There is a “Chinese Elon Musk” called “Yi Long Ma” on tiktok, don’t know if it’s not deep fake, but the guy looks like Elon’s twin brother.

I’m not invested in this stock but maybe it’s interesting for somebody.

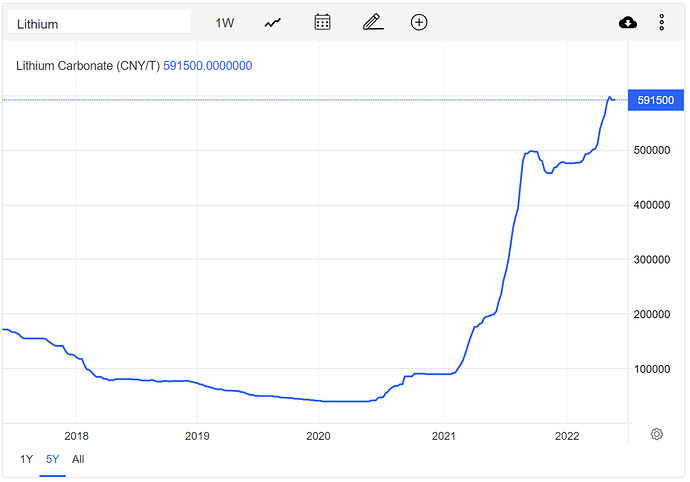

I stumbled upon this chart, source: Lithium - Price - Chart - Historical Data - News

If I remember correctly, Cathie Wood’s TSLA bull-case assumed that batteries keep getting cheaper. The price of lithium is up tenfold over the last two years. Presumably, these prices will come back down somewhat when there’s more mining output, but right now this probably hurts margin’s a lot.

And I’m not sure how much they can raise their prices, because I also read that lead times for Teslas have dropped significantly and you can now get certain models within weeks in some places. (I haven’t verified this)

Maybe it’s because of some new tax credits in 2023 and people are waiting for that, but who knows.

I am very surprised by the silence on this thread…

TSLA is at 138. Time to buy or cut the loss ?

still valued a crazy amount, still in trouble over Twitter, competition ha EV on the market and sales are dropping.

There is also the rumor of the margin call of musk at 120 for about 25% of the floating shares (that might be lower since he already sold lots of shares).

I feel bad that i closed my short that early. Well profit is profit.

For a short-term trader this may be relevant. But Twitter has no impact on Tesla fundamentals. If Elon has to sell more Tesla shares, they just change owner, this has no effect on the execution of the company.

The most comprehensive number IMO is the quarterly production/deliveries. I don’t think it’s been dropping.

Again, some short-term turmoil. It’s Musk’s problem, not Tesla’s.

At a share price of $140, and a projected EPS of $7 in 2023, we’re looking at a forward P/E of 20. And I believe there is strong evidence that these earnings will grow significantly in the following years.

You want an answer to this question, then figure out what the company is doing, study the financials, build a model for future cost, revenue and income, arrive at a fair price estimate. If that price is higher than now => buy, if lower => sell. Or at least study some models of other people, if their assumptions make any sense to you. I don’t think it’s of any value if someone just writes “wow TSLA so cheap, buy now!” or “it’s only the beginning, lots more pain to come!”.

Isn’t Tesla valuation largely linked to Musk’s involvement?

Is Tesla planning new models to update/replace existing ones?

To me, since I started paying attention to 3/Y models, more than 2 years ago, they are now getting bit outdated and boring from the outside. I’m always fascinated to see new BMW/Audi etc models on the streets. I know this usually happens 6/7 years apart on specific model, but probably because these makers have wider selections of models, it feels that they constantly releasing new models.

Tesla minimalistic interior was fun in the beginning, but I know rather sit in aforementioned makers cars.

Since Tesla does not make their own batteries, I assume their km per charge superiority comes from optimization. How long until other makers will catch up on this part?

What else I am missing on Tesla still being good investment?

No, they actually started making the cars worse since the end of 2021. Constantly removing hardware and trying to replace it with software (Tesla Vision) which isn‘t working.

I‘m happy with our Q1 2022 Tesla Model 3, but probably won‘t buy another Tesla. Company philosophy just sucks and others are catching up very fast. My next car will be an EV again for sure, but just another brand. Many of my Tesla friends think the same.

Combine this decline in quality and service with Elon Musks current behaviour. No wonder the stock is falling hard.

this is the biggest draw down. I’m happy his image is finally shifting. I never was a fan of that guy.

I heard the same from my friend who used to be big Tesla fan (still an owner).

Thank you for beeing transparent despite having a Tesla, @Cortana.

My leasing contract will expire in approx. 3.5y, and I am very looking forward how the whole situation with charging/electricity/stop of new production of gasoline cars will look like.

I don’t think his image is shifting anywhere. Imho, guy is going into politics and is stepping on someones toes, thus some negative publicity.

Nothing, but respect for Elon for:

- Tesla. Stepping in saturated auto sector, taking complete different direction and achieving success. It just could be that Tesla reached ceiling and/or might disappear. I think his idea was that personal car like smartfone that can be faceless in the long run and provided as a “service”. This was cool until you could be exceptional owning Tesla. But now people revert back to exceptionalism having different personal (electric) cars.

- SpaceX is getting NASA orders

- Starlink. Ukraine is begging not to switch off internet during conflict.

- Putting a lot of eggs in one basket and taking over Twitter with some bold move, advocating for freedom of speech (maybe it’s just smoke, who knows).

- Paypal

- Neuralink. Ok, this one is still in the air, but imagine if they manage to put chip in brain successfully?

Opposite to Steve Jobs and Bill Gates, who are known to be a$$holes, Elon is known to be a touch egocentric (asperger?) but a good person.

If you know anyone who mange to create successful business and to retire early, they usually come back after some time to prove that first business was not a fluke. Elon is serial successful entrepreneur!

What? Did you follow the twitter saga? Most people in tech would definitely not want to work for him now (for those who weren’t sure).

It is, but when Elon’s share drops from 18% to 13%, it’s still significant. If he takes 2 months to fully dedicate to Twitter, Tesla won’t stop working. It’s a well set-up company with competent people, who know what they’re doing. It’s in a place, where Musk doesn’t have to be putting out fires everyday anymore. Of course, I would appreciate if he was more present.

There is a Model 3 Highland refresh in the works. Not much is known about it.

From an investor standpoint (as opposed to consumer), it is important to know if these models are being sold with profit. If BMW releases a small batch of vehicles, sells them at zero margin, this does not mean it’s catching up.

Well, they are. Tesla is taking cells (these round things) from external suppliers, and making the battery pack. Additionally, they’ve been working on making their own cell (the 4680), though the progress has been slow. But yes, Tesla’s advantage is mostly the optimization.

That’s the million dollar question. How fast can the competition catch up? While they’re catching up, is Tesla going to sleep / develop more slowly?

What examples of it do you have to give? It sounds like they did it 10 times already. I only know about two examples: removing radar and removing proximity sensors. At first, the replacement is worse, but it’s improving with time.

what does this even mean? can you elaborate? your own Tesla is fine, but company philosophy sucks? What sucks about eliminating components which are not being used and making the car cheaper? In the end it’s about making the biggest bang out of your buck. In part it can be transferred to higher margins, in part to lower prices.

Again, this only makes sense if you look at the volumes of vehicles produced and the profit made on them. If legacy carmakers are selling EVs at a loss, what happens to them when there is no more demand for their ICE cars? Just that a carmaker can produce an EV that is compelling to the customer, doesn’t mean financial success.

Let’s see when you’re about to make that decision. When you evaluate the prices, the performance, the charging infrastructure. Will you base your decision on logic, or on hating on Elon Musks for making stupid tweets?

https://twitter.com/GergelyOrosz/status/1605598046217154560

It looks like there’s a lot of decent choices?

That’s covered with an Ioniq 5 or EV 6, not a Tesla.

Charging network is slowly becoming less of an argument for them; and I don’t see any other ones in their favor.

But we are talking about the products here, which doesn’t have too much to do with Tesla as a company, and even less so as an investment. ![]()

I‘m not sure about this statement. Teslas share price is all about their superiority to other car makers.

It used to be about them not being an automaker and pricing in robotaxis, solar pannels and other projects, which may be part of why the price is getting down. Maybe they’re valued as a regular car company now.

The Twitter mess may make it harder for Musk to sell his “we’ll deliver FSD next year” kinds of promises, which wouldn’t justify the growth that was priced in the stock anymore.

No I did not. What did he do to upset all tech people?

My thinking is that he took over left leaning company and brought his opposing views. Since he’s now dabbing in political mine field it’s natural he’s creating uproar and potential enemies.

If I’m a bit right, then he lost some liberal supporters and gained some conservatives.

I would say this is a good approximation of what happened. Plus we got a peek into how messy an agile transformation of a company in Musk-style is. Making some decision, then back tracking, contradicting yourself. He wants to act fast and isn’t afraid to be wrong. It will take time to see if he eventually succeeds, or are these signs of his incompetence, as critics point out.