It’s also quite something to actually borrow money and having a big minus cash position in your account. Especially during bear markets.

For the other funds, you can’t buy their managed futures strategy separately. They target pretty high volatility and trade lots of markets, not that common in the etf space.

But technically if you were able to you could buy VOO and then stack 10% Managed Futures with margin on top. That is a little more efficient depending onyour marginal tax rate. Say at 25% you have an efffective borrowing interest of 5.1%, while they will be around 5.5% or something.

But yes for managed futures you could simply take your favourite MF fund and borow XX% and stack it on top. Effectively similar and more cost efficient, all-else-equal.

For me personally they allow even more leverage than I would be comfortable on taking with margin.

I use 10% RSSB and 15% RSBT. But also at the same time I have 25% margin. This gives me effective leverage of 150%, while only borrowing 25%. Even those 25% seeing as a minus cash position is already something you need to be able to handle. And have a plan, when they turn to 50% during a stock market crash.

The funds are just very capital effcientand help you take on lots of leverage easily and effectively.

For example 100% RSSB you could already not replicate in CH, as you would surely be classified as a professional trader taking on 100% margin. And 1:1 replicatiung it with rolling your own huge futures contracts, would require very high capital and also probabaly classify you as professional trader.

The embedded borrowing cost in futures contracts is very close to the risk free rate and therefore very cheap. Currently due to the inverted yield curve, the yield of the bond is of course lower then the borrowing cost. But this will change in the medium term. But yes the idea is the negative correlation and taking on term risk (duration). They have an effective medium term duration overall.

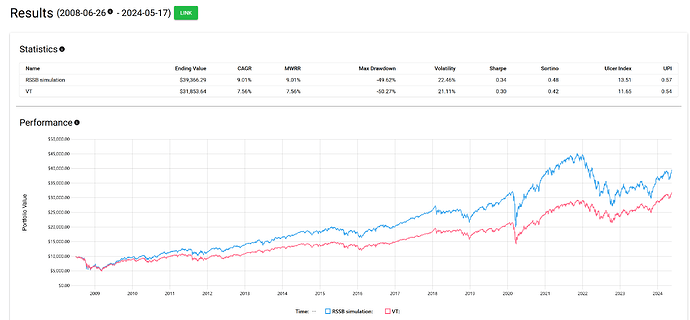

I simulated 100% RSSB and compared it to VT here. For RSSB you need to substract about 0.4% on the CAGR to account for the cost of the fund.

Done on https://testfol.io/ (fuck the portfoliovisualizer update btw)

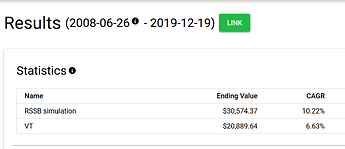

So we get about 1% more return with similar risk.

and stopping just before the covid madness and big bond drawdown etc:

Should not be taken as given, just to illustrate.

I would expect this fund to have somewhere between 1-2% more return than VT over the longterm.

Thanks for your explanation and your comment about the inverted yield curve. I am convinced it’s a good product, there are nice development with stacked products (also the Wisdomtree Effcient Core series (NTFX, GDE, etc.)). Taxes is the big question for me, especially RSST…

Thanks for the nice analysis! 2008-2022 was an exceptional period for bonds however with yields just going down further and further to levels no one imagined and bond markets skyrocketing. Not sure I would consider this period sufficient to base investment decisions on. I would be very curious to see such a comparison for 1950-1980 when treasuries lost around 60% overall on an inflation-adjusted basis…

Yea that is of course true, one just have to look a the 30 year bond yield from the 80s to 2022, where it went continuously down. 2022-2023 however was insanely bad. We are now again at a relatively high starting point. I would therefore expect moderate returns going forward. I think 1-2% excess return over VT is pretty realistic. I mean even +1% cagr at similar volatility is really really good.

Maybe I am just biased. I worked in equity products financial engineering for a few year, already many years ago. The basic “idea” was always the same: you take a good argument (efficient portfolio, sector play, whatever) build a strategy around it, underpin it by a suitable backtest and then sell it to clients with a little extra charge. It would have worked had the product existed back then. But no one knows whether it will work in the future also… The bank does not care, it still wins anyway. It was always the same.

The market is already pricing in a decrease in rates. What if rates stay at the level they are now for longer (super high US debt, coupled with inflation not fully coming back) or even increase further mid-term, maybe even substantially if US debt gets further out of control? What if the yield curve stays inverted for longer, together with the higher TER creating negative carry for the leverage? Not sure I would feel comfortable with the ETF in these scenarios…

I mean sure. But that‘s only a short/medium term concern. We should all be in it for the long game.

Your excess return comes from leverage in this case. 50/50 stocks/bonds levered 2x. Why should this stop working?

Well, according to the prospectus, the fund currently holds 90% equities in the cash market + 10% cash or cash equivalents to fund margin calls. Additionally, 10% notional exposure in us stocks, 100% notional exposure in bonds, both through futures. Consider a scenario where both stocks and bonds lose in value, say both by 10% (which is a very mild scenario). In this case, the fund loses 20%, 11% through futures, 9% through cash equities.

In my understanding, in this scenario, the fund needs to liquidate “something” as the cash (10%) is not sufficient to cover margin calls (11%). Either it closes some of it futures to reduce exposure or it sells equities to have more cash for margin calls. Either way, it cannot sustain 100% leverage in that scenario, and needs to sell at bottom prices. Also, the manager needs to make a decision what to sell (-> active management risk). 100% leverage with only 10% cash in my mind seems pretty crazy.

They have provided a backtest of 100/100 in their sales presentation available on the website, where 100/100 nicely beats 100 stocks. However, I am quite sure that for the backtest they have assumed that they can sustain that leverage through all time. Practically, I very much doubt it.

Also, the prospectus speaks about a maximum TER of 1% (the 0.56% from the fact sheet does not seem to be the TER), which seems pretty pricey and is not reflected in the backtest either.

Conveniently for them, they also started their backtest at the peak of the dotcom bubble… (poor stocks performance, excellent bond performance in the decades to come).

I have not studied the fund very closely but already from that superficial analysis, I would see too many red flags (sustainability of 100% leverage, active management risks, high TER, conveniently chosen backtesting period). Just my personal view obviously…

I feel such funds are giving an illusion.

Investors who don’t want to buy investments by taking loan or margin end up buying funds who are using a leverage in another way.

In bull markets - this looks very good

In bear markets - this looks very bad

But investors need to be clear that they don’t only own assets, they own liabilities too. As long as it is clear , it is fine. Some of these funds might end up illiquid in bad market conditions. They might not be able to leverage and then how are they going to achieve their mandate? Similar to a private investor if they get a margin call.

I always thought such things are good for short term trading but for long term investments , are they really good idea ?

And that‘s where your assumption is incorrect.

They will always maintain the 100/100 exposure. Yes of course if stocks/bonds drop enough, they need to sell some to maintain their postion. But they will always keep the 100/100 exposure, the overall value will just drop. Just like with any kind of leveraged fund essentially.

It‘s basically a very similar backtest then what I did here in this thread. If you have a -CASHX position, you rebalance (sell and buy) into and out of that minus position.

Also 100/100 will beat 100% stocks in most market environments, I don‘t think this should be such a mystery. I think you are also forgetting that bonds normally have very low volatility. What happened 2022 only happened once at another time in the 70s.

On the backtest, what do you want them to do? Of course funds will show nice backtests. That‘s what ANY fund does. They are also transparent on how they do it. Do any backtest period from the last 40 years and 100/100 beats 100% stocks basically any time, except some brief periods in 2022. Modeling in accurately before that is difficult due to data constraints.

The 0.56% is the TER, not sure why you think they can just lie about it in the fact sheet. Due to the nature of the product they need to have some flexibility here and speak about a max, doesn‘t mean it will use that. That‘s also completely normal.

E:

EE: backtests were wrong, did add the expenses ratio not substract it. Will add some correct ones later. Most backtesting I did showed >1% benefit with less volatility.

You an backtest any timeframe over the last 35 years yourself.

And again I never said to take backtests at face value and yes we had a bond bull market over the last 40 years. This does not mean the fund (or rolling bond futures yourself or borrowing yourself to do a similar strategy) does not have expected excess return.

Why should it be bad in a bear?

It will look like 50/50 stocks bonds levered 2x in a bear.

Not much worse than 100 stocks in a bear.

Except of course stagflation situations like 2022, will look much worse, but 50/50 also looked terrible in 2022. This is expected.

This is not a daily leveraged 200% stocks fund such as SSO or 300% such as Upro.

Completely different product.

100% of your portfolio would of course be stretching it, but a fund like this. Or NTSX/I/E are really capital efficient ways to introduce some amount of relatively safe leverage. It‘s leverage that comes from bonds not stocks, which are mostly uncorrelated in the short term and have low volatility.

These funds are nothing like other crazy leveraged funds and also no one is promising crazy excess returns or anything.

Also review on the fund here: https://www.optimizedportfolio.com/rssb/

That’s what I mean 2X positive returns and 2x negative returns. Imagine if someone has a portfolio drop of 40% vs 20%.

And another issue is that when such drops happen, the fund might get stressed for liquidity if investors start pulling money out. Because that would also cause issues in borrowing.

I am not saying it’s a scam. But it is certainly a asset + liability play and not just an asset play

Thanks for sharing. Will look into it. I am just a bit wary of leverage. I try to use money I have ![]()