It should be clear from the posts above that, when building a globally diversified stocks portfolio using 3a and taxable accounts, it is advantageous to hold US stocks as US ETFs at Interactive Brokers and Developed Markets ex US as CSIF funds in 3a account (finpension). The question now is: how advantageous it is and if it is worth extra efforts? I will use parameters which are pessimistic for 3a investment (marked red), so an actual advantage should be higher.

Note that I refer to MSCI classification and indices and I won’t talk about MSCI Emerging Markets. MSCI EM is a nicely segregated geographic segment of the global stocks market (10-11%) and, based on a comparison presented above, I decided to invest in this geographic segment via an Irish MSCI Emerging Markets IMI ETF.

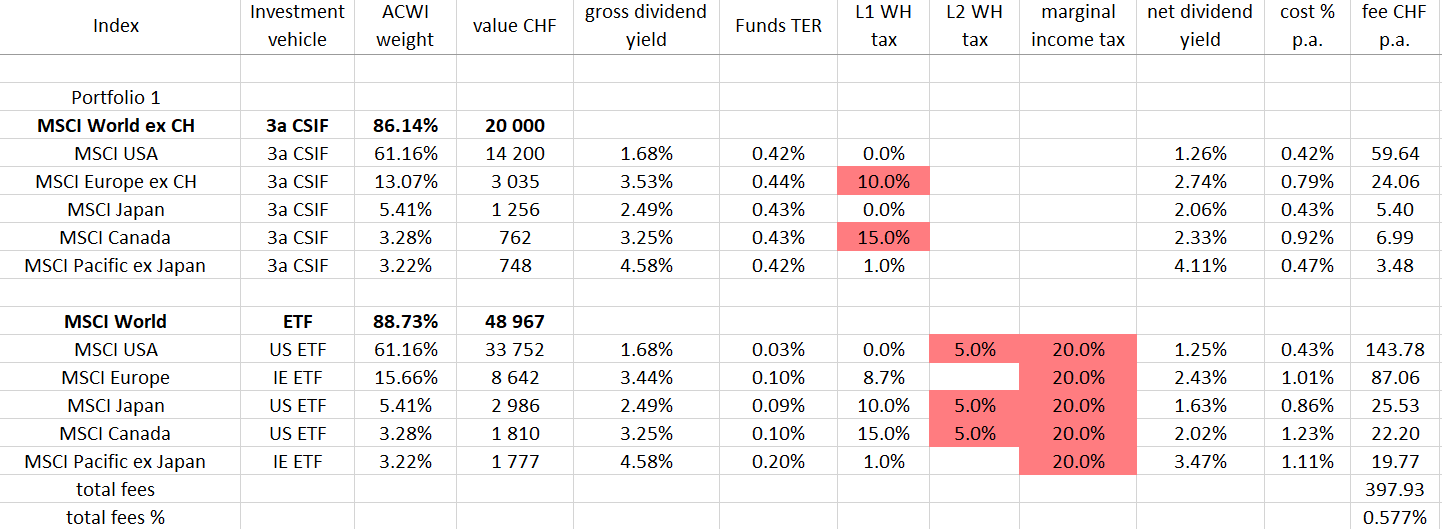

So, let’s consider a simple portfolio 1: an MSCI World ETF in a taxable account (48967 CHF) and CSIF MSCI World ex CH Index Fund in 3a account (20000 CHF). To make comparison easier, let’s assume that both of them are equivalent to the following combination of ETFs or index funds:

Note that our “synthetic” MSCI World ETF has TER of 0.055% p.a. and a preferable treatment of withholding taxes for each geographic segment. For CSIF funds I assumed L1 withholding taxes equal to that of CH based fund in a taxable account, unless it is known that they have a preferential treatment. This is what I mean with “parameters which are pessimistic for 3a investment”.

The total investment cost for the portfolio 1 is 397.93 CHF p.a.

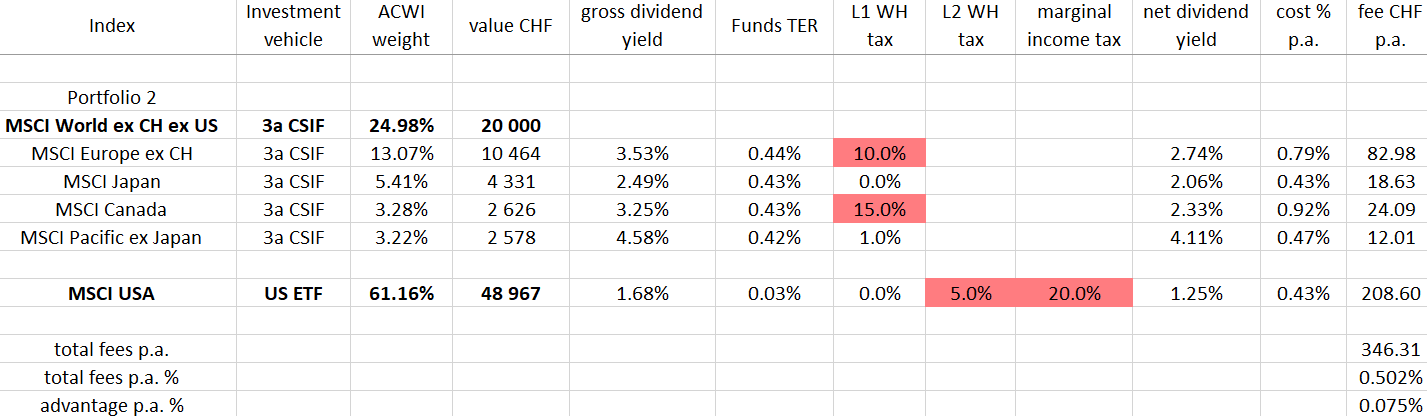

Now we consider an “advanced” portfolio 2. It is correctly weighted geographically, and both taxable and 3a account have exactly the same value. However now the taxable account holds only a US ETF on US stocks, all other geographic segment are held in 3a account as CSIF index funds. The 3a account is therefore a synthetic “MSCI World ex CH ex US” fund.

The total investment cost for the portfolio 2 is 346.31 CHF p.a. The advantage of the portfolio 2 is 51.62 CHF p.a., 0.075% p.a. with respect to the total value of both portfolios or 0.258% with respect to the value of the 3a account.

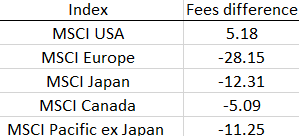

And this is how much we save (negative numbers) per geographic segment with portfolio 2:

Now the question is: is it worth to create a synthetic MSCI World ex CH ex US fund in a 3a account using CSIF index funds? For me it is clearly worth. Even this conservative estimation shows an advantage of such approach. Real savings should be higher.

But there is another important non-financial consideration. Namely that holding ex US stocks as a US ETF means that one pays US taxes that US is not entitled to receive: withholding taxes on dividends distributed by companies domiciled outside of US. We are always considering that we are getting reimbursed, at least partially, withholding taxes paid to US, but this is not exactly what happens. US does not reimburse our withholding taxes, instead we are paying less taxes to Switzerland. So we are giving money to US and taking it from Switzerland. As a good Swiss citizen, I would like to avoid it. So I invest into Developed Markets ex US via CSIF index funds. This need some calculations, but nothing complicated.