There is no translation. That page is missing in German.

Maybe it’s not the case here? I asked the Leasing company and Tesla. Waiting for a reply.

Btw I might go with LeaseTeq.

Why, they have a higher rate?

This is only if you lease the car directly from Tesla no? If you chose another leasing provider they will just outright buy the car form tesla and so they are the new owners and lease it back to their customer which can have a clause to buy the car at the end of the lease?

OK, so in this case the car belongs to SwissQuote or LeaseTeq. And does Tesla lease cars directly in the US? I would be surprised if Tesla did that, because it takes a lot of capital and the return is just what, 3-4% per year?

If it’s up to SwissQuote or LeaseTeq, then I expect they don’t want to actually keep the cars. I think Tesla wants to keep them, because they eventually want to build their robotaxi fleet.

All three (Cembra, SwissQuote, LeaseTeq) have the same offer with 2.99% Leasing. But LeaseTeq seems to have the highest residual value and thus reducing the monthly leasing rate. Will have to recheck as soon as I get all my questions answered.

Cembra sucks because you can’t even send them emails, they want everything asked by phone lol.

Edit: SwissQuote just confirmed me by email that we can buy the car at the end. They aren’t probably interested anyway as a company to have cars.

Great. Well, they could have had a side deal with Tesla where Tesla reserves the right to buy back these cars. But it looks like that’s not the case, so great.

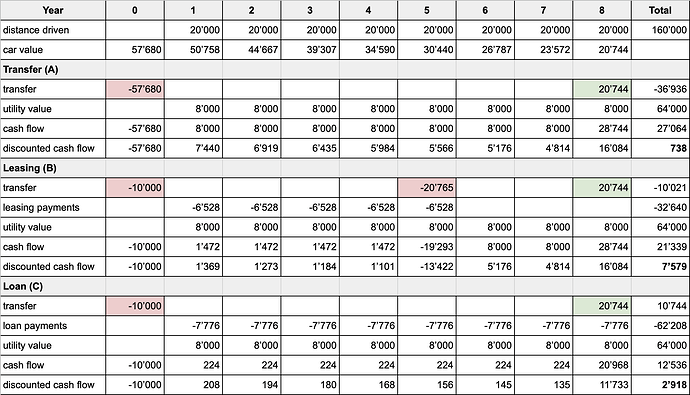

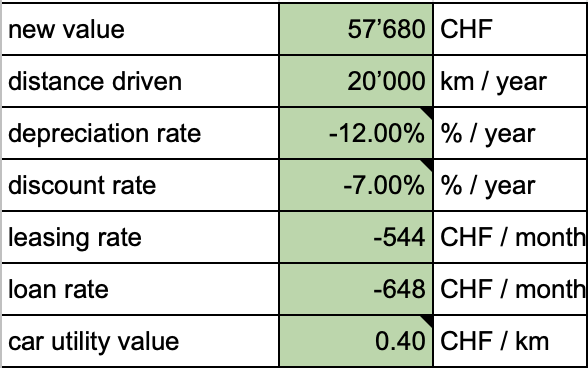

@Cortana for your peace of mind, I’ve plugged in the most recent numbers into my Tesla financing comparison tool.

With the following parameters:

The red/green cells are one-off transfers (downpayment, purchase, sale).

The value in bold shows the present value of each option, given all the assumptions. Two big factors changing the result are:

- your personal discount rate - if you put it very low, like 3%, it’s better to pay with cash

- your perceived utility - it’s net of all other costs like fuel, insurance etc

The utility has to be high enough for the present value to be positive. Otherwise the whole deal makes no sense (you’re losing “value” on it).

I’ll get back to it later, thanks.

Btw Tesla increased the price overnight by 2k.

Yes, that appeared on the social media a few hours before, apparently related to nickel price increase…

it doesn’t make sense financially, like any new car.

But don’t spoil the fun ![]() sometimes we just need a toy for all the frugality we go through.

sometimes we just need a toy for all the frugality we go through.

BTW the new Mégane EV can be had for about 15k less.

I’d say the asset allocation/risk tolerance lens can be used in this context too: if we need to reward ourselves with a toy for the frugality we undertake, then we may have bitten too much frugality instead of getting ourselves in a sustainable situation.

My view is that the lifestyle we want to live should be part of the assessment we do at the start of our FIRE journey, and then, a good part of the journey would be about making that lifestyle sustainable for our lifetime (and first reaching it if we are not there yet). I think it’s what @Cortana is doing and it’s a conscious choice, though transportation is one of the easiest area where to find good savings while not affecting our general life overly much (so should be kept in check if savings and investing are a meaningful goal for us).

I admit this is miles away from the starting viewpoint of Mr. Money Mustache, the funder of the FIRE movement, when he first started blogging. He would have punched in the face anybody who hadn’t reached FIRE yet for buying (let alone leasing!) any kind of car instead of a reliable bike, then.

Edit: He describes his view on how to be frugal in this very good post, which is part of the email serie to get started: https://www.mrmoneymustache.com/2011/04/17/getting-started-4-if-you-try-sometimes-you-just-might-find-you-get-what-you-need/

Current situation with our VW Polo 2004. We drive 3000km/month on average.

Insurance and tax: CHF 800

Gas: CHF 3’400

Repairs/maintenance/service: CHF 1’000

Total: CHF 5’200 → CHF 4’030 (after taxes)

Tesla 3:

Leasing: CHF 6’480

Insurance and tax: CHF 1’800

Electricity: CHF 1’600

Tires: CHF 500

Total: CHF 10’380 → CHF 8’045 (after taxes)

So yeah, we’ll spend 4k/year more on our car than before. But those 4k are totally worth it ![]()

36‘000km per year? ![]()

Where are you going all the time?

Commute distance is 128km (back/forth).

I’m sure you will love driving that Tesla. It’s not a frugal choice, but it brings a lot of joy.

Add ~6-8k amortization per year as well. ![]()

But at this much driving it’s sure worth to drive electric.

Wrong, you over-amortize with leasing.

There’s no way out of hedonic adaptation: After a while driving a Tesla you won’t feel joy anymore and you might be reminded of that initial good feeling only after you are temporarily forced back to a regular car for some reason and then get back on the Tesla.